Growing up as a Midwest farm kid in the 1970s, I frequently listened to the group Kansas. One of my favorite songs was “The Point of Know Return.” The seemingly grammatically incorrect title was intentional. The lyrics signaled the crossing of an imaginary line beyond the known, familiar, and safe to the new, unexplored, and unknown. Some applied the song to drug usage, but that’s a topic for a different commentary. Just returning from a European research trip, I was reminded of the song as I was studying the Western Europe and German electric power industry. Historically, a stable and relatively predictable equity investment, many of these companies are charting new paths, evolving away from traditional fuel sources, moving into a category known as renewables. Promising, yes, but investors beware: they may get zapped.

Electric power traditionally qualifies as one of the safer equity investments. These companies generate, transmit, and distribute electricity to homes and businesses everyday regardless of economic conditions. Although their generation or distribution assets initially requires a significant capital investment, they usually generate guaranteed income through government-set rates to provide a reasonable profit. They’re frequently regional monopolies or semi-monopolies with limited competition, and have a captive, electricity-dependent customer base. Ergo, they rarely go bankrupt. With such consistent cash generation and limited need to reinvest in their businesses, they frequently pay out a large proportion of earnings in cash dividends. These dividends are rarely reduced and provide investors with an attractive yield, typically higher than high-quality government or corporate bonds. These companies have been relatively simple and sleepy businesses.

Historically, the primary fuels for electricity generation have been coal, natural gas, and nuclear. But burning coal emits pollution, a lot of it, including carbon dioxide, mercury, sulfur dioxide, nitrogen oxide, and particulates (better known as soot). These pollutants have been linked to global warming and acid rain, as well as health problems like asthma and other lung ailments, cancer, and neurological disorders. Natural gas is relatively clean, but still creates carbon dioxide emissions. Nuclear, while considered environmentally friendly since it produces less greenhouse gas, has its own problems including the need for radioactive waste disposal, adverse impacts from uranium mining, and the threat of loss of life from an accident or militant activities.

Enter the renewables. Both wind and solar avoid the nasty problems listed above, but have not yet achieved what’s known as grid parity. In other words, investment and operating costs per megawatt-hour of electricity are still higher for wind and solar compared to nuclear and coal. The societal damage nuclear and fossil fuels inflict, however, gives renewables the advantage, by some calculations. These societal impacts are hard to quantify and are not yet reflected in most customer electricity bills globally. Spearheading the effort to move to a different model is Europe and, more specifically, Germany. To effect the change to cleaner energy there, governments are requiring the purchase of carbon credits. Companies producing one megawatt-hour of electricity using coal, produce one ton of carbon dioxide emissions, and need to purchase a carbon credit. This raises the cost of coal-generated electricity, making renewable-generated electricity more competitive.

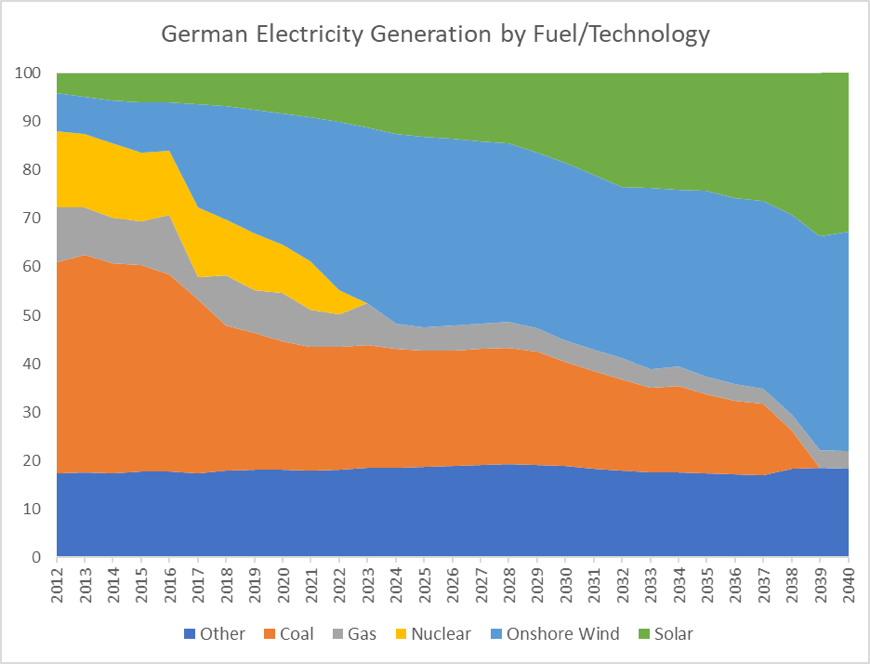

Germany is one of the more aggressive in its transition, trying to lead the European Union away from its traditional fuels for power generation. Germany plans to completely phase out nuclear power by 2022. This is incredible for a country where just five years ago, nuclear accounted for over 22% of the country’s conventional electricity production. Coal, meanwhile, is planned to be completely phased out by 2038, even though it accounted for about 39% of Germany’s electric generation last year. Obviously, these plants have much longer useful lives, but to speed the conversion, the government has agreed to compensate the power producers to decommission the plants, an expensive and potentially contentious proposition.

Source: Advisors Capital Management, Bankhaus Metzler, Bloomberg Finance L.P. Data as of June 2019

Other European countries are pursuing this transition, but are generally behind Germany. Additionally, the U.S. and other regions lag behind Europe. Thus, the German experience will be closely watched. Obviously, there are many unknowns. How quickly will solar and wind generation costs decline? Will they achieve grid parity? Will the government and taxpayers continue to pay for these expensive plant shutdowns to convert to higher cost power? Will the carbon credit market continue to function as intended to drive more renewable generation? Will they achieve this in the targeted timeline? We view the answers to these and other questions to be especially important in gauging the investment attractiveness of the industry. Unfortunately, at this point in time, we think projections could vary wildly from reality. It seems clear that the government will play a crucial role, not only in the industry’s evolution but also in the success of the companies involved in this new type of generation. This gives us reason to pause as investors. We seek companies with a defensible competitive edge, but generally find limited opportunities in those that depend on governments affecting positive change, and we’re especially leery in this German case of the government fulfilling its monetary and timeline promises to help decommission existing plants. The Kansas song goes “How long, how long to the Point of Know Return?” Frankly, in terms of the electric power industry transition, we don’t know how long (or which path) it will take, but we would be “shocked” if it went smoothly.