Are We In A Bubble?

Why We’re Not in a Bubble Yet

The stock market has been on a wild run. Big Tech keeps setting new records, AI is reshaping industries overnight, and investors everywhere are asking the same question: “Is this another bubble?”

Goldman Sachs tackled that question in a recent report titled “Why We’re Not in a Bubble… Yet.” Their take is that we’re not at the bursting point, but the ingredients are starting to pile up. The keyword here is “yet.”

What a Bubble Really Is

Let’s start with what a bubble actually means. It’s not just when prices go up fast, that’s called a bull market. A bubble happens when excitement about the future sends prices way beyond what companies can realistically earn.

Goldman looked back at history: tulips in the 1600s, railroads in the 1800s, the dot-com craze in the 1990s, and the housing market in the 2000s. Every bubble followed a similar path. There’s a big new innovation, investors flood in, prices skyrocket, everyone thinks “this time is different,” and eventually reality sets in.

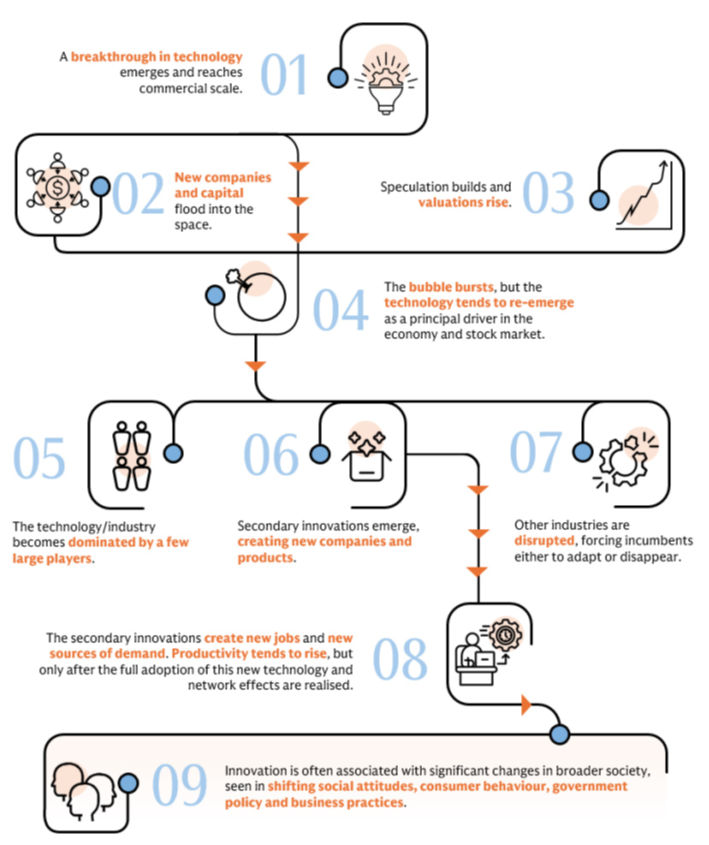

Here is a chart to help you visualize what I mean.

First comes the breakthrough. Then comes speculation. Prices rise, greed kicks in, and eventually the bubble bursts. What’s left, though, is usually real progress. Railroads transformed trade, the internet transformed communication, and AI may very well transform everything from medicine to manufacturing.

Why Today Looks Different (For Now)

Goldman’s data shows that the current tech rally isn’t just hype. Unlike the late 1990s, today’s big players are actually earning massive profits. The “Magnificent 7”- Nvidia, Apple, Microsoft, Alphabet, Amazon, Meta, and Tesla, generated record earnings last year and hold some of the strongest balance sheets in history.

During the dot-com bubble, most of the companies driving the surge were not profitable at all. They were relying on potential future earnings. Today’s industry leaders already have a global presence, steady cash flow, and actual products that people use every day.

Valuations Are High, But Not Insane

Now, none of this means stocks are cheap. Far from it. Goldman shows that the average price-to-earnings ratio (the P/E) for U.S. stocks is sitting above 21 times earnings, one of the highest levels in 20 years. Tech companies are even higher.

But when Goldman compared today’s numbers to the height of the dot-com bubble, they found something interesting. Back then, the biggest companies traded at more than 50 times forward earnings, double where we are now. The gap between profits and prices was massive.

In other words, stock prices are expensive today but not yet detached from reality. The rise in prices has been largely offset by an increase in actual profits.

The Concentration Problem

The part that should make everyone a little uneasy is how much of the market now depends on a handful of companies. The ten largest U.S. stocks now make up nearly a quarter of the entire global stock market. That has never happened before.

When a small number of companies account for such a large share of returns, the market becomes fragile. If one or two stumble, the whole index can wobble. It’s not necessarily a sign of a bubble, but it’s a sign that diversification matters more than ever.

This kind of dominance has happened before. Energy companies ruled in the 1960s and 70s, banks led in the early 2000s, and now technology is the driver. Each time, the leading sector stayed strong for years, until something shifted.

The AI Boom and the Spending Surge

AI has become the center of gravity for markets. Every major company is racing to invest in data centers, chips, and cloud infrastructure. Spending by the largest “hyperscalers”, Amazon, Microsoft, Google, Meta, and others has exploded from under $100 billion in 2020 to nearly $400 billion expected next year.

The risk here isn’t that AI is a fad. The risk is that companies could overspend in pursuit of growth, just as telecom firms did in the early 2000s. Remember when the world laid ten million miles of fiber-optic cable? Most of it sat unused for years.

The good news is that today’s tech giants are funding this spending with cash, not borrowed money. In fact, Goldman notes that their balance sheets are among the strongest on record, with very little debt. That means even if AI enthusiasm cools, we’re unlikely to see a full-blown financial crisis.

What Could Go Wrong

Even if this isn’t a bubble, corrections can still happen. If earnings disappoint or interest rates stay higher for longer, investor optimism could fade quickly. Markets tend to fall much faster than they rise, and when everyone owns the same few companies, selling pressure hits all at once.

Goldman warns that valuations are “becoming stretched” and the margin for error is thin. That doesn’t mean panic. It means expectations are high, and when expectations are high, surprises hurt more.

What This Means For You

So, what do you do when the market looks great on the surface but fragile underneath? You stay disciplined. You stay diversified. And you make sure your financial plan isn’t hanging on one idea, even one as promising as AI.

If you look back through history, the investors who survived every major boom and bust weren’t the ones who guessed when to jump in or out. They were the ones who had a plan, rebalanced regularly, and kept their emotions out of their portfolio decisions.

This is where having a professional in your corner makes a difference. It’s not about chasing the next big thing. It’s about managing risk in a world that’s always changing. The stock market doesn’t reward panic, but it doesn’t reward complacency either.

Bottom Line

We’re not in a bubble yet. But we’re closer than we’d like to admit. The market is strong but stretched. AI is real, but expectations are high. The smart move right now isn’t fear, it’s focus.

Stay invested. Stay diversified. And make sure your plan can handle both the climb and the drop because the climb is where people get excited. The drop is where real investors are made.

Sources

Stock Market Calendar This Week:

| Time (ET) | Report |

| MONDAY, NOV.3 | |

| 9:45 AM | S&P final U.S. manufacturing PMI |

| 10:00 AM | ISM manufacturing |

| 10:00 AM | *Construction spending |

| 12:00 PM | San Francisco Fed President Mary Daly speech |

| 2:00 PM | Fed governor Lisa Cook speech |

| TBA | Auto sales |

| TUESDAY, NOV.4 | |

| 6:35 AM | Fed Vice Chair for Supervision Michelle Bowman speech |

| 8:30 AM | *U.S. trade deficit |

| 10:00 AM | *Factory orders |

| 10:00 AM | *Job openings |

| WEDNESDAY, NOV.5 | |

| 8:15 AM | ADP employment |

| 9:45 AM | S&P final U.S. services PMI |

| 10:00 AM | ISM services |

| THURSDAY, NOV. 6 | |

| 8:30 AM | *Initial jobless claims |

| 8:30 AM | *U.S. productivity |

| 10:00 AM | *Wholesale inventories |

| 11:00 AM | Fed governor Michael Barr speech |

| 11:00 AM | New York Fed President Williams speaks |

| 3:30 PM | Fed governor Christopher Waller speech |

| 4:30 PM | Philadelphia Fed President Anna Paulson speaks |

| 5:30 PM | St. Louis Fed President Alberto Musalem speaks |

| FRIDAY, NOV.7 | |

| 3:00 AM | New York Fed President John Williams speech |

| 7:00 AM | Fed Vice Chair Philip Jefferson speech |

| 8:30 AM | *U.S. employment report |

| 8:30 AM | *U.S. unemployment rate |

| 8:30 AM | *U.S. hourly wages |

| 8:30 AM | *Hourly wages year over year |

| 9:30 AM | Dallas Fed President Lorie Logan speaks |

| 10:00 AM | UMich Consumer sentiment (prelim) |

| 3:00 PM | Consumer credit |

| 3:00 PM | Fed governor Stephen Miran speech |

| *Subject to delay due to government shutdown NA – Not available due to government shutdown | |

Did you miss our last blog?

Stop Letting Uncle Sam Eat Your Returns

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.