Financial Fear

One of my favorite aspects of my career is the chance to meet and speak to so many different people continually. I often meet people for the first time when they are at the height of their financial fears, and watching those fears slowly fall away through the planning process is incredibly rewarding. As the years and hundreds of meetings have gone on, I have noticed that many people’s fears are the same.

Fear of Volatility

In 2022, the market fell 20+% to a bear market low that we hit in October of that year. Since then, we have watched the market shoot up almost 20%.

This is volatility.

Over the past decade, the market has averaged over 10% annually. This is BECAUSE of volatility.

Our negative feeling towards volatility, the very thing responsible for these long-term returns, is why so many people need help as individual investors. It’s like getting angry that exercise makes you tired despite the exercise being the primary reason for your health or weight loss.

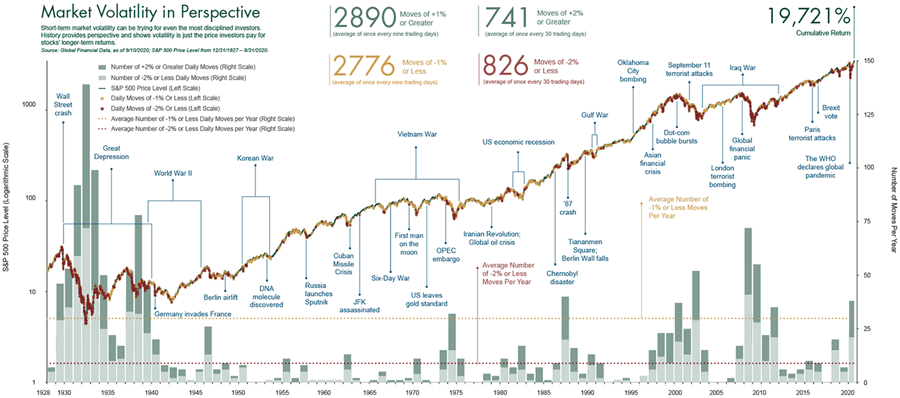

Volatility is the price investors pay for stocks’ longer-term returns. Take a look at the chart below, and you will see that since 1928 we have averaged a 1% up or down day once every nine trading days or so.

Learning not to fear volatility but to expect it as part of your plan is the difference between emotional and data-based decisions.

Fear Of Not Having Enough

I was at a lacrosse tournament this weekend and struck up a conversation with another parent. As we sat in the rain together, commiserating over our misery of being wet, the conversation made its way to our professions. When they found out I was a Financial Planner, the first thing they said was, “Oh, we don’t have enough for a planner.”

I reminded them that “the journey of a thousand miles begins with a single step.” I wish I could take credit for coming up with that, but alas, the credit must go to Lau Tsu, an ancient Chinese philosopher.

I came from a company with strict minimums. I would turn away the people who needed my help the most, so when I started Forefront Wealth Planning, my top requirement wasn’t a dollar amount minimum but rather a character minimum.

I know some firms can make you feel less than with their minimums and overall demeanor (I’m looking at you, Fisher Investments), but those firms can kick rocks.

Life is hard, add in some kids, a career, maybe a family pet, and the rest of life, and it becomes exponentially more challenging. No one knows your family’s journey in life up to this point.

This is a helping profession; anyone you meet who starts talking about minimums or makes you feel like you don’t have enough should be removed from your life immediately. There is no such thing as not having enough; we all start from the same place.

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, JUNE 26 | |

| None scheduled | |

| TUESDAY, JUNE 27 | |

| 8:30 AM | Durable-goods orders |

| 8:30 AM | Durable-goods minus transportation |

| 9:00 AM | S&P Case-Shiller home price index (20 cities) |

| 10:00 AM | New home sales |

| 10:00 AM | Consumer confidence |

| WEDNESDAY, JUNE 28 | |

| 8:30 AM | Advanced U.S. trade balance in goods |

| 8:30 AM | Advanced retail inventories |

| 8:30 AM | Advanced wholesale inventories |

| 9:30 AM | Fed Chair Powell speaks |

| THURSDAY, JUNE 29 | |

| 2:30 AM | Fed chair Powell speaks |

| 8:30 AM | GDP (revision) |

| 8:30 AM | Initial jobless claims |

| 10:00 AM | Pending home sales |

| FRIDAY, JUNE 30 | |

| 8:30 AM | Personal income (nominal) |

| 8:30 AM | Personal spending (nominal) |

| 8:30 AM | PCE index |

| 8:30 AM | Core PCE index |

| 8:30 AM | PCE (year-over-year) |

| 8:30 AM | Core PCE (year-over-year) |

| 9:45 AM | Chicago Business Barometer |

| 10:00 AM | Consumer sentiment (final) |

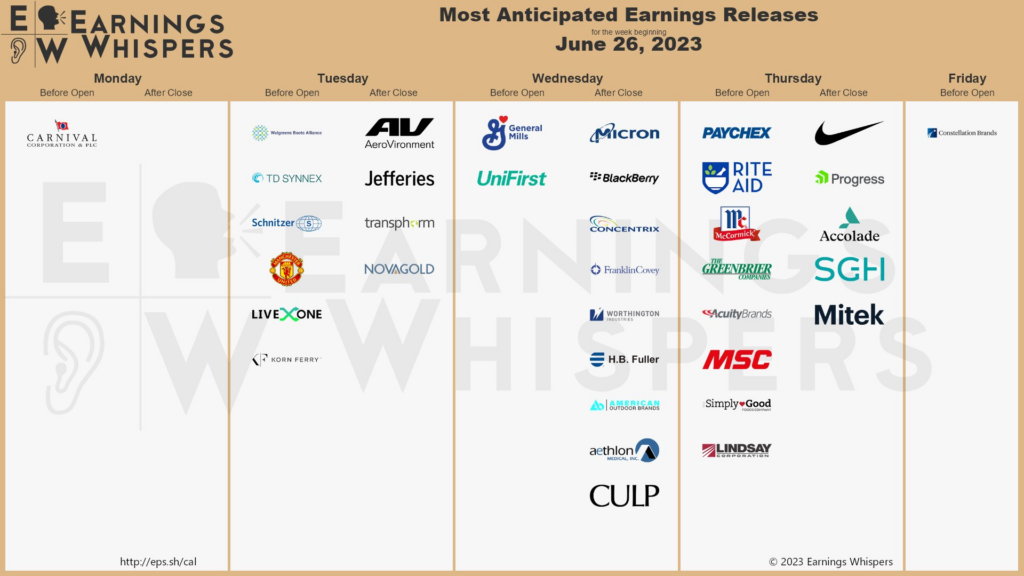

Most anticipated earnings for this week:

Did you miss our blog last week?

Comparison is the Thief of Joy

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.