5 Smart Investing Principles – Diversify

We’ve already gone over Estimating Your Time Horizon and Knowing Your Risk Profile. Up next is one of the most important principles, “Diversify, Diversify, Diversify.”

Diversification is a cornerstone of smart investing principles, offering protection and potential for growth in your portfolio. By spreading your investments across various asset classes, industries, and geographic regions, you can reduce the risk of significant losses from any single investment or market downturn. Diversification not only helps to smooth out volatility but also allows you to capture gains from different sectors and asset classes that may perform well at different times. In essence, it’s like not putting all your eggs in one basket—by diversifying, you increase the likelihood of achieving consistent, long-term returns while minimizing the impact of unforeseen events on your investment portfolio.

Diversify, Diversify, Diversify

Diversification suggests that a portfolio of different kinds of investments, on average, may potentially yield a higher return and pose less risk than any individual investment.

In short, diversification helps manage the company-specific risks.

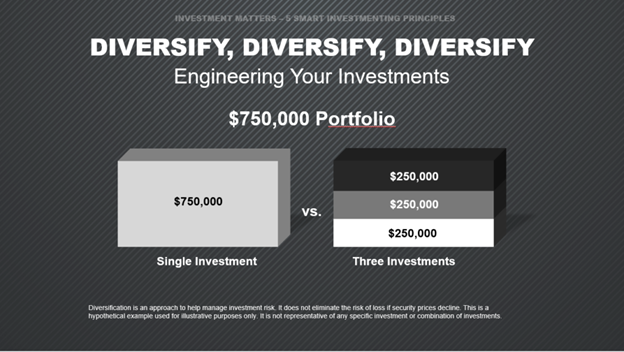

Let’s assume we have an investor who has $750,000 to invest. On the left is a hypothetical example of $750,000 placed into a single investment.

On the right is a hypothetical example of the same amount divided between three investments.

Diversification is an approach to help manage investment risk. It does not eliminate the risk of loss if security prices decline. This is a hypothetical example used for illustrative purposes only. It is not representative of any specific investment or combination of investments.

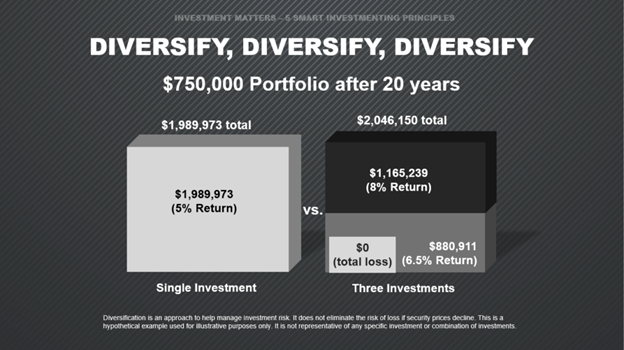

After 20 years, the single investment, assuming a 5% annual return, will have grown to roughly $2 million.

During the same period, our diversified portfolio will have grown to just over $2 million. And in this example, we’re assuming that one of the investments was a total loss; that is, it was worth nothing at the end of 20 years.

Diversification is an approach to help manage investment risk. It does not eliminate the risk of loss if security prices decline. This is a hypothetical example used for illustrative purposes only. It is not representative of any specific investment or combination of investments.

Understanding Market Moves

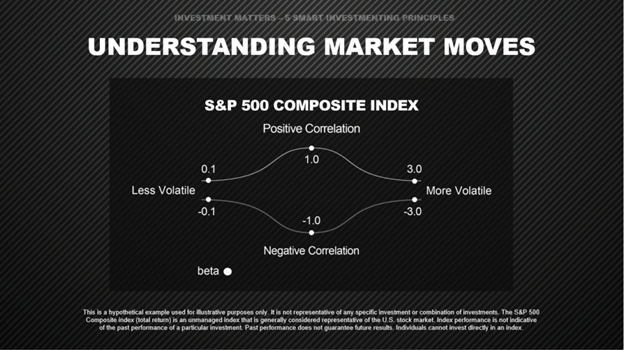

There’s more to diversification than simply spreading your money around to different investments. In principle, you want to select investments that have a low correlation with each other. That is, investments that don’t tend to behave the same in a market environment.

One measure of correlation is called the “beta.” Beta is a measure of a stock’s correlation with the overall stock market. Beta is a measure of how likely a stock is to move up and down as the overall stock market moves up and down.

In this example, we’re using the Standard & Poor’s 500 Composite Index (total return) to represent the market; so it has a beta of one. The S&P 500 is an unmanaged index that is generally considered representative of the U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Individuals cannot invest directly in an index. A stock price that varies more widely than the S&P 500 would be expected to have a beta that is greater than one. A stock with a beta of two, for example, will rise and fall, on average, by twice as much as the wider stock market. So, if the S&P 500 falls by a hypothetical 1%, a stock with a beta of 2 would be expected to drop by 2%.

Beta can also be negative. For example, a stock with a beta of negative one would expect to see its value fall by 1% when the market rises by 1%.

What we have reviewed are hypothetical examples used for illustrative purposes only. They are not representative of any specific investment. Past performance does not guarantee future results.

Principle 4: Consider Taxes and Inflation

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.