Forefront’s Market Notes:

August 12, 2024

Stocks ended last week with modest losses, masking a volatile five-day trading period that saw investors embrace recession concerns and then dismiss the slow-down talk as speculation as the week progressed.

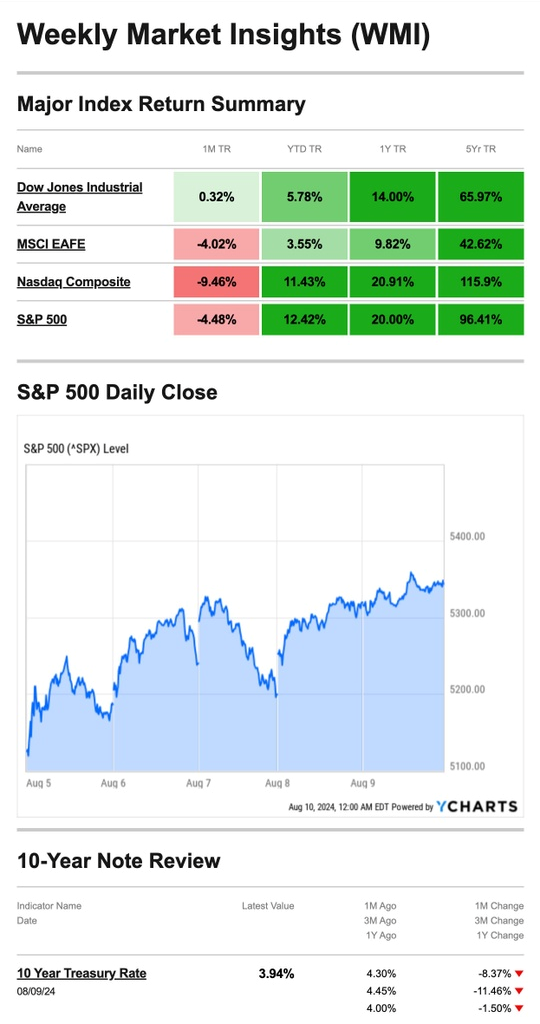

The Dow Jones Industrial Average slipped 0.60 percent, while the Standard & Poor’s 500 Index ended flat (-0.04 percent). The Nasdaq Composite dipped 0.18 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, fell 1.21 percent.1,2

Stocks Stage Comeback

Monday was the worst day for the S&P 500 and the Dow in nearly two years. As recession talk grew louder, investors took a “risk off” position.

On Monday, the Japanese market had its worst drop since 1987 as market participants unwound positions from a popular trading strategy called a “carry trade” amid a global sell-off in stock prices.3

But on Thursday, initial jobless claims fell less than expected—a positive sign for the labor markets— which quieted some of the recession talk. Also, as the week progressed, there was growing speculation that the July jobs report was more of an outlier than a lead indicator of a pending recession.

By Friday’s close, all three major averages had regained most of the week’s losses.4

Source: YCharts.com, August 10, 2024. Weekly performance is measured from Monday, August 5, to Friday, August 9.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Mortgage Update

Last Thursday, the average rate on a 30-year fixed mortgage dropped to 6.47 percent—a 15-month low. Many home buyers welcomed the news, and it appeared to help support Thursday’s rally.5

But the announcement left some wondering whether rates would continue to trend lower. Mortgage rates are tied to the interest rates set by the Federal Reserve. Some speculated the drop was due to market participants anticipating the Fed would adjust rates in September, which remains anything but certain.6

Divorce or Separation Can Affect Your Taxes

The first thing to consider is alimony payments. Alimony payments paid under a divorce or separation instrument are deductible by the payer, and the recipient must include it in income. Alimony is not subject to tax withholding, so increasing the tax paid during the year may be necessary to avoid a penalty.

The next thing to consider is IRA contributions. A divorce agreement by the end of the tax year means taxpayers can’t deduct contributions made to a former spouse’s traditional IRA. They can only deduct contributions made to their own traditional IRA.

Once you reach age 73, you must begin taking RMDs from a traditional IRA in most circumstances. Withdrawals from traditional IRAs are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov7

Footnotes and Sources

1. The Wall Street Journal, August 9, 2024

2. Investing.com, August 9, 2024

3. CNBC.com, August 5, 2024

4. The Wall Street Journal, August 8, 2024

5. The Wall Street Journal, August 8, 2024

6. The Wall Street Journal, August 9, 2024

7. IRS.gov, May 8. 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, AUG. 12 | |

| 2:00 PM | Monthly U.S. federal budget |

| TUESDAY, AUG. 13 | |

| 6:00 AM | NFIB optimism index |

| 8:30 AM | Producer price index |

| 8:30 AM | Core PPI |

| 8:30 AM | PPI year over year |

| 8:30 AM | Core PPI year over year |

| WEDNESDAY, AUG. 14 | |

| 8:30 AM | Consumer price index |

| 8:30 AM | CPI year over year |

| 8:30 AM | Core CPI |

| 8:30 AM | Core CPI year over year |

| THURSDAY, AUG. 15 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Empire State manufacturing survey |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 8:30 AM | Import price index |

| 8:30 AM | Import price index minus fuel |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 10:00 AM | Business inventories |

| FRIDAY, AUG. 16 | |

| 10:00 AM | Consumer sentiment (prelim) |

| 8:30 AM | Housing starts |

| 8:30 AM | Building permits |

| 10:00 AM | Home builder confidence index |

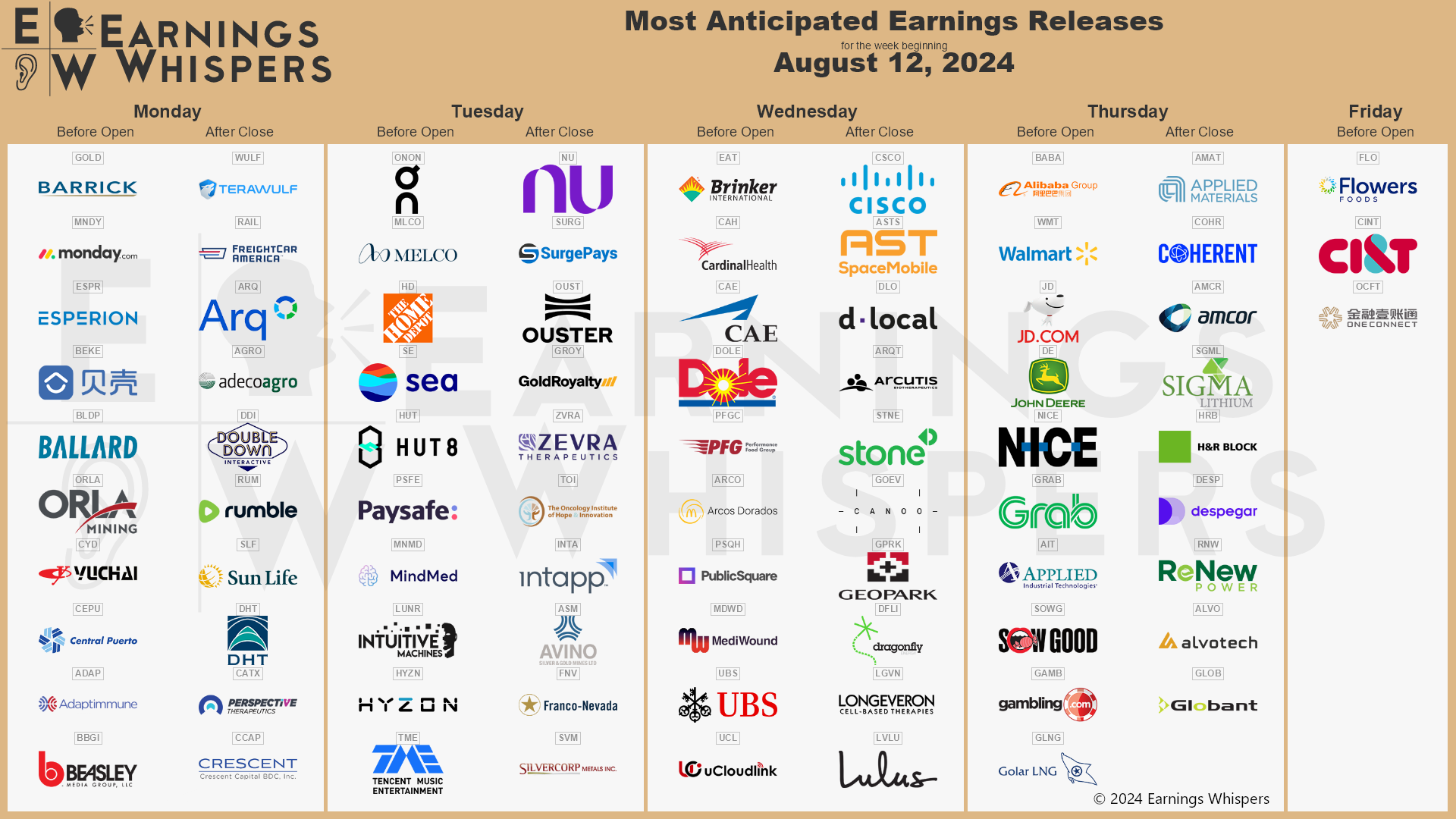

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: How Volatility Impacts Your Plan

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.