Forefront’s Monday Market Update

Why are we so grumpy about our economic recovery?

I see and speak to dozens of clients each week, and almost just as many prospective clients as well, and over the past 12 months I have seen a distinct change in attitude towards our economy, and overall consumer sentiment. This is largely driven by the media pushing a rhetoric designed to divide us rather than provide us information. This is even true of financial media such as CNBC etc.

Economic Facts:

- Economic forecasters are expecting real GDP growth to be 5.7% this year and 4% in 2022.

- Non-Farm Payrolls (jobs) have been up 655,000 per month over the past 6 months bringing the unemployment rate down to 4.6%

- The S&P 500 is up 37% over the past 12 months ending Nov 3rd, marking the best performance EVER in the year following the election of a new president.

In summary, GDP is rising, jobs are being created, and the market is increasing. Did I mention that wages have been rising briskly as well?

Cynical

Now, it is easy to say “well inflation is high.” If you use media talking points you will think some how Joe Biden is the reason you can’t buy a dishwasher.

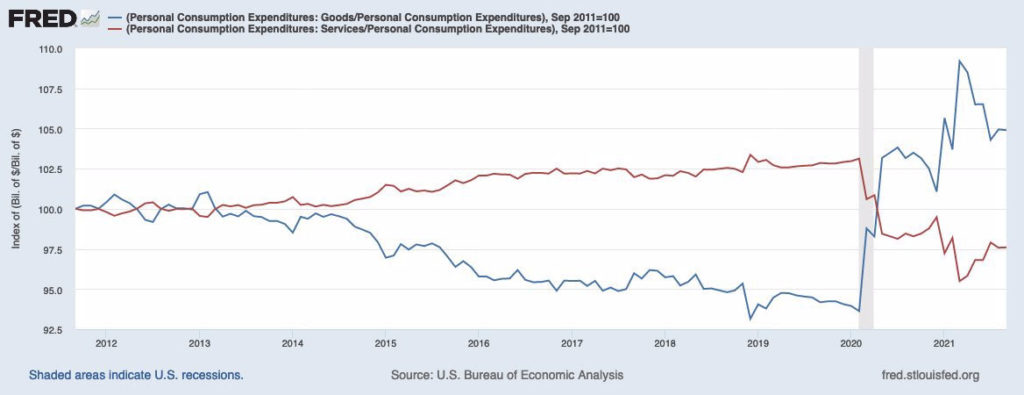

Inflation is high because demand is through the roof, and the only reason demand is through the roof is because consumers (that’s us) are buying goods faster than we ever have before. We can only buy goods if we have money, which at the moments American’s are flush with. Take a look at the chart below as it shows the relationship between American spending on goods vs services over the past 10 years.

Simply put, we just weren’t prepared for the huge spike in demand for goods, because over the past 10 years, the divergence between spending on goods vs spending on services has rapidly increased. It has nothing to do with who the president is. This is a fall out from a change in behavior brought on by a global pandemic.

Inflation is not a predictor

The past 6 months have seen consumer prices rising faster than they ever have since the early 1980’s, but the rate of increase has slowed tremendously in the month-to-month data.

When many of us think about inflation, the drawn-out period of stagflation of the 1970s and early 1980s is what immediately comes to mind, because its what many of us lived through, and remember. As someone whose process for making decisions always includes historical data, I feel like what we are seeing can be easier compared to the spike in inflation we saw after WW1 and WW.

The pain of inflation is absolutely real, and must be taken seriously, but also put into perspective when using it to gauge what may happen going forward. The unemployment rate and inflation are both lagging indicators, meaning they look backwards, not forwards.

Inconsistency breeds cynicism

For better or for worse, we have all grown accustomed to a steady march higher, with occasional blips on the radar that cause some concern. We are getting economic data on a weekly basis that shows a lot of start and stop momentum to the economy, and that is a direct result of the Covid – 19 pandemic, and a direct factor in explaining the crummy mood most people are in.

The Michigan consumer survey director, Richard Curtin, said that the drop in consumer sentiment “reflects an emotional response, mainly from dashed hopes that the pandemic would soon end.”

The pandemic is ending, and life is returning back to normal, but that doesn’t mean a disruption to the economy like Covid-19 wasn’t going to cause behavioral changes that the economy would have to deal with.

It isn’t crazy to have concern that bad things might happen, especially when a lot of the good things happening in the economy don’t feel great emotionally. A tight labor market that is driving up wages makes the wait time at your favorite restaurant longer and that is emotionally upsetting and causes people to think the economy is the problem. We are an economy built on consumption of goods and services, as wages rise, more people can consume goods and services, which is a long-term benefit to our overall economy. A long-term benefit, that comes with a longer wait time at your favorite restaurant at the moment, but a more prosperous economy over time.

My message is always consistent; the media is not designed to provide you advice, or guidance. I would put their job as providing news at maybe 10% of what they actually do, rather their job is to get you to engage. They want you to watch, click, share, and discuss whatever it is they are talking about, and the way to do that is to cause outrage. Seek out unbiased sources, and make sure the information you are getting is from someone who actually cares about you, your plan, and your success.

So what?

So how does this impact all of you?

- The economy is doing well, stop being so cynical.

- It is okay to worry about bad things happening, but not at the cost of ignoring the good.

| MONDAY, NOV. 8 | |

| 8:30 AM | St. Louis Fed President James Bullard speaks |

| 9:00 AM | Fed Gov. Richard Clarida speaks on the policy framework |

| 10:00 AM | Boston Fed interim President Ken Montgomery speaks on risks |

| 10:30 AM | Fed Chair Jerome Powell gives opening remarks |

| 12 noon | Philadelphia Fed President Patrick Harker speaks on the outlook |

| 12 noon | Fed Gov. Michelle Bowman speaks on housing |

| 1:50 PM | Chicago Fed President Charles Evans speaks on supply chains |

| TUESDAY, NOV. 9 | |

| 6:00 AM | NFIB small-business index |

| 7:50 AM | St. Louis Fed President James Bullard speaks |

| 8:30 AM | Producer price index (final demand) |

| 9:00 AM | Fed Chair Jerome Powell speaks on diversity |

| 11:00 AM | Real household debt (SAAR) |

| 11:35 AM | San Francisco Fed President Mary Daly speaks |

| WEDNESDAY, NOV. 10 | |

| 8:30 AM | Initial jobless claims (regular state program) |

| 8:30 AM | Continuing jobless claims (regular state program) |

| 8:30 AM | Consumer price index |

| 8:30 AM | Core CPI |

| 10:00 AM | Wholesale inventories (revision) |

|

2:00 PM

|

Federal budget

|