by Dr. JoAnne Feeney

You may have forgotten, given more urgent concerns surrounding the coronavirus, but we are once again at the cusp of earnings season. Make no mistake, this will be ugly. First quarter results will begin to show the impact of the shutdowns, and second quarter guidance even more so. Earnings estimates from Wall Street analysts have yet to fully adjust for the declines in economic activity for most companies. Despite this coming reckoning, the S&P 500 climbed 23% from its March 23rd low after having falling 34% from its February 19th high. What are investors thinking? Will the rally hold, or are we on the verge of another pullback as earnings outlooks deteriorate? The most important question, though, is how much does it matter for investing decisions today?

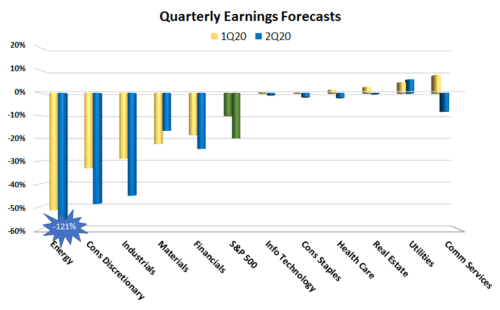

According to Factset, analysts are currently modeling a 10% year-over-year drop in first quarter earnings for the S&P 500 and are expecting companies to guide to a 20% drop in second quarter earnings (we suspect a larger decline), but there’s wide variance by sectors:

Source: Factset

Most investors recognize that earnings estimates will be coming down even further, but by how much remains an open question. Moreover, those second quarter (and full-year) forecasts will be characterized by far greater uncertainty than usual. Some companies are likely to refrain from even offering full-year guidance because of that uncertainty. Everyone recognizes that no one knows exactly when the economy will reopen and that the dislocation from the ongoing skyrocketing unemployment will be far reaching. But investors are more prepared now to deal with elevated uncertainty than they were when the market began its descent on February 20th.

Over the last two weeks, we’ve seen the market climb, in part, because slowing COVID case growth enabled investors to realize that no matter how bad the virus and related economic dislocations become, we will see the economy reopen. Moreover, investors determined that valuations had fallen by far more than reasonable forecasts of longer-term earnings power warranted. This does not mean that we won’t see another pullback, but actions by the Federal Reserve and fiscal authorities have dampened the near-time disruptions and reduced some of the risks of longer term damage. The S&P 500 is still down from the February high by 18%, though, because we will see earnings drop precipitously this quarter and the full year, and because the timing and pace of the economic recovery remains at the mercy of the virus.

At the most fundamental level, investing in the face of such uncertainty demands looking further into the future to a time when companies return to “longer term earnings power.” That could be a year from now, or two years. You could take a very cautious perspective and set your “recovery clock” to three-to-five years: the point of the exercise is to imagine how much profits companies will generate once this is over, and for years beyond, and how much they therefore should be worth. The implications for investing strategy today would be very similar for most investors regardless of where you set your recovery clock, except for those with a relatively short time horizon or an especially high degree of risk aversion. Despite the recent climb in stock prices, valuation of the S&P 500 companies remains $4.5 trillion lower than it was in mid-February. That leaves plenty of opportunities on the table for value (or any other) investors. So how to choose among them all?

First, we look at how far below intrinsic value individual stocks have fallen, but second, and equally important, we look at how the risk of achieving long term earnings power has risen. Included in that analysis is time: the longer we think it will take, the riskier is the investment because there are more chances for all sorts of relevant variables (end markets, competition, pricing, borrowing costs, etc.) to change. That’s one reason we have been shifting holdings to the companies we expect to recover most quickly once the economy reopens.

Analysts are currently modeling next year’s earnings to rise nearly 20%, after a drop this year of 9%, and that kind of reversal in earnings helps to buoy investor interest in equities, particularly long-term investors.

Source: Factset

Investors recognize, however, that these forecasts are more suggestive of directional change, rather than exact predictions. Everyone’s range of uncertainty is high. But they are still a useful reminder that it remains critical—even as the news shifts between good and bad—that there will be a time when earnings growth returns once again. And with it, an ultimate return to valuations based on long-term earnings power.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth