Forefront’s Market Notes

April 21st, 2025

U.S. stocks slipped over the shortened trading week as Q1 corporate reports started to roll in.

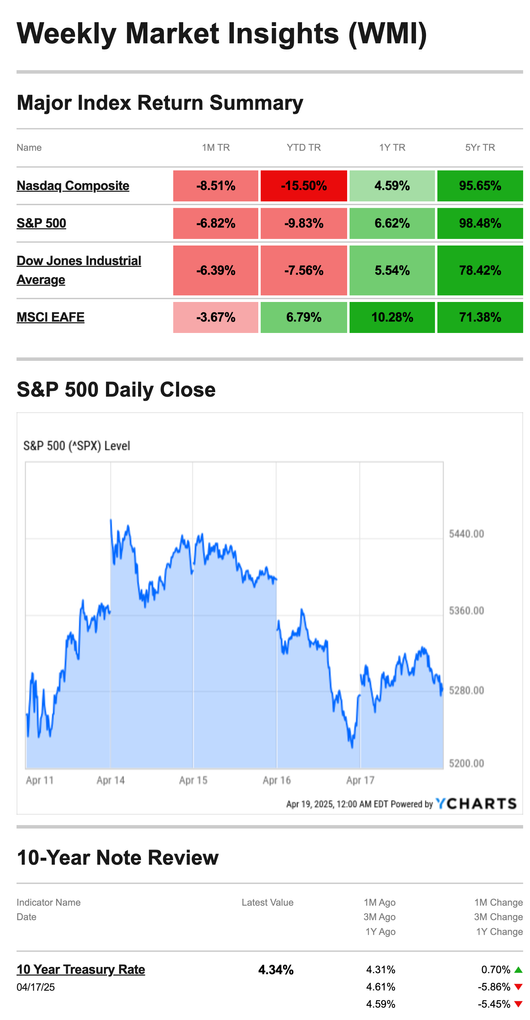

The Standard & Poor’s 500 Index dropped 1.50 percent, while the Nasdaq Composite Index fell 2.62 percent. The Dow Jones Industrial Average lost 2.66 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, added 4.19 percent.1,2

U.S. Stocks Slide

Stocks started the four-day week with modest gains. Trade volatility subsided as several money center banks reported Q1 numbers at or above expectations.3

Stocks trended lower midweek after Federal Reserve Chair Jerome Powell expressed concern that tariffs would likely “move us further away from our goals”—including keeping inflation in check.4

Stocks were mixed on the week’s last trading day as traders evaluated White House news that trade deals were progressing with Japan, China, and the European Union. The S&P 500 ended the day higher, but the Dow Industrials were under pressure after a large healthcare company gave a disappointing Q1 report.5

Source: YCharts.com, April 19, 2025. Weekly performance is measured from Monday, April 11, to Thursday, April 17. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

The Fed’s Influence

Stocks were under pressure following comments from Fed Chair Powell, who expressed concern about the ability of the Fed to balance its inflation and employment goals given the current trade situation. He said, “Tariffs are highly likely to generate at least a temporary rise in inflation,” and “the inflationary effects could be more persistent.”6

These are Powell’s latest remarks about tariffs. The Fed Chair made similar comments earlier this month at an event in Alexandria, Virginia.7

The Small Business Health Care Tax Credit

The IRS introduced the small business healthcare tax credit in an effort to extend healthcare benefits. This credit may benefit employers with fewer than 25 full-time equivalent employees, offer a qualified health plan through a Small Business Health Options Marketplace, and pay at least 50% of the employee-only health care coverage cost. There may also be some average wage requirements.

The maximum credit covers:

- 50% of premiums paid for small business employers

- 35% of premiums paid for small tax-exempt employers

The credit may also be available for two consecutive taxable years.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS8

Footnotes and Sources

1. The Wall Street Journal, April 17, 2025

2. Investing.com, April 17, 2025

3. CNBC.com, April 15, 2025

4. CNBC.com, April 16, 2025

5. WSJ.com, April 17, 2025

6. CNBC.com, April 16, 2025

7. CNBC.com, April 4, 2025

8. IRS.gov, September 30, 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, APRIL 21 | |

| 10:00 AM | U.S. leading economic indicators |

| TUESDAY, APRIL 22 | |

| 9:30 AM | Philadelphia Fed President Patrick Harker speaks |

| 2:00 PM | Minneapolis Fed President Neel Kashkari speaks |

| 2:30 PM | Richmond Fed President Tom Barkin speaks |

| WEDNESDAY, APRIL 23 | |

| 9:00 AM | Chicago Fed President Austan Goolsbee opening remarks |

| 9:30 AM | St. Louis Fed President Alberton Musalem and Fed Governor Christopher Waller speak |

| 9:45 AM | S&P flash U.S. services PMI |

| 9:45 AM | S&P flash U.S. manufacturing PMI |

| 10:00 AM | New home sales |

| 2:00 PM | Fed Beige Book |

| 7:40 PM | Atlanta Fed President Bostic speaks |

| 6:30 PM | Cleveland Fed President Beth Hammack speaks |

| THURSDAY, APRIL 24 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Durable-goods orders |

| 8:30 AM | Core durable orders (business investment) |

| 10:00 AM | Existing home sales |

| 5:00 PM | Minneapolis Fed President Neel Kashkari speaks |

| FRIDAY, APRIL 25 | |

| 10:00 AM | Consumer sentiment (final) |

Most anticipated earnings for this week

Did you miss our last blog?

Why Market Volatility is a Crucial Opportunity for Couples to Strengthen Their Financial Connection

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.