August 5th, 2024

How Volatility Impacts Your Plan

Waking Up from Hibernation

The bears have awoken from their 30,000 Dow point slumber, once again predicting doom and gloom for the market. Interestingly, many of these voices aren’t professional market participants but rather work in the publishing industry. It’s almost as if sensationalizing their views helps their careers.

Why Did the Market Go Down?

How Often Do Market Corrections Happen?

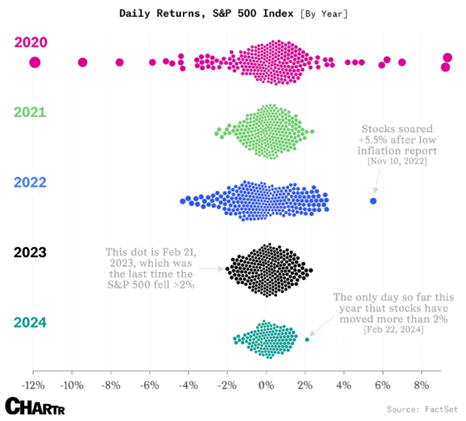

Market corrections are a normal part of the investing landscape. Historically, a market correction, defined as a decline of 10% or more from a recent peak, occurs approximately once every 1 to 2 years. Here are some key points:

- Frequency: On average, the S&P 500 experiences a correction once every 19 months.

- Duration: The average correction lasts about 4 months.

- Recovery: Following a correction, the market typically rebounds strongly, with the average time to recover losses being around 4 months.

The above chart shows that we’ve been overdue for a market correction after several years of not having one.

Why There Is No Reason to Panic

- Long-Term Trends: Despite short-term volatility, the market has historically trended upward. Over the past 50 years, the S&P 500 has returned an average annual rate of about 10%.

- Economic Fundamentals: The U.S. economy remains fundamentally strong. Even with a slowing labor market, adding over 100,000 jobs in a month is still a positive indicator.

- Market Gains: The market is still up over 10% this year, showing resilience despite recent fluctuations.

How Does This Impact Your Plan?

For Those Accumulating Assets:

If you are still building your 401(k) or IRA, lower prices can be beneficial. Dollar-cost averaging into the broad markets at lower prices can enhance your final accumulated amount. Remember, trees don’t grow to the sky; we can’t expect our portfolios to only increase. Continue to contribute to all your savings vehicles, and if possible, increase your contributions. Don’t let emotions, short-term volatility, or impatience derail your plan.

For Those Nearing or In Retirement:

If you are within two years of retirement or already retired, your plan likely includes a fixed-income allocation. I always advocate for a higher cash reserve than usual. Unlike the bear market of a few years ago, bond yields are now more favorable. You get higher yields while dampening volatility, and as rates decrease, the price of existing bonds will rise, benefiting your portfolio. If you are taking distributions, we keep extra cash on hand for times like these.

What Do We Do Now?

- Market corrections during bull markets happen ALL THE TIME.

- Although our labor market is slowing, we added over 100k jobs last month, not lost them

- The market is still up over 10% this year.

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, Aug. 5 | |

| 8:30 AM | Chicago Fed President Goolsbee TV interview |

| 9:45 AM | S&P final U.S. services PMI |

| 10:00 AM | ISM services |

| TUESDAY, Aug. 6 | |

| 8:30 AM | U.S. trade deficit |

| WEDNESDAY, Aug. 7 | |

| 3:00 PM | Consumer credit |

| THURSDAY, Aug. 8 | |

| 8:30 AM | Initial jobless claims |

| 10:00 AM | Wholesale inventories |

| 3:00 PM | Richmond Fed President Tom Barkin speaks |

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: July 29th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.