The word I hate most

No matter what financial article or television show you watch, the word unbiased gets thrown around constantly. Now, I think we all know that media, in general, is biased, and as I have stated a number of times, their job is to sell advertising and get viewers, not to give you financial advice, or frankly care about the outcome if you follow their advice or not. There is no such thing as being unbiased, and anyone you trust to provide guidance should not only recognize that, but be actively working to recognize what theirs and your most common bias will be and take it into consideration when learning new information.

The brain controls financial success

Information bias and bandwagon effect are the two most common biases we face as savers and investor. Information bias is inevitable with the 24-hour news cycle that we have now and instant access to news at our fingertips via our smart phones. It is hard to see the trees through the forest when we are inundated with useless information with tiny nuggets of real information buried deep beneath it. The easiest piece of useless information that we ALL look at daily is share price and share price movement of a specific company. What can the knee jerk reaction of today tell me about the medium-term prospects of a high-quality company? Nothing is the answer. Keep in mind there are entire television shows and news publications dedicated to nothing but analyzing not just day to day share price movements, but moment by moment. No wonder its hard to know what is actual information and what is fluff.

Jumping on the bandwagon

When I was growing up, and although I am embarrassed to admit it now, I love the New York Knicks basketball team. Growing up they were a tough, hard-nosed team that found from the first whistle to the last. I loved watching them play, but every year ended in heartbreak because during that era there was another player that no one could beat. He played for some team in Chicago, the memories pain me to this day.

It would have been easy to jump on the bandwagon but I loved the Knicks and I couldn’t abandon them like that. Group thinking, herd mentality, whatever you want to call it, we as humans are more comfortable doing something because we believe other people are doing it. It’s what makes Jim Cramer’s show so successful. Thinking about today, I have never spoken to more people who are either to close to retirement or don’t even have an emergency fund saved up yet who are asking me about investing in Tesla and Bitcoin. When you hear about enough people doing it, your comfort level grows despite the risk.

Cognitive Biases

There are 10 Cognitive Biases that exist and are hardwired into us as humans, hence why being unbiased is simply impossible. Understanding and overcoming the most common human biases will directly lead to better decision making. The problem is, how do you identify those biases and work to overcome them? That is where working with a good professional can make all the difference in the world. If they are leading with performance as the reason to use them, then you know they don’t truly understand the art of financial planning and money management. Investing is a soft skill, not a hard science.

So What?

So how does this impact all of you?

- Buzz words like unbiased don’t mean anything, understand the incentive of the person giving you advice.

- Work hard to understand your own biases, and work to overcome them to make better financial decisions.

- Financial plans are designed to manage emotions first and foremost

Stock market calendar this week:

Thursday December 10th, 2020

Initial and Continuing Jobless Claims @ 8:30AM

Most anticipated earnings for this week

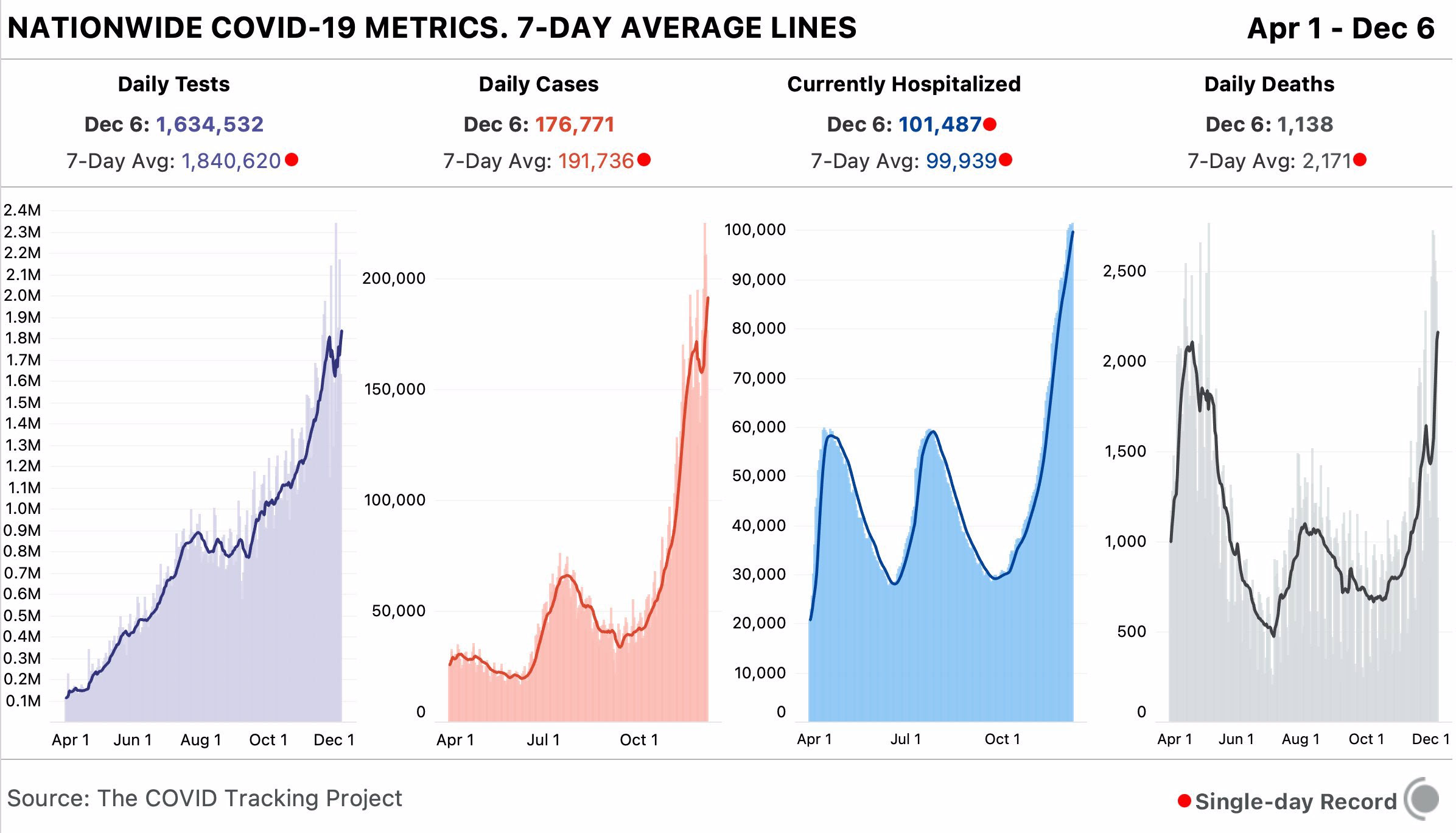

Latest Covid-19 Data