Forefront’s Market Notes

February 18th, 2025

Stocks advanced last week despite some intra-week volatility as investors showed concern about the economy’s strength.

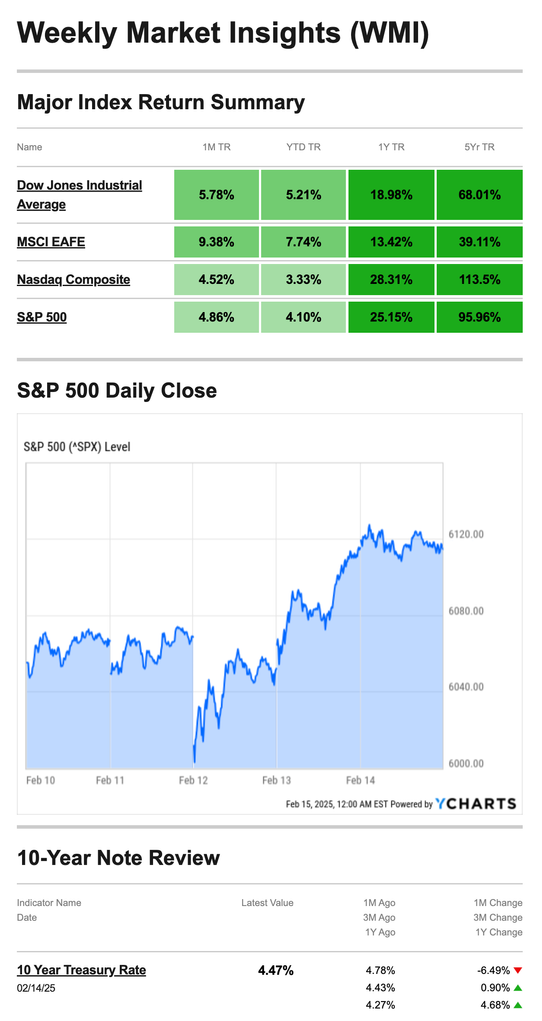

The Standard & Poor’s 500 Index gained 1.47 percent, while the Nasdaq Composite Index picked up 2.58 percent. The Dow Jones Industrial Average added 0.55 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, tacked on 2.53 percent.1,2

The Fed Is in “No Hurry”

Stocks opened the week higher, quickly discounting news that the White House would impose 25 percent tariffs on all steel and aluminum imports. Tuesday was a volatility session, punctuated by comments from Fed Chair Powell, who told lawmakers the central bank doesn’t “need to be in a hurry” to lower interior rates further.3,4

Stocks opened lower Wednesday after a warmer-than-expected update on consumer prices. But stocks showed some resilience and rallied throughout the day. The Nasdaq managed to claw back its losses before Wednesday’s close.5

On Thursday, the White House announced a plan for reciprocal tariffs (levies on goods imported into the U.S. from countries that impose tariffs on U.S.-exported goods). But markets rallied on news that the administration would pause tariffs until they determine how much to levy on each country. Stocks took a breather on Friday, shrugging off a weaker-than-expected retail sales report.

The S&P ended shy of a record close, and the Nasdaq finished the week above the 20,000 mark.6

Source: YCharts.com, February 15, 2025. Weekly performance is measured from Monday, February 10, to Friday, February 14. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Inflation in Focus

The Consumer Price Index report showed prices rose 0.5 percent in January–slightly hotter than expected. Shelter costs remained elevated, increasing 0.4 percent for the month.

Core CPI, which excludes volatile food and energy prices, was also above forecast. Food prices rose 0.4 percent, pushed by a 15.2 percent increase in egg prices related to ongoing issues forcing farmers to cull chicken flocks. Energy prices picked up 1.1 percent as gasoline prices rose.7,8

You May Be Able to File Your State and Federal Tax Returns for Free

Taxpayers whose adjusted gross income is $79,000 or less may be able to file their federal taxes for free using IRS Free File and do their state taxes at no charge through the same service. More than 20 states have a Free File program similar to the federal service.

IRS Free File partners also feature several helpful online products. Through Free File, taxpayers can choose the Free File option, guided tax preparation, or Free File Fillable Forms. Make sure to filter for the free options because some additional services may have a charge.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS9

Footnotes and Sources

1. The Wall Street Journal, February 14, 2025

2. Investing.com, February 14, 2025

3. MarketWatch.com, February 10, 2025

4. CNBC.com, February 11, 2025

5. The Wall Street Journal, February 12, 2025

6. CNBC.com, February 14, 2025

7. The Wall Street Journal, February 12, 2025

8. MarketWatch.com, February 10, 2025

9. IRS.gov, August 20, 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, FEB. 3 | |

| 9:45 AM | S&P final U.S. manufacturing PMI |

| 10:00 AM | Construction spending |

| 10:00 AM | ISM manufacturing |

| 11:00 AM | Boston Fed President Susan Collins TV appearance |

| 12:30 PM | Atlanta Fed President Raphael Bostic speaks |

| TBA | Auto sales |

| TUESDAY, FEB. 4 | |

| 10:00 AM | Job openings |

| 10:00 AM | Factory orders |

| 11:00 AM | Atlanta Fed President Raphael Bostic speaks on housing |

| 2:00 PM | San Francisco Fed President Daly speaks |

| 7:30 PM | Federal Reserve Vice Chairman Philip Jefferson speaks |

| WEDNESDAY, FEB. 5 | |

| 8:15 AM | ADP employment |

| 8:30 AM | U.S. trade deficit |

| 9:00 AM | Richmond Fed President Tom Barkin speaks |

| 9:45 AM | S&P final U.S. services PMI |

| 10:00 AM | ISM services |

| 1:00 PM | Chicago Fed President Goolsbee speaks |

| 3:00 PM | Fed Governor Michelle Bowman speaks |

| 7:30 PM | Fed Vice Chairman Philip Jefferson speaks |

| THURSDAY, FEB. 6 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | U.S. productivity |

| 2:30 PM | Fed Governor Christopher Waller speaks |

| 5:10 PM | Dallas Fed President Lorie Logan speaks |

| FRIDAY, FEB. 7 | |

| 8:30 AM | U.S. employment report |

| 8:30 AM | U.S. unemployment rate |

| 8:30 AM | U.S. hourly wages |

| 8:30 AM | Hourly wages year over year |

| 9:25 AM | Fed Governor Michelle Bowman speaks |

| 10:00 AM | Wholesale inventories |

| 10:00 AM | Consumer sentiment (prelim) |

| 3:00 PM | Consumer credit |

Most anticipated earnings for this week

Did you miss our last blog?

Forefront Market Notes: February 3rd

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.