When the Headlines Get Loud, Remember the Long Game

The past few weeks have felt like déjà vu: economic headlines flashing words like “volatility,” “tariffs,” “uncertainty,” and “policy shift.” It’s hard not to feel a little unsettled. Whether you’re a retiree watching your nest egg or a working professional trying to stay disciplined, the mood in the markets can feel…tense.

So, let’s take a deep breath — and a step back.

Markets don’t move in a straight line. They never have. And trying to interpret every short-term move through the lens of long-term success? That’s a recipe for stress, not smart investing.

Volatility Isn’t a Bug. It’s a Feature.

Since 1950, the S&P 500 has experienced 38 corrections — defined as drops of 10% or more. That’s one every ~2 years. In fact, a 10–15% decline in the market is so common it’s practically background noise.

Yet, during the same period, the S&P 500 has delivered an average annual return of roughly 10%. ¹

Think about that: despite recessions, wars, oil shocks, inflation spikes, political upheavals, pandemics — the market has always marched forward. Not because investors are irrationally optimistic but because, over time, earnings grow, innovation compounds, and human progress continues.

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett.

Trying to Time the Market? History Says Don’t.

In volatile periods like this, it’s tempting to “wait things out” — sell high, sit in cash, and jump back in when things “feel safe again.”

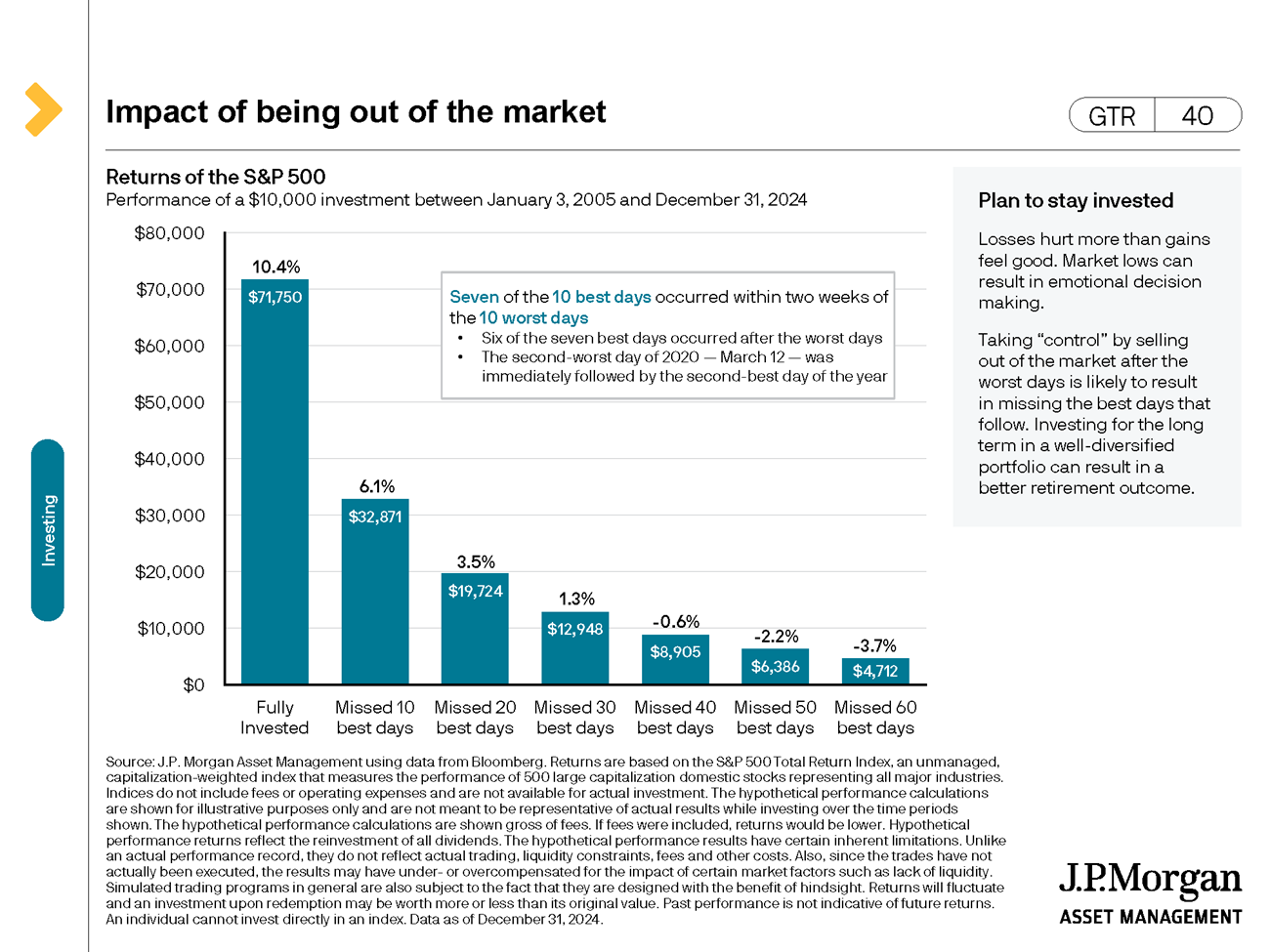

But here’s the problem: some of the best days in the market happen right after the worst ones.

Let’s take the 20-year period from 2003–2022. If you missed just the 10 best days, your return was cut in half.² And 7 of those 10 days? They happened within two weeks of the 10 worst days. You blink, you miss the rebound.

This isn’t just anecdotal. It’s data. And it tells us something simple: timing the market isn’t a strategy — it’s a gamble.

The Power of Staying Invested

Source: J.P. Morgan Asset Management, Guide to the Markets (2025)

But What About Tariffs and Policy Uncertainty?

It’s fair to ask whether tariffs and shifting economic policies might “break” the pattern.

We’ve seen this movie before. In 1930, the Smoot-Hawley Tariff Act raised U.S. tariffs dramatically, leading to a trade war that worsened the Great Depression.³ But that’s not the world we live in today.

Today’s global economy is more connected, more responsive, and frankly, a lot more resilient. Yes, protectionist policies can hurt in the short term. But markets adapt. Supply chains shift. Earnings recover. Investors who stay disciplined are often rewarded.

“Markets hate uncertainty, but they love adaptation. And they’re better at it than most of us give them credit for.” — BlackRock

What Should You Do Right Now?

Whether you’re retired or just starting your investing journey, here’s what history — and logic — suggest:

- Stay invested. Time in the market > timing the market.

- Stay diversified. Don’t put all your eggs in one economic policy basket.

- Zoom out. Your plan should be built for decades, not days.

- Tune out the noise. Headlines aren’t investment strategies.

In Summary:

Yes, things feel uncertain. But when haven’t they?

Markets are noisy. Politics are messy. But if you trust history, trust your plan, and trust in long-term growth, you’ll be in better shape than most.

Because when the headlines scream chaos, discipline becomes your biggest advantage.

Footnotes and Sources

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, APRIL 7 | |

| 10:30 AM | Fed Governor Adriana Kugler speaks |

| 3:00 PM | Consumer credit |

| TUESDAY, APRIL 8 | |

| 6:00 AM | NFIB optimism index |

| 8:00 AM | San Francisco Fed President Mary Daly speaks |

| WEDNESDAY, APRIL 9 | |

| 10:00 AM | Wholesale inventories |

| 11:00 AM | Richmond Fed President Tom Barkin speaks |

| 2:00 PM | Minutes of Fed’s March FOMC meeting |

| THURSDAY, APRIL 10 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Consumer price index |

| 8:30 AM | CPI year over year |

| 8:30 AM | Core CPI |

| 8:30 AM | Core CPI year over year |

| 10:00 AM | Fed Governor Michelle Bowman testifies to Senate |

| 10:00 AM | Kansas City Fed President Jeff Schmid speaks |

| 12:00 PM | Philadelphia Fed President Patrick Harker speaks |

| 12:00 PM | Chicago Fed President Austan Goolsbee speaks |

| 2:00 PM | Monthly U.S. federal budget |

| FRIDAY, APRIL 11 | |

| 8:30 AM | Producer price index |

| 8:30 AM | Core PPI |

| 8:30 AM | PPI year over year |

| 8:30 AM | Core PPI year over year |

| 10:00 AM | Consumer sentiment (prelim) |

| 10:00 AM | St. Louis Fed President Alberto Musalem speaks |

| 11:00 AM | New York Fed President John Williams speaks |

Most anticipated earnings for this week

Did you miss our last blog:

Tarriffs Are Back – But Haven’t We Learned This Lesson Before?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.