The Jenga Tower Economy

The economy right now reminds me of a long game of Jenga. The tower grows taller, and everyone cheers. Then you look closely and notice the bottom shifting just a little each time. That is where we are in 2025.

A Tower That Looks Strong from Far Away

Growth appears healthy. Markets continue reaching new highs. Fiscal policy remains loose. The Fed has reduced its pressure. From an outside perspective, the structure appears solid.

To quote the illustrious fictional character Cher Horowitz from the 90s movie Clueless, “it’s like a Monet, from far away it looks okay, but up close, it’s a big old mess.”

Small Businesses Start to Slip

Small American companies have faced significant challenges this year. These firms employ nearly half of all workers in the country. In trade, their influence is even more substantial. A recent report from the Department of Commerce revealed that small businesses account for a third of the total value of all imported goods and make up almost every importing company in America.

They are also the least able to absorb tariffs and rising costs. They lack the scale to rebuild supply chains or access the resources that larger companies rely on. The Atlanta Fed surveyed small firms and found they expect sales to fall about nine percent due to higher expenses. Large firms expect only a small fraction of that.

To stay afloat, small businesses have been reducing staff. Between April and September, they cut over one hundred thousand jobs, while large companies continued to hire.

Cracks in the Labor Market

The government expects to eliminate about three hundred thousand jobs this year. Private companies are pausing hiring and trimming staff as they balance higher costs and rising A.I. investments. In October, layoffs reached the highest level in over twenty years, according to data from Challenger, Gray and Christmas.

Job losses hit spending. Lower spending hits revenue. That cycle is how a tower starts leaning.

Consumers Have Been the Key Support

Consumer spending remains the main pillar supporting the economy this year. However, that support is becoming uneven. More spending is coming from the top of the income ladder, while households in the lower and middle ranges are falling behind. Delinquencies are increasing, and their spending is leveling off.

The top 10% of households now owns nearly 90% of all corporate stock and mutual funds. They have enjoyed huge gains. The S&P 500 has increased by more than seventy percent since late 2022.

Technology Companies Are the Cornerstone

Large American tech companies have become the central part of the economy. Their growth has fueled most of the market’s gains. The wealth generated there has kept household spending alive, especially for those most able to spend.

Their investment levels are historic. Alphabet, Meta, Microsoft, and Amazon together are expected to spend more than three hundred eighty billion dollars this year on data centers and infrastructure. In the first half of 2025, spending linked to A.I. contributed more to GDP than household consumption.

This group of companies is powering the tower. Their investments boost markets. Markets lift wealthy households. Wealthy households keep spending. That cycle has been the stabilizer.

How Long Can This Last

If these firms continue investing and stay profitable, the tower remains stable. Tax refunds in spring could boost household budgets. Cooler inflation might enable the Fed to lower rates.

Wall Street is betting on stability. Forecasts predict solid GDP growth next year and strong earnings from major companies.

But towers do not grow forever. A.I. companies could face limits, including the electricity needed for expanding data centers. Revenue may fall short of expectations. Inflation could stay sticky. Global risks could show up out of nowhere.

No one knows which block will be pulled next.

What This Means For You

Your financial success should not rely on whether the next layer of blocks remains steady. The economy will always experience cycles. Markets will have both good and bad periods. The only thing you control is your plan.

Remain diversified. Remain patient. Remain disciplined. The tower can sway without jeopardizing your future.

Sources

- United States Department of Commerce

Small Business Trade and Import Activity Report, April 2025 - Federal Reserve Bank of Atlanta

Business Inflation Expectations Survey, April 2025 - ADP Research Institute

National Employment Report, April to September 2025 - Challenger, Gray and Christmas

Monthly Job Cut Report, October 2025

Historical Layoff Data Series - Bureau of Labor Statistics

Employment Situation Summary, 2025

Labor Market Trends and Worker Demographics - Federal Reserve Board of Governors

Household Balance Sheet Data, 2025

Remarks by Governor Lisa Cook, November 2025 - Bloomberg

S&P 500 Index Performance Data, 2022 to 2025

Consensus GDP and Earnings Forecasts, 2025 - Company Public Filings and Earnings Calls

Alphabet Capital Expenditure Reports, 2025

Meta Platforms Infrastructure Investment Announcements, 2025

Microsoft Quarterly Capital Spending Data, 2025

Amazon Web Services Infrastructure Plans, 2025

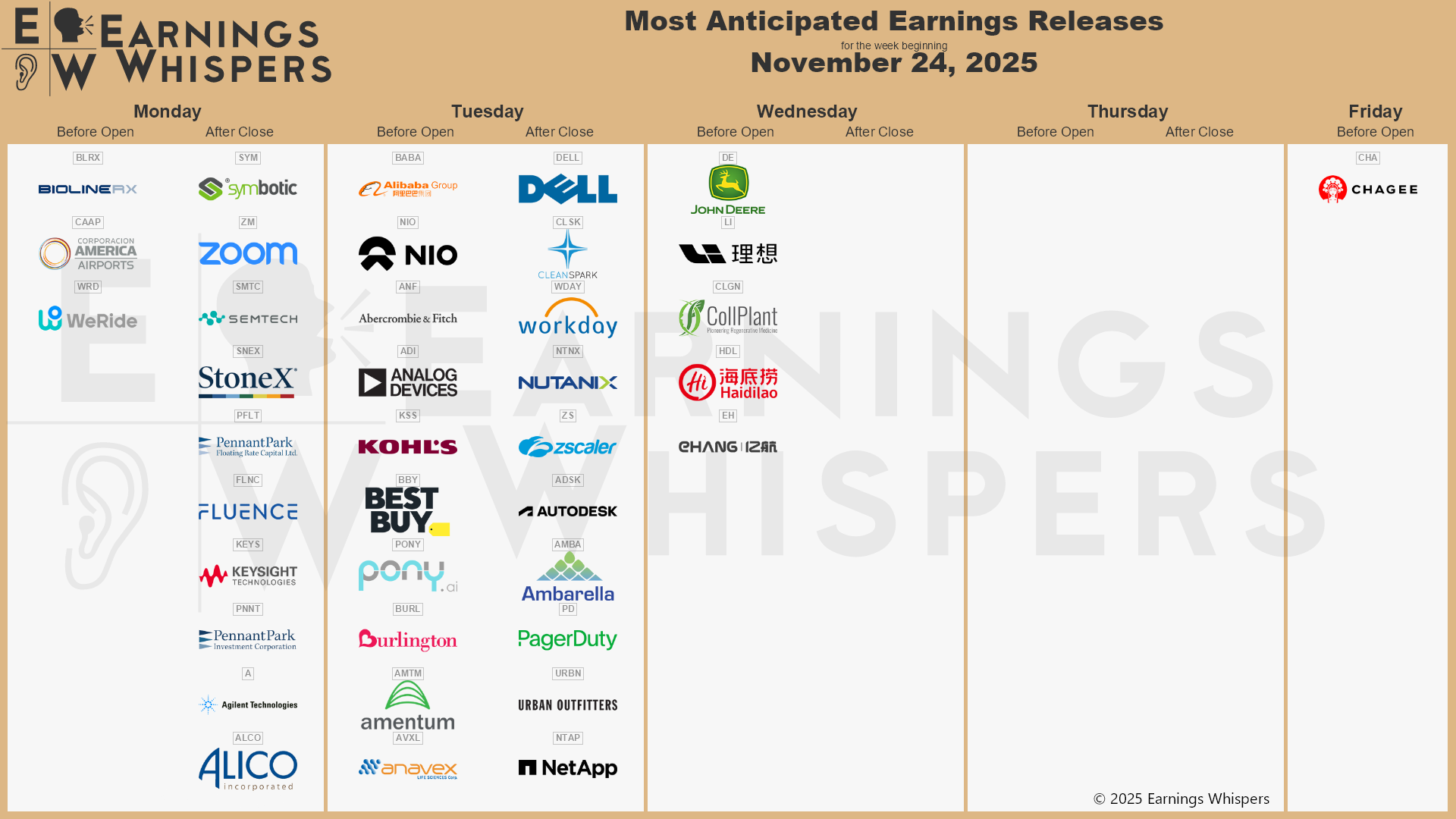

Stock Market Calendar This Week:

| Time (ET) | Report |

| MONDAY, NOV. 24 | |

| None scheduled | |

| TUESDAY, NOV. 25 | |

| 8:30 AM | U.S. retail sales (delayed report) |

| 8:30 AM | U.S. retail sales minus autos |

| 8:30 AM | Producer price index (delayed report) |

| 8:30 AM | Core PPI |

| 8:30 AM | PPI year over year |

| 8:30 AM | Core PPI year over year |

| 9:00 AM | S&P Case-Shiller home price index (20 cities) |

| 10:00 AM | Business inventories (delayed report) |

| 10:00 AM | Consumer confidence |

| 10:00 AM | Pending home sales |

| WEDNESDAY, NOV. 26 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Durable-goods orders (delayed report) |

| 8:30 AM | Durable-goods minus transportation (delayed report) |

| THURSDAY, NOV. 27 | |

| Thanksgiving holiday, none scheduled | |

| FRIDAY, NOV. 28 | |

| 9:45 AM | Chicago Business Barometer (PMI) |

Did you miss our last blog?

How Investment Advisors Are Structured

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.