5 Smart Investing Principles – Taxes and Inflation

So far we’ve gone over Estimate Your Time Horizon, Know Your Risk Profile, and Diversification. Now we delve into Taxes and Inflation.

In the realm of investment strategy, two formidable foes often loom large: taxes and inflation. While both are inevitable aspects of the financial landscape, understanding their impact is crucial for any savvy investor. Taxes can erode returns and eat into profits, while inflation quietly erodes the purchasing power of your money over time.

Taxes

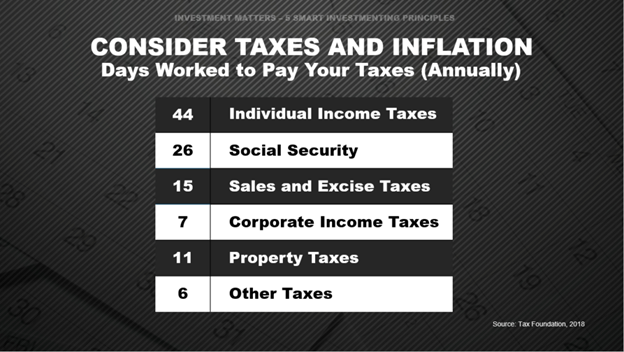

The chart below shows how many days the average American will work in 2018 to pay their tax obligation. Americans pay income taxes, Social Security taxes, sales and excise taxes, and property taxes.

The same concept occurs when you put your money to work. Taxes may take part of your return.

So when you are looking at the return on an investment, ask yourself, “What is my return after taxes?”

Inflation

Another silent thief you have to watch out for is the effect of rising prices, otherwise known as inflation.

Over the long term, inflation erodes the purchasing power of your income and wealth.

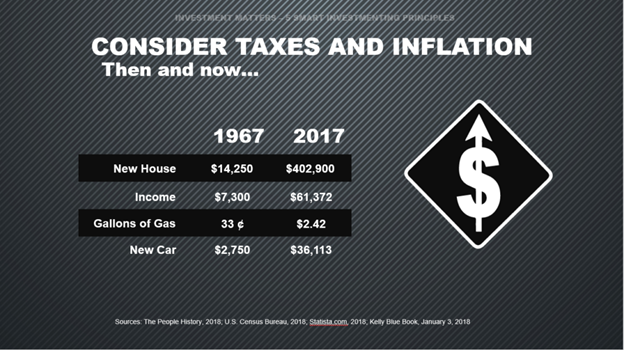

It’s easy to see; just look at prices from 1967.

In 1967, a new house cost $14,250. Income was $7,300 per year. A gallon of gas cost 33 cents. And the average cost of a new car was $2,750.

In 2017, the average price of a new home was $402,900. The median household income was $61,372 per year. The average price for a gallon of gas was $2.42, and the average price of a new car was $36,113.

Investing to keep up with inflation requires a proactive approach that accounts for the erosive nature of rising prices over time. By strategically allocating your investments across asset classes that historically outpace inflation, such as stocks, real estate, and commodities, you can seek to preserve and potentially grow your purchasing power.

Principle 5: Get Started Now

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.