5 Smart Investing Principles – Get Started Now

Our last investment principle is get started now. Procrastination can be costly.

Please be sure to check out our first 4 principles if you had missed any of the previous posts.

The importance of starting now cannot be overstated. Time is a powerful ally in the world of investing, as it allows your investments to compound and grow exponentially over the long term. By starting early, even with small contributions, you give your investments the greatest gift of all: time. This enables you to weather market fluctuations, take advantage of the power of compounding, and build a substantial nest egg for the future. Remember, the best time to start investing was yesterday, but the second best time is today. Don’t let procrastination rob you of the opportunity to secure your financial future—start now and reap the rewards later.

The Sooner the Better

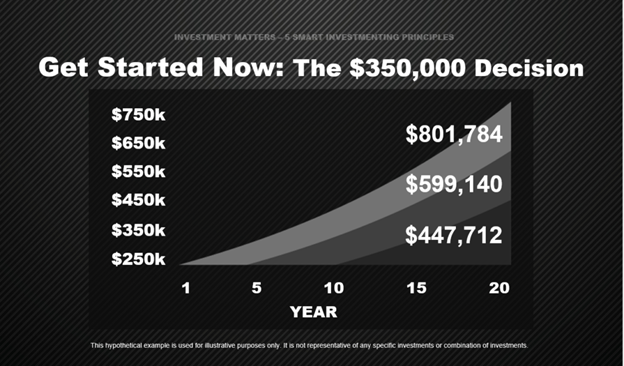

For example, if you were to deposit $250,000 in an account earning 6%, at the end of 20 years your account would be worth $801,784.

If you waited five years before starting your investment program, the $250,000 would have 15 years to work and would grow to $599,140.

And if you waited 10 years, then started your program, you’d only end up with $447,712.

Put another way, waiting 10 years to start was a $350,000 decision.

Keep in mind, this is a hypothetical example used for illustrative purposes only. It is not representative of any specific investment or combination of investments.

What now?

When you’re ready to move forward, we’ve identified some specific action items to help you get started.

First, put together a personal income statement. You want to identify all your sources of income and where your money is going.

Next, put together a simple balance sheet. This should give you a good snapshot of your assets and liabilities.

Identify your long-term, medium-term, and short-term financial goals.

Then, be honest with yourself about your tolerance for risk. Can you stomach big market swings or are you more comfortable with less volatility? Once you have sized up your personal finances, you may be ready to discuss your situation with a professional.

Following a few smart investment principles can make your investment efforts much more effective. But it doesn’t end there. Effective investing requires an ongoing effort. And there’s a lot more to know.

Here are some questions that arise at different stages of life:

Anthony and Selena have a growing family and wonder, “What’s the best way to fund our childrens’ college education?”

Dave and Christine are in retirement. They ask, “Should we change the allocation of our portfolio now that we’re no longer working?”

Rebecca is a single woman with a small business. She wants to know, “My business is finally doing well; what’s the best way to put my extra income to work for my family’s future?”

Isaac likes to do research online. He asks, “Does it make sense to watch the market every day and trade on what happens there?”

Answers will depend on each unique situation.

There are a number of strategies you can use to attempt to invest wisely.

And that’s where we come in. We specialize in helping people just like you set up investment strategies that help them pursue their investment objectives.

If you are ready to take a fresh look at your investment portfolio, take advantage of our complimentary consultation and schedule a review today.

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.