by Jeff Deiss

CFP, AEP, Wealth Advisor

The Social Security Administration announced last week that benefits and the maximum amount of wages subject to payroll taxes will increase by 1.6% in 2020. This reverses the trend of higher increases over the past two years and while it is more than a full percentage point less than the 2.8% increase for 2019, it is still ahead of the average 1.4% increase per year over the past decade.

Social Security benefits increase automatically if the CPI-W, which measures price inflation for urban workers, increases in the third quarter (July, August & September) of the current year over the third quarter of the previous year. So some of you might recall this year’s larger 2.8% increase was somewhat impacted by temporary issues, namely hurricanes Florence and Michael, that occurred during the third quarter of 2018.

Payroll Tax Impact

From a wage perspective, employers and employees each pay 6.2% in payroll taxes to help fund Social Security. In 2019, the payroll tax applied to the first $132,900 of a worker’s gross earnings. In 2020, a 1.6% increase will raise the taxable wage limit by about $4,800, to roughly $137,700.

Impact on workers who claim early Social Security Benefits

Individuals will also be able to earn a bit more from a job without jeopardizing any of their benefits if they claim Social Security before their “full retirement age”.

If you’ve claimed Social Security early and are working, then you can earn up to $18,240 in 2020 without jeopardizing any benefits (up from $17,460) this year. Any earnings above this cap mean that you lose $1 of Social Security benefits for each $2 over the $18,240 limit. This earnings cap does not apply “unearned” income like pensions or investment income.

In the year that you reach your full retirement age, there is a more generous cap. If your full retirement age is next year, for example, then you can earn up to $48,600 in the months that lead up to your birthday, after which you lose $1 in benefits for every $3 earned over the cap.

Once you reach full retirement age, which is currently 66 and moving toward 67 depending on the year you were born, these restrictions disappear.

Impact on Social Security Retirement Income beneficiaries

In December 2019, Social Security COLA notices will be available online to most of the 63 million beneficiaries who receive social security income benefits in the message center of their “my social security” account on the www.ssa.gov website.

The average monthly benefit for all retirees is expected to be $1,479 in December 2019 before the 1.6% COLA raises the average benefit to $1,503 per month or an increase of $24 per month or $288 for the year. The increase will be more in dollars for those with a higher benefit and less if your benefit is less than average.

Many retirees should again see a slight increase in their “net” Social Security benefits in 2020, like last year and unlike 2018 when the 2% COLA was basically wiped out by a $25 increase in monthly Medicare Premiums.

High-income retirees continue to pay more for the same Medicare Coverage (IRMAA)

For 2020, the basic Medicare Part B premium is projected to increase by $8.80, to $144.30 per month, up from $135.50 this year. The official announcement about Medicare premiums for 2020 will be issued later this year.

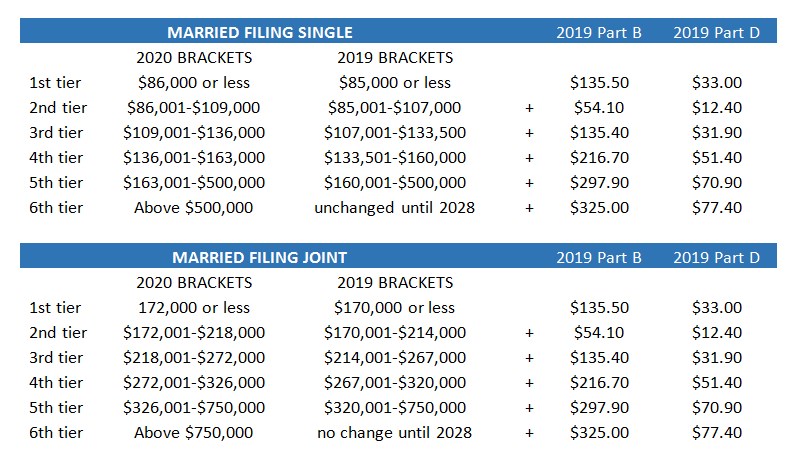

Individuals with a modified adjusted gross income (MAGI = Adjusted Gross Income plus tax-exempt interest from municipal bonds) above Medicare’s thresholds pay a surcharge on both their Medicare Part B (doctors) and Part D (prescription drug) premiums. There are six tiers that determine surcharges on about 5% of total Medicare beneficiaries whose income is high enough for them to apply.

These surcharges, also known as an income-related monthly adjustment amount, or IRMAA, are based on your tax return from two years prior. In 2019, the surcharges were based on your MAGI for 2017 and, in 2020, the surcharges will be based on your MAGI from your 2018 tax return. The surcharges paid is not constant as it can go up, or down, in a given year depending on your income.

For 2019, just $1 of MAGI over the bracket could have cost a single filer an extra $649 in Medicare Part B premiums ($54.1 x 12 months) and $149 in Medicare Part D premiums ($12.4 x 12) due to the surcharge on the first bracket jump from ($85,000 to $85,001).

IRMAA to be indexed to inflation starting Jan 1, 2020

For the first time in a decade, the income brackets used to determine Medicare premium surcharges will be indexed to inflation. For 2020, the gauge used is the CPI change from September 2018 through August 2019, which was 1.7%, rounded to the nearest $1,000. The updated income brackets for 2020 are included above and there is some good news and bad news as a result.

The good news is that the brackets are higher, meaning that you can earn a bit more income before being kicked into a surcharge bracket. This translates to an additional $1,000 to $3,000 for single filers and $2,000 to $6,000 for joint filers just for 2020. And the brackets will continue to be adjusted for inflation going forward, with the exception of the top bracket (Tier 6), which won’t be indexed until 2028.

Previously, the brackets had essentially been fixed since 2011, which meant that a growing number of beneficiaries had become subject to the surcharges.

One study on this issue by Healthview profiled several case studies, such as a single, 65-year old woman living to age 89 and with an income of $100,000 (Tier 2). The expected outcome of inflation indexing indicated that she can expect to save more than $50,000 over her lifetime as a result of indexing going forward vs. a scenario where the surcharge brackets were not indexed for inflation.

The bad news is that reduced revenues from Medicare surcharges could put added pressure on the Medicare Trust fund longer term. So retirees should expect additional changes and cost-shifting in order to make up for the lost revenue.

Managing Surcharges in Retirement

Required minimum distributions (RMDs) from IRAs are added to MAGI and can impact Medicare surcharges in retirement if you are not expecting this. If you have large retirement accounts, then you may have an increase in your taxable income once your RMDs start (when you turn age 70.5) and push you into a higher, surcharge bracket.

It’s important to understand the impact RMDs have as well as opportunities to manage or reduce surcharges by incorporating helpful planning techniques. We’ve discussed many of these in previous posts including Roth IRAs, Health Care Savings Accounts (HSAs), Qualified Charitable Distributions (QCDs) and Reverse Mortgages. Distributions of cash value from permanent life insurance policies (up to your cost basis) would also fall into this category. If you have questions, reach out to your ACM Wealth Advisor for information and assistance.

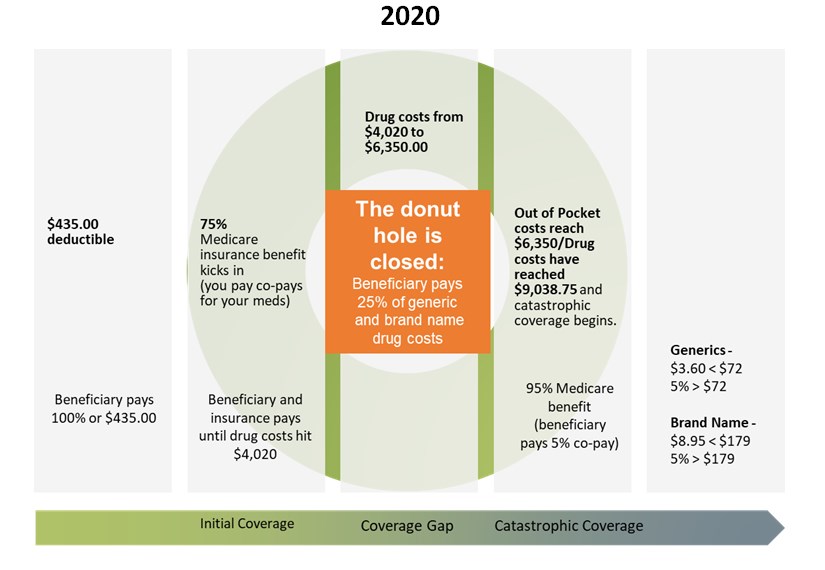

Say Goodbye to the Donut Hole

Since the Affordable Care Act was passed in 2011, the gap in prescription drug coverage under Medicare Part D, which is also known as the Donut Hole, has been slowly closing. In the past, and in the donut hole, Medicare beneficiaries paid a higher percentage for the cost of generic and brand-name prescription drugs between their “initial coverage” and until they reached “catastrophic coverage”. Starting on Jan. 1, 2020, the donut is closed in that beneficiaries will pay the same 25% that applies during Initial Coverage all the way until they hit $6,350 in total out-of-pocket drug costs.

Only about 5% of Medicare beneficiaries make it to catastrophic coverage, but for those that do, Medicare essentially covers 95% of the cost of generic and brand-name prescription drugs.

Medicare Part D has greatly helped to reduce drug spending for millions of Medicare recipients and the trend in drug costs has turned favorable due to continued pressure from the federal government. But there are certain medications that are specialty drugs or that fall outside of Part D altogether. And you only receive these benefits if your formulary (the medications prescribed, as well as their dosages and frequency) is covered by your plan.

It’s Annual Election (AEP) Season: Part One

CMS announced that premiums for Part D premiums are expected to continue to trend down, as they have for the past couple of years, by about 13.5% for 2020, to a projected $30 per month (the base premium before any surcharges may be applied for high earners).

As we mentioned last week and in previous posts, shopping your Part D plan every year is a must. Premiums and coverage commonly change from year to year on most Part D plans, meaning that a plan that offered the best value in 2019 may not be the best value for you in 2020. It’s easy to do through Medicare’s Plan Finder, which has been modernized and redesigned for the first time in a decade. Closely examine the plans available to you to ensure that your prescription medicines are covered for the best possible price wherever you are most likely to get them (preferred drugstore). Failing to take this step and shop could wind up costing you big-time.

If you are not comfortable with the computer or the internet, then find a friend or relative who is to help you. If you are plum out of friends and relatives, then pick up the phone and call Medicare at 800-633-4227. Unlike Social Security, Medicare is open 24/7 and the best time to call is late when volumes are low and you’re likely to get more attention. Be sure to have your medications, dosages, and preferred pharmacy info handy when you call so that they can help you find the best plan.

Using Medicare’s own Plan Finder tool (rather than a third party’s tool) allows you to hold Medicare and your Part D plan accountable if any information turns out to be inaccurate. You should be able to change plans during the year if that turns out to be the case and you can back it up with proof that a plan gave you incorrect information when you were selecting it.

If you can’t find a plan that covers all your medications, then you may be able to work with your doctor to get your existing plan (where they have changed a medication to require pre-authorization) to cover the drug anyway. Keep any correspondence from your Part D insurer that show they’ve approved the drug for the year as evidence to submit to support your case. Also, if your plan benefit has changed for next year, then your existing insurer generally must still offer you a 90-day filling of your current medications (known as “transition fill”).

It’s Annual Election Season: Part Two

The other option you have from Oct 15 to Dec 7 every year is to shop your Medicare Advantage Plan, also known as Medicare Part C.

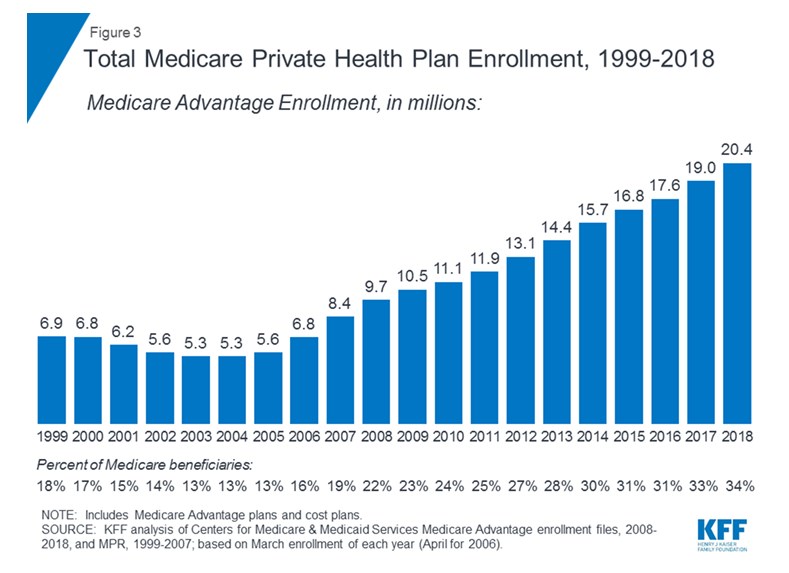

Medicare Advantage Plans are heavily marketed this time of year and are a constant source of confusion. It can even be a little intimidating because there are so many different plans and it can be difficult to determine if you are getting a good deal. Medicare Advantage Plans are also increasingly popular as you can see below.

When you turn 65, or otherwise initially enroll in Medicare, you have the option of choosing “original” Medicare, which consists of Parts A, B, and typically Part D and a Medicare Supplement (aka “Medigap”) plan, OR a Medicare Advantage Plan.

There is a lot to like about Medicare Advantage plans in that they include a maximum annual out-of-pocket expense for hospital (Part A) and outpatient (Part B) coverage, they typically include prescription drug coverage as well as other services such as dental, vision, hearing. For chronically ill enrollees, and new for 2020, some plans will even be able to offer meal delivery, transportation, grocery shopping and support for family caregivers. Original Medicare doesn’t offer all of these services or a maximum annual out-of-pocket expense.

In exchange for typically lower premiums and expanded benefits, the tradeoff vs. original Medicare is that most Medicare Advantage plans require members to use their “in-network” health care providers and the plans often require prior approval to see specialists.

Medicare Advantage plan members still pay Part B premiums (and any related surcharges), but they can’t buy a Medigap policy and usually don’t need to buy a Part D plan. So the monthly premiums might be lower without a Part D and Medigap plan, but out-of-pocket costs can be higher (due to deductibles, coinsurance and co-payments).

Original Medicare typically has higher premiums and does not cover vision, dental and hearing, but when combined with a comprehensive Medicare Supplement plan, your premiums cover the majority all of your health insurance expenses. So you don’t have to shop from year-to-year (other than your Part D plan) or worry that your doctors are no longer “in-network” in your plan. As a result, original Medicare can have fewer “moving parts” vs. Medicare Advantage plans.

Medicare Advantage plans are issued by private insurance companies, which can set their own deductibles, co-payments, coinsurance amounts and networks of providers. These variables can vary widely from plan to plan and company to company from year to year. So some homework is required to choose a plan and it can be complicated to know if you are getting a good deal.

There have been 40 studies reviewed by the Kaiser Family Foundation concluding that older, sicker Medicare beneficiaries receive better access and a higher quality of care through original Medicare while Medicare Advantage members typically end up choosing lower-rated nursing homes when the time comes. As a result, there is a trend of older, sicker individuals moving back to original Medicare later in life. This is not always easy to do as it can be challenging to obtain a Medicare Supplement plan if you are sick/after your initial enrollment period.

Medicare is now the fastest-growing segment of the health insurance market and there is a lot of competition for baby boomers. There will be even more Medicare choices next year and more tradeoffs between original Medicare and Medicare Advantage plans.

On the one hand, the Trump Administration has given private health insurance companies greater flexibility to include additional benefits. All while average monthly premiums for Medicare Advantage plans are expected to drop again in 2020, by about 14%. But keep in mind that Medicare Advantage plans are still private insurance and lower premiums are often offset by higher deductibles, co-payments and coinsurance.

On the other hand, Democratic presidential hopefuls such as Sens. Bernie Sanders and Elizabeth Warren have proposed banning all private health insurers and enrolling all Americans in original Medicare plans administered by the government.

Bottom line: Consider what’s important to you, whether it’s access to your preferred doctors, lower monthly premiums or the best plan to help with your specific drug needs. Consider the “moving parts” as well. Health care expenses typically grow as we age, while our decision-making capacity declines. Whether you have a good support network in place, or not, is important in terms of managing the complexity of your health insurance coverage when the time comes.

No more Medigap policies that cover the Part B annual deductible

People who turn 65 after Jan. 1 and choosing original Medicare will no longer be able to buy Medigap policies that cover the Part B annual deductible, which will be $197 in 2020. So instead of buying one of the most popular Medigap policies, Plan F, new enrollees in Medicare in 2020 and beyond may want to purchase Plan G, which covers all the same things as Plan F, except for the Part B deductible. People who are already 65 or older this year can continue to buy Medigap Plan F, but a shrinking insurance pool (fewer new insureds being added to a pool of older, sicker insureds) could lead to higher premiums for Plan F participants in the future.

Final Thoughts

Your cash flow may be particularly impacted by rising health care costs in retirement. Out-of-pocket expenses for a couple could add up to $285,000, based on Fidelity estimates of expenses that will be incurred during retirement. This is confirmation that health care still represents one of the largest retirement expenses and must be part of an overall retirement strategy. And it does not include all health care related expenses, such as over-the-counter medications, dental care or nursing homes and long term care (which is a separate and important conversation).

Like wading through the minefield of investment options, managing your healthcare in retirement and Medicare options is no less daunting, particularly as we all get older. The confidence of knowing that your health care is covered is one of the most valuable things you can take into retirement.

Please reach out to your ACM Wealth Advisor with questions on your plan and these important issues and consider engaging us in a conversation about your retirement cash flow if you haven’t already.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth