Forefront’s Market Notes

February 3rd, 2025

Stocks were mixed last week as investors parsed market-moving news nearly every trading day—from an unsettling AI update to White House news to Q4 corporate reports.

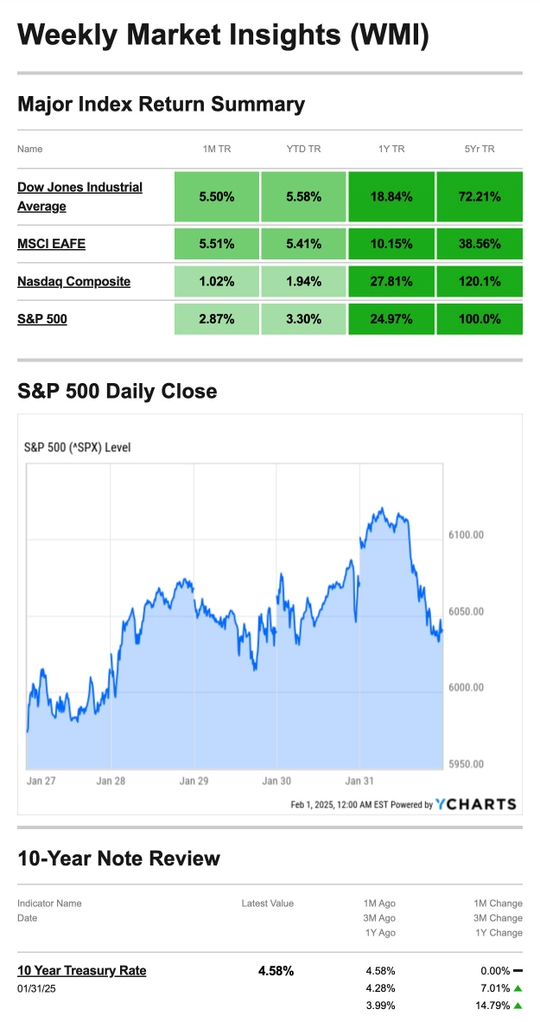

The Standard & Poor’s 500 Index fell 1.00 percent while the Nasdaq Composite Index slid 1.64 percent. Meanwhile, the Dow Jones Industrial Average rose, picking up 0.27 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, added 0.75 percent.1,2

A Choppy End to January

The week started on a down note with news that a Chinese artificial intelligence (AI) startup had made a breakthrough, which put pressure on a wide range of tech stocks. The tech-heavy Nasdaq fell 3 percent for the day, but the Dow Industrials ended the trading session slightly higher.3

Stocks were under pressure again mid-week as investors waited on news from the Federal Reserve. The Fed voted to hold firm on short-term interest rates. Even though the decision was widely expected, markets were under pressure again after the Wednesday afternoon announcement.4

Stocks rallied Thursday but reversed course Friday afternoon as traders adopted a more “risk-averse” position going into the weekend. There was a bit of anxiety knowing that the new administration’s tariffs on Mexico and Canada were scheduled to take effect on Saturday.

Interestingly, it was the Dow Industrial’s fourth-straight week outperforming both the S&P and the Nasdaq.5

Source: YCharts.com, February 1, 2025. Weekly performance is measured from Monday, January 27, to Friday, January 31. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Black Swan Event

It’s hard to overstate how much the markets were caught off guard by Monday’s news related to the success of a new AI startup based in China.6

What unsettled investors was the company’s claim that it developed a competitive AI model that performs as well as its Western counterparts at a fraction of the cost. As the week progressed, markets started to process the news and began to evaluate whether it was truly a “black swan” event or just another development in the fast-moving world of AI.6

Be On the Lookout for Unemployment Identity Theft Scams

With millions of people receiving unemployment, it’s no surprise that scammers are taking advantage of this situation and filing fraudulent claims for unemployment compensation. They do this by using stolen personal information of taxpayers who haven’t filed unemployment claims.

If you filed for unemployment and received an incorrect Form 1099-G, contact the issuing agency to request a revised form. When filing your federal tax return, you can also contact the IRS and request an identity protection PIN to protect your identity. Educate yourself on the many signs of identity theft and take the proper steps to help protect yourself.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS7

Footnotes and Sources

1. The Wall Street Journal, January 31, 2025

2. Investing.com, January 31, 2025

3. CNBC.com, January 27, 2025

4. The Wall Street Journal, January 29, 2025

5. CNBC.com, January 30, 2025

6. CNBC.com, January 30, 2025

7. IRS.gov, December 28, 2023

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, FEB. 3 | |

| 9:45 AM | S&P final U.S. manufacturing PMI |

| 10:00 AM | Construction spending |

| 10:00 AM | ISM manufacturing |

| 11:00 AM | Boston Fed President Susan Collins TV appearance |

| 12:30 PM | Atlanta Fed President Raphael Bostic speaks |

| TBA | Auto sales |

| TUESDAY, FEB. 4 | |

| 10:00 AM | Job openings |

| 10:00 AM | Factory orders |

| 11:00 AM | Atlanta Fed President Raphael Bostic speaks on housing |

| 2:00 PM | San Francisco Fed President Daly speaks |

| 7:30 PM | Federal Reserve Vice Chairman Philip Jefferson speaks |

| WEDNESDAY, FEB. 5 | |

| 8:15 AM | ADP employment |

| 8:30 AM | U.S. trade deficit |

| 9:00 AM | Richmond Fed President Tom Barkin speaks |

| 9:45 AM | S&P final U.S. services PMI |

| 10:00 AM | ISM services |

| 1:00 PM | Chicago Fed President Goolsbee speaks |

| 3:00 PM | Fed Governor Michelle Bowman speaks |

| 7:30 PM | Fed Vice Chairman Philip Jefferson speaks |

| THURSDAY, FEB. 6 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | U.S. productivity |

| 2:30 PM | Fed Governor Christopher Waller speaks |

| 5:10 PM | Dallas Fed President Lorie Logan speaks |

| FRIDAY, FEB. 7 | |

| 8:30 AM | U.S. employment report |

| 8:30 AM | U.S. unemployment rate |

| 8:30 AM | U.S. hourly wages |

| 8:30 AM | Hourly wages year over year |

| 9:25 AM | Fed Governor Michelle Bowman speaks |

| 10:00 AM | Wholesale inventories |

| 10:00 AM | Consumer sentiment (prelim) |

| 3:00 PM | Consumer credit |

Most anticipated earnings for this week

Did you miss our last blog?

Forefront Market Notes: January 27th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.