Forefront’s Monday Market Update

Stimulus = Futures down almost 2%?!?! Not Surprising

Late last night, lawmakers from both sides finally came to an agreement on a Government stimulus package. As I have written about before, anytime the Government undertakes deficit spending, they are alerting the people that at one point that money will be owed back, and the way the government is going to generate that money for the payback, is taxes.

One would think a stimulus package that will have to be paid for by the people, would go to actually helping the people. Rest assured though, there was money allocated for sports venues and arenas. I love the NY Yankees more than anyone I know, but do they really need more subsidization on the stadium after already getting tax breaks etc. from the city when it was first built?

Unfortunately, as cynical as the above sounds, its also the outlook of the markets to some extent. Yes, there is concern about a new covid strain in Europe that spreads faster. The German Health Minister came out and said that the vaccine is effective against this new strain, but markets are understandably a little spooked.

The people matter

Many of us reading this today won’t qualify for the $600 stimulus, just like we didn’t qualify for the original $1200. Some of us will qualify but not actually need the money, because although our income comes in below the limit, we have created financial security for ourselves through savings and investments.

Many of us know others who desperately need this stimulus infusion, not to go buy stocks on Robinhood, but to buy groceries for the month for their family or some sort of other critical need. The markets recognize that, and recognize that this package falls woefully short for the people. The economy is humming when the people feel secure financially.

The market is a forward-looking tool, and although the rocket-like rise of the market off its March lows would indicate the future looking bright, without helping the people that future will get darker and darker.

2021, the year we stop paying attention to “headlines”

I want to make some sort of witty joke about the image above, but frankly I just can’t stomach it. What you are seeing is a “news aggregation” of the most important articles to read for the Economy and Entrepreneurs. Do you notice that 4 out of 4 articles are written by the marketing machine that is Ken Fisher? Ken Fisher didn’t write the 4 most important articles for you to read, he paid the WSJ so they would place his articles in such a way where it just looks like he did. How much more disingenuous and laughable could this be?

All of this is marketing, it’s all advertising. From the way headlines are written, to the keywords being used, the design is to elicit a response, any response from you. This doesn’t mean stop reading the news, it means understand the incentive that the news organizations have. Ken Fisher isn’t being published for his intelligence; he is being published because of the weight of his wallet.

So What?

So how does this impact all of you?

- “Nees” publications are just advertising and marketing

- Stimulus helps, but falls short at helping those who truly need it

- 2021 is when we start paying attention to news that informs, not that invokes emotion.

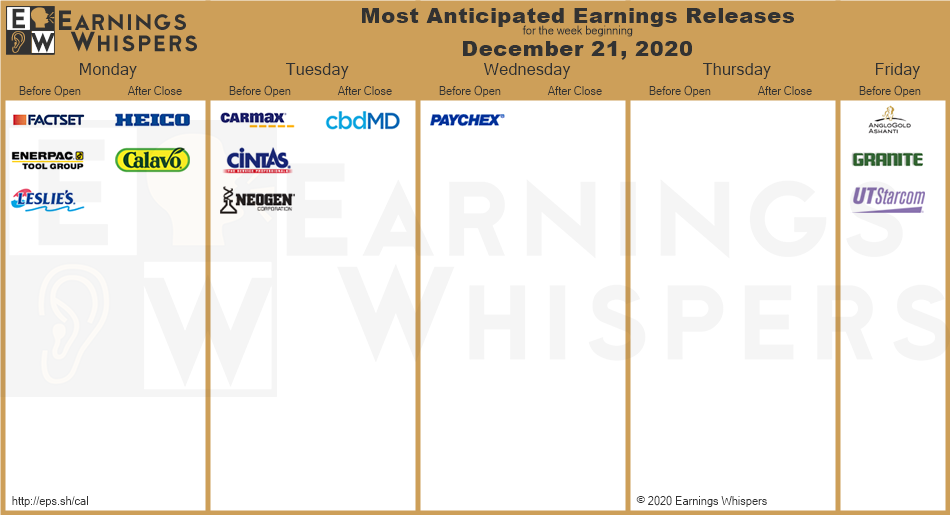

Stock market calendar this week:

Wednesday December 23rd, 2020

Initial and Continuing Jobless Claims @ 8:30AM

Most anticipated earnings for this week

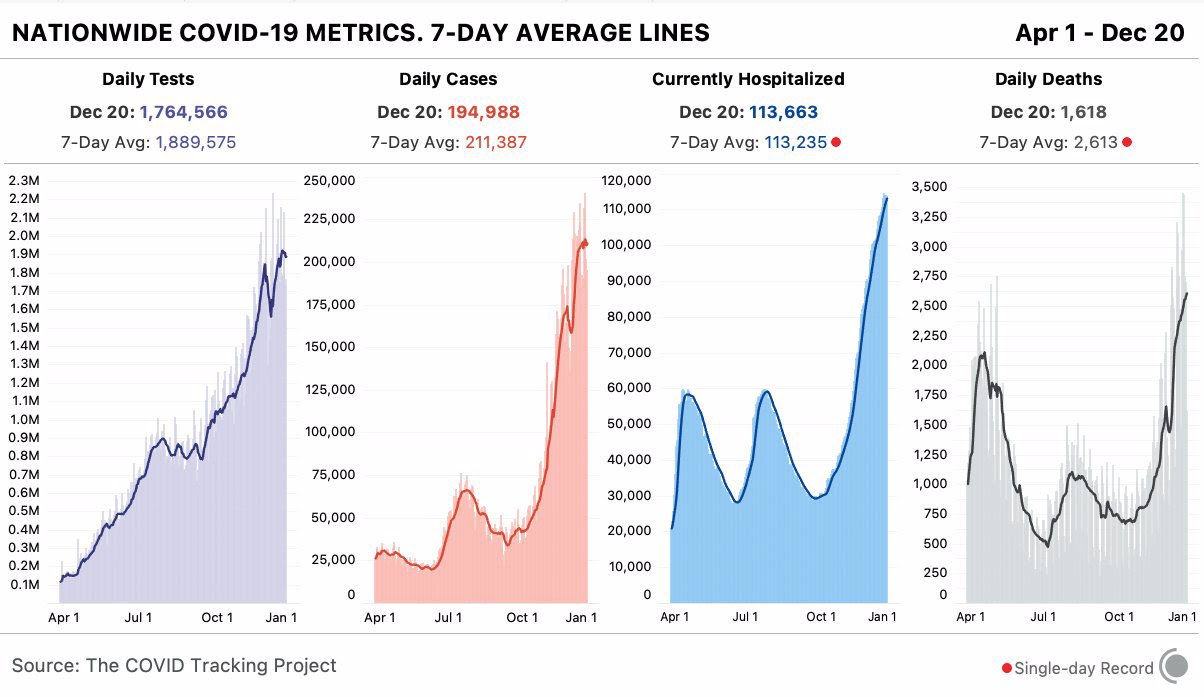

Latest Covid-19 Data