April 24, 2023

See You Next Year, Mr., or Mrs. Accountant

Tax season has come and gone, and most of us now either wait for our anticipated refunds or curse the government for telling us we owe them money. Regardless, your three-month relationship with your accountant has ended, and you will see them again next year. Therein lies the problem with the generally accepted process we undertake each tax season.

Tax Planning =/= Tax Advice

Often, I see families I serve confusing tax advice with tax planning, but they are very different. Tax advice is given by a tax practitioner that is federally authorized, like a CPA, attorney, enrolled agent, etc. That advice will generally involve recommending a specific tax strategy to navigate a particular issue someone is having, like acquiring a business or immigrating to the USA permanently.

Tax Planning is what every single one of you should be doing with your CFP® professional, and it involves helping you navigate settled tax law and how it applies to your life. It also is designed to help project upcoming tax changes, like the sunsetting of the TCJA at the end of 2025, and how it will impact your potential tax strategies.

Value

Those families I serve have all heard me say it before; the plan is the product, not the portfolio. Now is when your CFP® professional should be assessing your 2022 tax returns and have a tax planning meeting with you. The time to be tax efficient for 2023 is now, not scrambling during tax time to make retirement account contributions or fund your HSA.

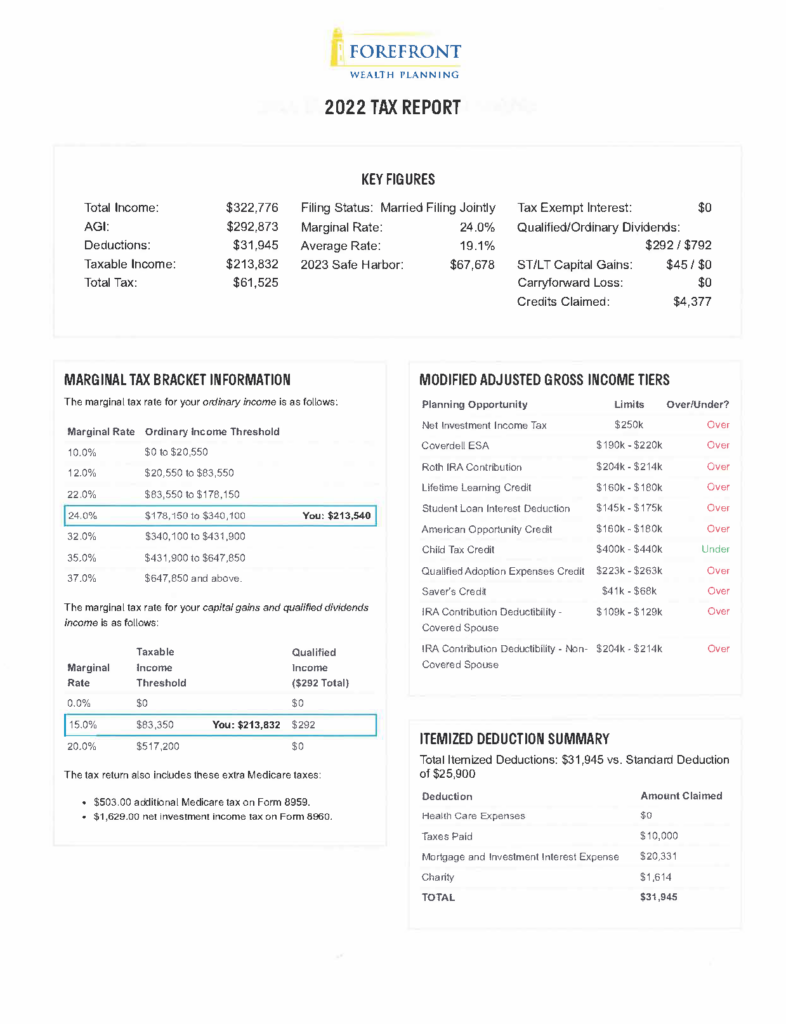

Do you know if you qualify for the Child Tax Credit, or was your income too much? With student loan payments and interest set to return, do you know the limits for the student loan interest deduction, and do you qualify? What about qualifying to make a Roth IRA contribution or get the American Opportunity Credit?

One of the most significant ways I bring value to the families I work with is through thorough tax planning and working closely with their CPA to help implement the tax advice they are giving. Tax planning can’t happen until you get a clear picture of your tax situation, and reading your tax return can be like studying a foreign language to many. Above is the first page of a sample report I give to families when we do tax planning, helping them understand the key facts about their returns. For example, it highlights the various credits they may or may not have available to them and the limits associated with the various credits. In addition, the report details Medicare premiums, Cap Gains, Marginal Tax Brackets, and a host of other information, all paramount to proper tax planning. You might not see your accountant until next year, but if your CFP® professional isn’t doing tax planning, they are not providing enough value.

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, APRIL 24 | |

| None scheduled | |

| TUESDAY, APRIL 25 | |

| 9:00 AM | S&P Case-Shiller home price index (20 cities) |

| 9:00 AM | FHFA home price index |

| 10:00 AM | New home sales |

| 10:00 AM | Consumer confidence |

| WEDNESDAY, APRIL 26 | |

| 8:30 AM | Durable-goods orders |

| 8:30 AM | Durable-goods minus transportation |

| 8:30 AM | Advanced U.S. trade balance in goods |

| 8:30 AM | Advanced retail inventories |

| 8:30 AM | Advanced wholesale inventories |

| THURSDAY, APRIL 27 | |

| 8:30 AM | GDP |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 10:00 AM | Pending home sales |

| FRIDAY, APRIL 28 | |

| 8:30 AM | Employment cost index |

| 8:30 AM | Personal income (nominal) |

| 8:30 AM | Personal spending (nominal) |

| 8:30 AM | PCE index |

| 8:30 AM | Core PCE index |

| 8:30 AM | PCE (year-over-year) |

| 8:30 AM | Core PCE (year-over-year) |

| 9:45 AM | Chicago Business Barometer |

| 10:00 AM | Consumer sentiment (final) |

Most anticipated earnings for this week:

Did you miss our blog last week?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.