Forefront’s Market Notes:

August 19, 2024

Stocks posted solid gains last week, buoyed by robust economic data and constructive comments from Fed officials.

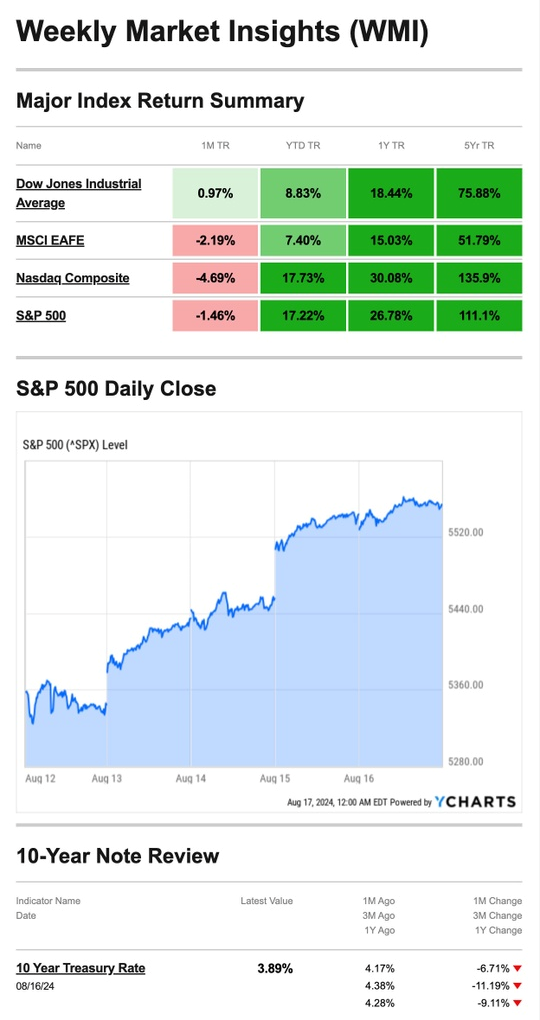

The Standard & Poor’s 500 Index rose 3.93 percent, while the Nasdaq Composite gained 5.29 percent. The Dow Jones Industrial Average lagged a bit, picking up 2.94 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, powered ahead by 4.31 percent.1,2

Upbeat Economic News

Three critical economic data points gave investors what they were looking for: wholesale inflation, consumer prices, and retail sales.

Both the Producer Price Index and the Consumer Price Index rose less than expected in July, reinforcing a picture of cooling inflation. The July retail sales report on Thursday was stronger than expected, which added more fuel to the week-long rally.3,4,5

Market action slowed down on the week’s final trading day, with positive consumer sentiment gains countered only by a drop in housing starts.

It was the S&P 500’s best weekly gain of the year so far and the best since November of 2023. The gains helped erase losses from earlier in the month, when “carry trades” news from Japan unsettled investors.6,7

Source: YCharts.com, August 17, 2024. Weekly performance is measured from Monday, August 12, to Friday, August 16. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Double Assist

Last week’s market rally saw assists from two places: economic data and constructive Fed comments.

On Thursday, Atlanta Fed President Raphael Bostic said he had “a lot more confidence that inflation’s sustainably on its way to 2%,” citing steady drops in CPI. And St. Louis Fed President Alberto Musalem said, “the time may be nearing when an adjustment (to the Fed Funds Rate) may be appropriate.8

Who Qualifies for the Child and Dependent Care Tax Credit?

Let’s outline who the Internal Revenue Service (IRS) defines as a qualifying person under this care credit:

- A taxpayer’s dependent who is under the age of 13 when the care is provided.

- A taxpayer’s spouse who is physically or mentally unable to care for themselves and lived with the taxpayer for more than half the year.

- The qualifying person received a gross income of $4,700 or more.

- The qualifying person filed a joint return.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov9

Footnotes and Sources

1. The Wall Street Journal, August 16, 2024

2. Investing.com, August 16, 2024

3. The Wall Street Journal, August 13, 2024

4. The Wall Street Journal, August 14, 2024

5. The Wall Street Journal, August 15, 2024

6. The Wall Street Journal, August 16, 2024

7. CNBC.com, August 16, 2024

8. The Wall Street Journal, August 15, 2024

9. IRS.gov, May 8. 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, Aug. 19 | |

| 9:15 AM | Fed Governor Christopher Waller welcoming remarks |

| 10:00 AM | U.S. leading economic indicators |

| TUESDAY, Aug. 20 | |

| 1:35 PM | Atlanta Fed President Raphael Bostic speech |

| 2:45 PM | Fed Vice Chair for Supervision Michael Barr speech |

| WEDNESDAY, Aug. 21 | |

| 2:00 PM | Minutes of Fed’s July FOMC meeting |

| THURSDAY, Aug. 22 | |

| 8:30 AM | Initial jobless claims |

| 9:45 AM | S&P flash U.S. services PMI |

| 9:45 AM | S&P flash U.S. manufacturing PMI |

| 10:00 AM | Existing home sales |

| FRIDAY, Aug. 23 | |

| 10:00 AM | Fed Chair Jerome Powell speech at Jackson Hole retreat |

| 10:00 AM | New home sales |

Most anticipated earnings for this week:

Did you miss our last blog?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.