January 2, 2023

Forefront’s Monday Market Update

New Year, New Rules

Happy New Year. I hope 2022 was full of love and joy for all of you. But, for those who want to forget 2022, remember the sadness and difficulties of life sharpen the joy that I hope fills your 2023.

I would be remiss if I did not brag a bit, as 2022 saw my children grow socially and academically in a fantastic way. Witnessing them start to make sense of the world around them, explore their abilities and push the boundaries of their weaknesses has brought me more joy than I ever thought possible.

Professionally, Forefront Wealth Planning has had its single most significant year of growth, all while the stock market was down 20+%. This is because of you and the incredible number of referrals my clients trust me with. In addition, we have added to the team and built the firm’s infrastructure even further. I could not have ever imagined the explosive growth we would have when I started Forefront Wealth Planning, and for that, I thank all of you.

Secure 2.0

With the changing of the calendar also comes The SECURE 2.0 Act, signed by President Biden last Thursday. I will spare you all my rant about by all bills should be stand-alone. This is the most comprehensive legislation focused on retirement since the original Secure Act came about in late 2019. If you remember, the bill in 2019 made considerable changes to required minimum distributions, making it, so most non-spouse beneficiaries are required to withdraw the dollars within ten years rather than stretching it over their lifetime, thus spreading the tax burden.

Secure 2.0 does much more to live up to its name, Setting Every Community Up for Retirement Enhancement. You can break down the changes we will see into four major areas.

Save, Save, Save

A significant provision to help Americans save more is that employers are required to automatically enroll employees into newly created workplace 401K and 403B plans. This will encourage savings regardless of age and ensure employees take advantage of employer-matching contributions.

Plans must enroll participants at a minimum of 3% and increase by 1% annually until they reach 10% contributions annually. Employees can opt out, but hopefully, many won’t.

There are several other pieces of the legislation designed to help Americans save money, like additional catch-up contributions, the savers match tax credit, and simplifying 401K and 403B plans for small businesses. I will be going over all of them in detail in a follow-up video later this week.

Required Minimum Distributions

If you turn 72 on Jan 1, 2023 (This past Sunday) or after congress has given you a pretty good birthday gift, the requirement to take money out of your retirement account has been moved to age 73. The age is likely to increase to 75 on Jan 1, 2033. It is only “likely” now because of a typo in the bill’s language that needs to be clarified. You can’t make this stuff up.

There are expanded Roth IRA opportunities as well, with a major one being the ability to roll up to 35K out of a child’s 529 and into a Roth IRA in their name. Keep an eye out for my video breaking down Secure 2.0 to find out the details of this provision, as you do need to meet a few criteria points to do this.

Emergencies

More than 50% of Americans can’t afford an emergency expense of $1,000. Although the fundamental reason for this is income not keeping up with expenses, Secure 2.0 is attempting to open an avenue for those people to meet their emergency needs from their retirement accounts.

I have never advocated for borrowing from your 401K, or, heaven forbid, a premature withdrawal because of the penalties and costs associated with it. However, secure 2.0 will allow employees who are NOT “highly compensated employees” to open a pension-linked emergency savings account.

In simple terms, this new type of account would allow up to 4 withdrawals a year without penalty, taxes, or fees. There would be a cap of $2,500 on contributions into accounts like this. But, similar to a Roth IRA, contributions would be after-tax, and their growth would be tax-free.

Retirement Lost and Found

Most of us are familiar with our state’s unclaimed funds websites, but it can be nearly impossible to find old retirement plans that you might forget about. Secure 2.0 is creating a national lost and found registry for retirement accounts. The reason retirement accounts are difficult to see is that many times the dollars will go to the state where the retirement plan provider is located, not the state you live in or even the state your employer is in.

This is one provision for retirement plans, but there are provisions making rollovers easier and impacting qualified charitable deductions. I will cover all of this in more detail in a follow-up video on Secure 2.0

So What?

So how does this impact all of you?

-

Is your advisor ready for these changes? Do you have a plan inplace to take advantage of these changes?

-

Secure 2.0 has opened up many planning opportunities; makesure you take advantage of everything in your financial plan.

Stock market calendar this week:

| MONDAY, JAN. 2 | |

| New Year holiday. None scheduled. | |

| TUESDAY, JAN. 3 | |

| 9:45 AM | S&P U.S. manufacturing PMI (final) |

| 10:00 AM | Construction spending |

| WEDNESDAY, JAN. 4 | |

| 10:00 AM | ISM manufacturing index |

| 10:00 AM | Job openings |

| 10:00 AM | Quits |

| 2:00 PM | FOMC minutes |

| Varies | Motor vehicle sales (SAAR) |

| THURSDAY, JAN. 5 | |

| 8:15 AM | ADP employment report |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Trade deficit |

| 9:45 AM | S&P U.S. services PMI (final) |

| FRIDAY, JAN. 6 | |

| 8:30 AM | Nonfarm payrolls |

| 8:30 AM | Unemployment rate |

| 8:30 AM | Average hourly earnings |

| 8:30 AM | Labor force participation rate, ages 25-54 |

| 10:00 AM | ISM services index |

| 10:00 AM | Factory orders |

| 10:00 AM | Core equipment orders |

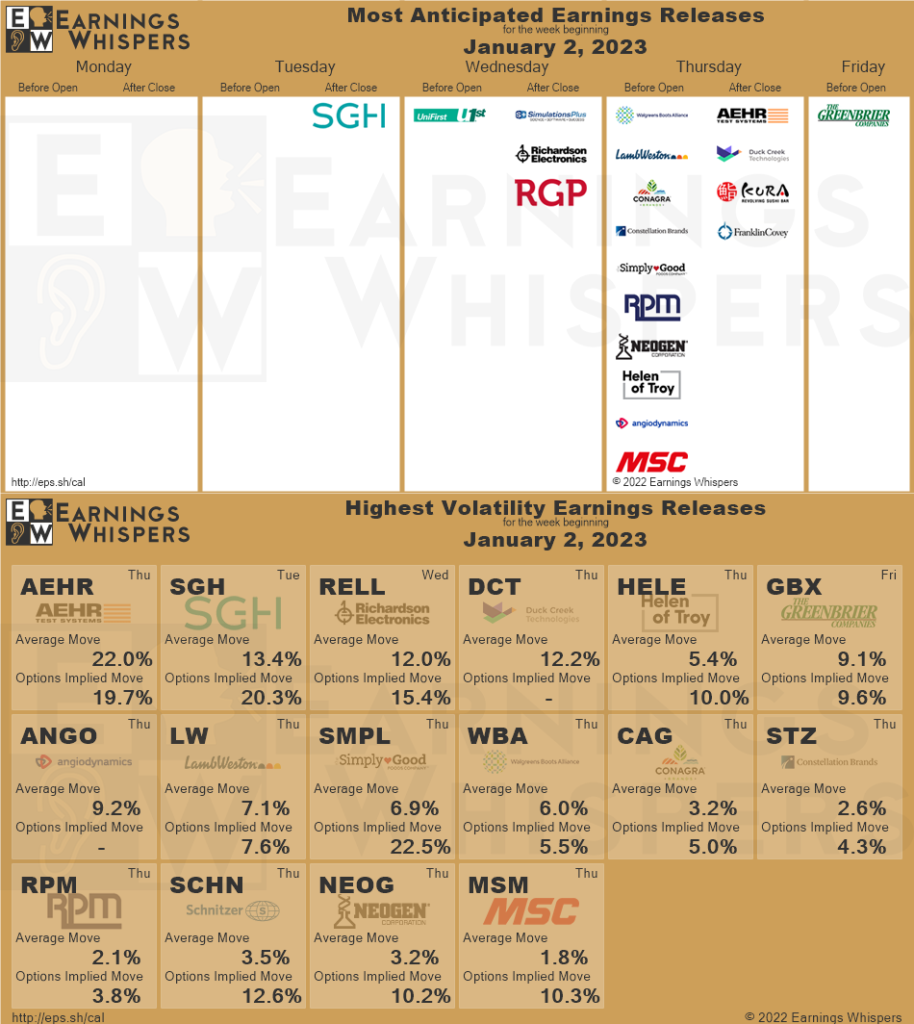

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.