Comparison is the Thief of Joy

It finally happened this weekend; the kids asked for social media accounts, specifically Snapchat. I was not ready to have this conversation, but the kids rarely do anything on my schedule.

As I told them in an age-appropriate way the dangers of social media and that they had no chance of having it for years to come, I thought about how much what I was telling them could apply to adults as well.

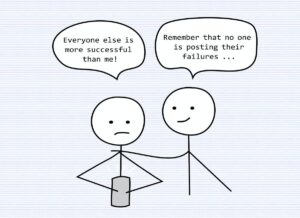

In the age of social media and constant connectivity, it’s all too easy to fall into the trap of comparing our lives to others’. Whether it’s seeing luxurious vacations, fancy cars, or beautiful homes, the comparison we make can often leave us feeling inadequate and unsatisfied.

This phenomenon also extends to our financial lives, where comparing ourselves to others’ wealth and success can rob us of the joy and contentment we should derive from our own financial planning.

If Johnny Jumped Off a Bridge…..

As the years go by, I become more and more like my parents, and I found myself asking my children this weekend, if their friend jumped off a bridge, would they also jump? As a nine and 8-year-old will do, they were excited to jump off this made-up bridge because “it sounds fun.”

It’s human nature to compare ourselves to others, especially in the realm of finances. We often measure our success based on external markers such as income, possessions, or job titles. This is guaranteed to have a detrimental effect on our well-being.

Comparing our financial situation to others’ can lead to unrealistic expectations. We will feel pressure to live beyond our means, striving for a lifestyle that doesn’t align with your values. This leads to stress, debt, marital issues, and a perpetual feeling of dissatisfaction. Comparing ourselves to others also clouds our vision of our own achievements. We tend to overlook our progress and accomplishments when comparing ourselves to others, which often triggers envy and resentment.

Embrace The Plan™

I put the little TM symbol next to the plan as a bit of a tongue-in-cheek joke, but for those who are clients or read my blog each week, you have heard me say the plan is the product, not the portfolio.

In the 17 years of giving financial advice, the best guidance I can offer for finances and life is to stop caring what other people think.

Instead of succumbing to the comparison trap, we can focus on the three things I have seen my most successful clients do.

Control cash flow, automate bill paying and savings, and change your plan when your life changes, not when the news changes.

It is easier to write those three things than implement them, but by leaning into your financial plan and blocking out the outside noise, you will succeed in your plan to retire and be happier along the journey.

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, JUNE 19 | |

| Juneteenth Day holiday, all markets closed | |

| 10:00 AM | Home builder confidence index |

| TUESDAY, JUNE 20 | |

| 8:30 AM | Housing starts |

| 11:45 AM | New York Fed President John Williams speaks |

| WEDNESDAY, JUNE 21 | |

| 10:00 AM | Fed Chair Powell testifies to House panel |

| 10:00 AM | Senate nomination hearing for Fed Govs. Jefferson and Cook and nominee Kugler |

| THURSDAY, JUNE 22 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | U.S. current account |

| 10:00 AM | Existing home sales |

| 10:00 AM | Fed Chair Powell testifies to Senate panel |

| 10:00 AM | U.S. leading economic indicators |

| FRIDAY, JUNE 23 | |

| 8:30 AM | S&P flash U.S. services PMI |

| 8:30 AM | S&P flash U.S. manufacturing PMI |

Most anticipated earnings for this week:

Did you miss our blog last week?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.