OBBA Tax Changes Everyone Needs To Know About

When a large tax bill passes, most people only see the headlines. The details rarely enter everyday conversations, even though those details influence what families actually pay. I put this fact sheet together to help explain the new rules in the One Big Beautiful Bill more clearly. My goal is to provide you with straightforward information so you can make better choices for your family.

Everyone’s situation varies, and these changes include income limits, reporting rules, and new deductions that aren’t always clear. If you’re unsure about how the new law applies to you, don’t hesitate to reach out. I’m always happy to help you understand it and create a plan that works for your life.

TAX BREAKS FOR WORKERS

Tip Income Deduction

- Maximum annual deduction: $25,000.

- Phase-out begins when Modified Adjusted Gross Income (MAGI) exceeds $150,000 (single) or $300,000 (married filing jointly).

- Available to both itemizing and non-itemizing taxpayers.

This deduction can reduce tax on up to $25,000 of reported tips, but it begins to phase out at $150,000 for singles and $300,000 for married couples.

- Self-employed individuals in certain service businesses may not qualify.

Overtime Pay Deduction

Deduction for the overtime “premium” portion (2025–2028).

- Maximum annual deduction: $12,500 (single) or $25,000 (joint).

- Phase-out begins at MAGI over $150,000 (single) or $300,000 (joint).

- Available to both itemizing and non-itemizing taxpayers.

Car Loan Interest Deduction

A new personal interest deduction on qualifying vehicle loans (2025–2028).

- Maximum annual deduction: $10,000.

- Phase-out begins at MAGI over $100,000 (single) or $200,000 (joint).

- Deduction is available whether you itemize or take the standard deduction.

Qualified loans must be for new, personal-use vehicles assembled in the U.S.; used cars do not qualify.

TAX BREAKS FOR SENIORS

Additional Senior Deduction

A temporary extra deduction for taxpayers age 65 or older (2025–2028).

- $6,000 per eligible individual; married couples may claim $12,000 total.

- Phase-out begins at MAGI over $75,000 (single) or $150,000 (joint).

Seniors receive an additional deduction in addition to the standard deduction, but it begins to phase out at $75,000 for individuals.

- Available to both itemizing and non-itemizing taxpayers who are aged 65 on or before the last day of the tax year.

HOMEOWNERS & HIGH-TAX STATES

State and Local Tax (SALT) Deduction Cap

- For 2025–2029, the SALT deduction cap is increased to $40,000 — up from $10,000 under prior law.

- The cap applies fully for taxpayers with MAGI up to $500,000; above that, the benefit phases down, returning to a $10,000 cap for higher earners.

Standard Deduction Becomes Permanent

- Approximate 2025 amounts (indexed):

- $15,750 (single)

- $23,625 (head of household)

- $31,500 (married filing jointly)

These higher amounts remain in place under the new law.

LIMITS FOR HIGH EARNERS

Top-Bracket Itemized Deduction Limitation

- Taxpayers in the top bracket will face a limit where itemized deductions can only reduce their tax by a maximum percentage of the deduction value.

(This is a broader limitation on high-income deductions like SALT and mortgage interest; specific IRS phase-out figures are not yet listed in the IRS fact sheet.) Don’t you love having to file taxes for rules that aren’t even set yet?

BUSINESS OWNERS & SELF-EMPLOYED

20% Pass-Through Deduction (Section 199A)

- The popular deduction for many owners of S corporations, partnerships, and sole proprietorships is preserved and extended.

- Phase-out thresholds adjust yearly and vary by filing status and type of business income. (IRS retains existing rules, but indexing updates are expected.)

Depreciation and Expensing Changes

- 100% bonus depreciation is made permanent for qualifying property placed in service after Jan. 19, 2025.

- Section 179 limits increase, enhancing upfront expensing for business equipment and certain investments.

- Business interest deduction rules revert to a more generous calculation.

ESTATE & GIFT PLANNING

Lifetime Gift and Estate Tax Exemption

- The higher exemption levels remain in place permanently and are indexed for inflation, offering certainty for families and business owners planning their legacies.

Higher estate exemptions are here to stay, but state taxes still require separate planning.

HEALTH SAVINGS & MEDICAL PLANNING

Expanded HSA Eligibility

- Certain bronze and catastrophic health plans now qualify as high-deductible plans, making more taxpayers eligible for Health Savings Accounts (HSAs).

- Certain telehealth and direct primary care arrangements also qualify. HSAs continue to offer triple-tax advantages.

WHY PROFESSIONAL GUIDANCE MATTERS

New deductions come with income phase-outs, reporting requirements, and eligibility rules that software can miss or misapply.

- Reporting requirements for tips, overtime, and car interest are new and unique. IRS

- Many benefits are temporary (2025–2028).

- Higher SALT caps and senior deductions change the itemizing vs. standard deduction decision.

- Business owners must coordinate depreciation, income planning, and entity structure.

OFFICIAL SOURCE

- IRS: One Big Beautiful Bill Act: Tax deductions for working Americans and seniors (IRS.gov).

- Kiplinger tax analysis on senior deduction phase-outs.

- Fidelity lay summary of key phase-outs.

- Investopedia & news analysis on phase-out ranges.

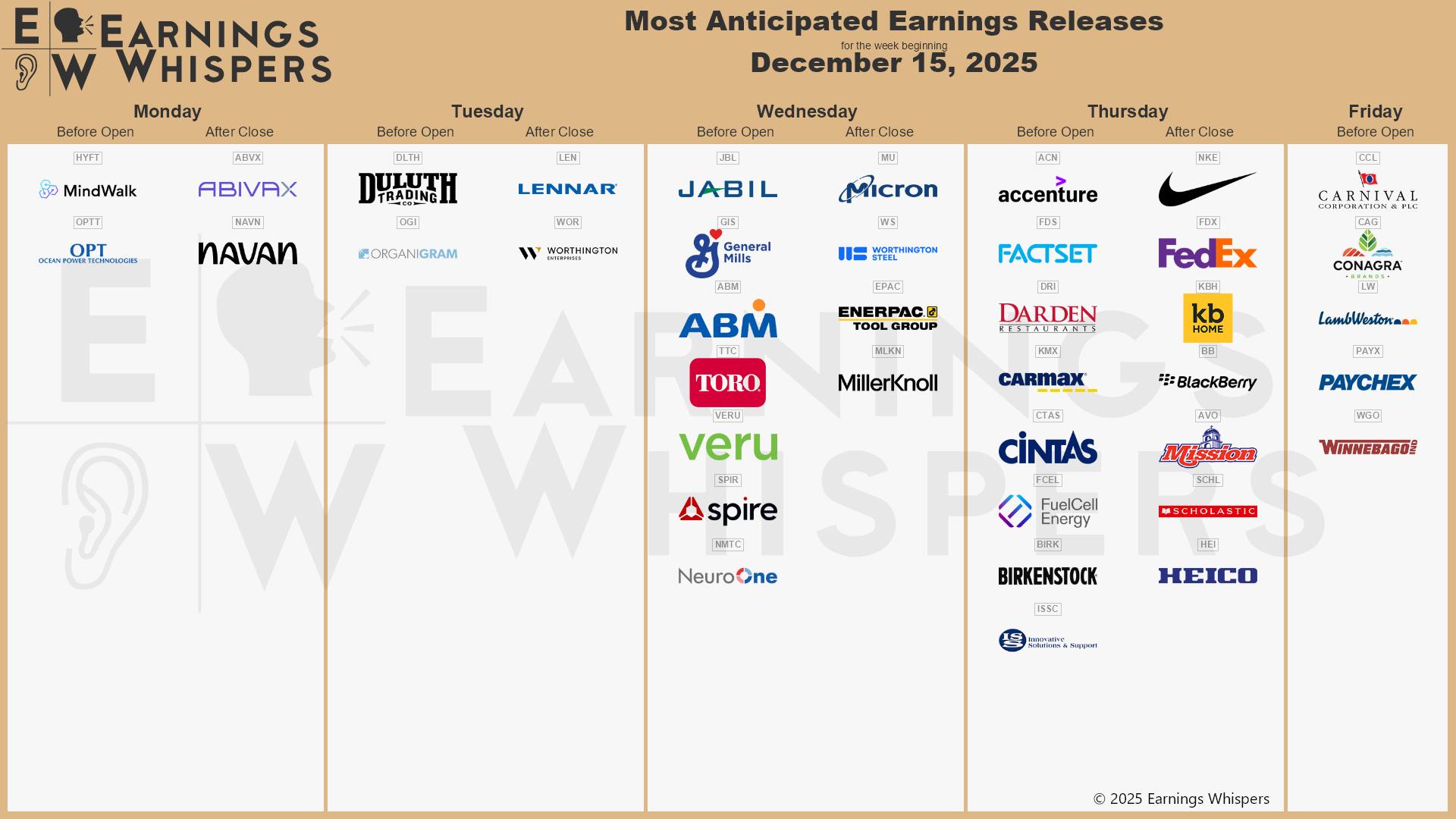

Stock Market Calendar This Week:

| Time (ET) | Report |

| MONDAY, DEC. 15 | |

| 8:30 AM | Empire State manufacturing survey |

| 9:30 AM | Fed governor Stephen Miran speaks |

| 10:00 AM | Home builder confidence index |

| 10:30 AM | New York Fed President John Williams speaks |

| TUESDAY, DEC. 16 | |

| 8:30 AM | *U.S. employment report (delayed report) |

| 8:30 AM | U.S. unemployment rate |

| 8:30 AM | U.S. hourly wages |

| 8:30 AM | Hourly wages year over year |

| 8:30 AM | U.S. retail sales (delayed report) |

| 8:30 AM | Retail sales minus autos |

| 9:45 AM | S&P flash U.S. services PMI |

| 9:45 AM | S&P flash U.S. manufacturing PMI |

| 10:00 AM | Business inventories |

| WEDNESDAY, DEC. 17 | |

| 8:15 AM | Fed governor Chris Waller speaks |

| 9:05 AM | New York Fed President John Williams opening remarks |

| 12:30 PM | Atlanta Fed President Raphael Bostic speaks |

| THURSDAY, DEC. 18 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | *Consumer price index |

| 8:30 AM | CPI year over year |

| 8:30 AM | *Core CPI |

| 8:30 AM | Core CPI year over year |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| FRIDAY, DEC. 19 | |

| 10:00 AM | Existing home sales |

| 10:00 AM | Consumer sentiment (final) |

Did you miss our last blog?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.