May 23, 2022

Forefront‘s Monday Market Update

The Right Questions

During times of uncertainty asking questions has a way of giving perspective, calming your nerves, and helps you process your next step. Not just any questions, but asking the right questions are key to getting relevant information back.

Should I sell now and get back in later? Is this the bottom? What if the market never recovers?

Now, if it was that easy everyone would do it. I don’t know. That will be a first in more than a century of the US stock market operating, and we will need to be more concerned about our supply of guns and canned food if it happens. These aren’t the right questions though. The information you get back does nothing to provide perspective, calm your nerves, or think rationally about your next steps.

When do I plan on using my money?

My children’s 529 accounts are invested ultra-aggressively. As the market has fallen, I have increased my contributions because time is on my side. AJ, my son, will be going into the 4th grade, while Priya, my daughter, will be going into 2nd. This won’t be the last correction we go through before college, but I have time.

All good financial plans consider the time horizon for each basket of dollars, so even if you are taking distributions from your accounts, a distribution plan has been established for up, down, and sideways markets. Continue to remind yourself that your dollars that are most exposed to the current market conditions are likely the dollars you don’t plan on using in the short term. Controlling your emotions during times like this will be the difference between success and failure.

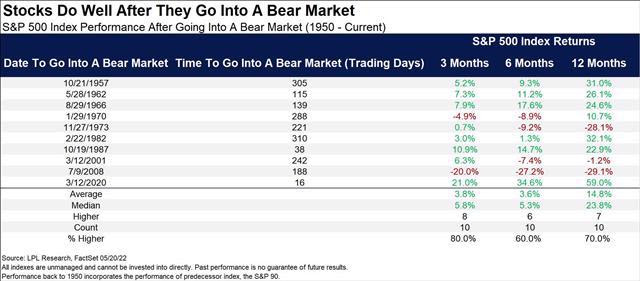

What does history look like after bear markets?

The market has been down for seven straight weeks, and for the average investor it has felt like seven straight months. This is the first time the market has been down for seven straight weeks since 2001 and only the fourth time in history. The other two times were 1970 and 1980 and both times the market was up 30+% one year later. This isn’t a prediction about the market, this is an observation that eventually the pain stops, and markets begin the rational climb back up. Even in 2001, the market was only off by a little more than 1% 12 months later. Not too bad all things considered.

Should I do anything?

Your portfolio is a lot like a bar of soap during market corrections. The more you touch it, the faster it seems to disappear

Yes, you should be doing something. Now is the time to look at how your financial plan has been holding up and discuss your emotions during this time with your financial planner. Understanding how you felt and reacted during times of extreme volatility and fear will help you fine-tune your plan and be ready for the inevitable recovery. But, more importantly, you will also be ready for the inevitable market correction that will happen again.

Make sure to check if your distribution plan needs to be fine-tuned and increase your savings rate if possible. Now is also the perfect time to increase your 401K contributions by 1 or 2 percentage points, or increase your automatic investment contribution for your taxable brokerage account.

Keep reminding yourself of the time frame for when you plan on using each basket of dollars, and let this help calm your nerves when you realize that anything short-term is not at risk. Pay attention to real data, not the opinion of people who look at the public eyeballs as a product to be sold to the highest advertiser. Data will give you perspective on what history can teach us, and what to expect moving forward. Ask questions of your advisor, lots of them. Information is your friend when uncertainty seems to be the only thing we can feel. It will help us take control of what we can, and prepare for what we can’t.

The week ahead

Last week, analysts expected a market bounce, but earnings disappointment from both Walmart and Target quickly soured the sentiment on the street. This has set up analysts to be cautious about the upcoming earnings for this week. Major retailers like Costco and Best Buy will release earnings in the coming week, along with discount retailers like Dollar Tree and Dollar General. Their reports and subsequent conference calls and comments will help to clarify if consumer spending is slowing across the broad economy, and how much inflation and supply chain issues continue to hurt the economy. The April retail sales report showed an 8.2% jump year over year, which makes the Walmart and Target earnings even more head scratching.

So What?

So how does this impact all of you?

- Controlling your emotions during times like this will be the difference between success and failure.

- Good information is your friend when uncertainty seems to be the only thing around

Stock market calendar this week:

| MONDAY, MAY 23 | |

| None scheduled | |

| TUESDAY, MAY 24 | |

| 9:45 AM | S&P Global U.S. manufacturing PMI (flash) |

| 9:45 AM | S&P Global U.S. services PMI (flash) |

| 10:00 AM | New home sales (SAAR) |

| WEDNESDAY, MAY 25 | |

| 8:30 AM | Durable goods orders |

| 8:30 AM | Core capital equipment orders |

| 2:00 PM | FOMC minutes |

| THURSDAY, MAY 26 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Real gross domestic product revision (SAAR) |

| 8:30 AM | Real final sales to domestic purchasers revision (SAAR) |

| 8:30 AM | Real gross domestic income (SAAR) |

| 10:00 AM | Pending home sales index |

| FRIDAY, MAY 27 | |

| 8:30 AM | PCE inflation |

| 8:30 AM | Core PCE inflation |

| 8:30 AM | PCE inflation (year-over-year) |

| 8:30 AM | Core PCE inflation |

| 8:30 AM | Real disposable income |

| 8:30 AM | Real consumer spending |

| 8:30 AM | Nominal personal income |

| 8:30 AM | Nominal consumer spending |

| 8:30 AM | Advance trade in goods |

| 10:00 AM | UMich consumer sentiment index (final) |

| 10:00 AM | 5-year inflation expectations (final) |

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.