Forefront’s Monday Market Update

Disposition Effect

Why do individual investors hold losing stocks for far too long, and sell winning stocks way to early? Avoiding regret, and seeking pride affects people’s behaviors, especially when it comes to investing, and it’s been dubbed the “disposition effect.” The idea that people dislike incurring losses more than they enjoy making gains, so investors will hold onto stocks that are losers, and be quick to sell their winners.

The Behavioral economist Richard Thaler once said that “What investors fear even more than losing money is having to say, ‘What an idiot I am.”

Digging in

In the nearly 2 decades I have been helping clients build wealth, one of the most amazing things I have seen are people’s ability to dig their heels in when a stock they bought is going down. The same doesn’t hold true for a stock that I have added to their portfolio, as they are quick to ask me to sell it at the slightest hint of red.

Imagine two investors for a moment, Bob and Wendy. Bob owns GameStop stock because he got caught up in the meme stock craze earlier this year. When considering whether or not to sell, Bob is focused on the pain of perhaps taking a loss, and having to sell something that he already owns. This is a big deal, as we all value what we already own, more than something we don’t own. Now, Wendy wants to buy GameStop stock. Jane is focused on the future pleasure of her potential gains, which is slightly offset by the pain of having to part with some cash to actually buy the stock.

Pain is far more intense and powerful than pleasure, so GameStop is “worth” way more to Bob than it is to Wendy, so he will tend to hold the stock until either the pain of the losses becomes too much to handle, or the stock has risen so much that selling becomes to tempting to resist. Behavioral economics tells us it will take a lot of losses and gains to help you get over the psychological impact of overvaluing what you already own.

The mugs game

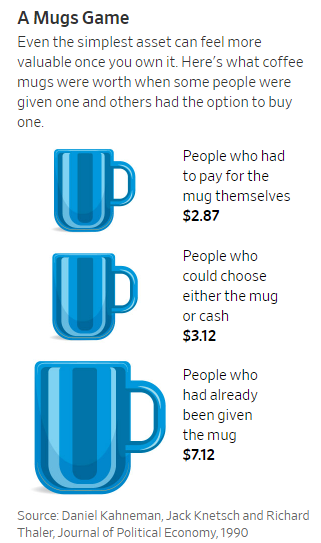

In the 1980s an experiment was done where people were broken up into 3 groups.

Group one you were told you could buy a coffee mug.

Group two you were told you could receive either cash, or a coffee mug.

Group three you were given a coffee mug, and the opportunity to sell it.

They asked members of each group one question. “How much money is equal to having the mug?”

Group 1 who had to buy the mug themselves, valued it at $2.87

Group 2 who could either get a mug or the cash equivalent valued the mug at $3.12

Group 3 who already owned the mug, and was now trying to sell it valued the mug at $7.12

Who Cares!?

The emotions and behaviors described and studied form a basis for making a decision of how you are going to invest your money. Many people opt for a set it and forget it type of strategy utilizing index funds etc. and this is a great option if you are able to keep your emotions even keeled.

Unfortunately, for many of us, human nature takes over and our emotions play a big part in our behavior when it comes to investing and saving for the future. If this is the case, evaluating what triggers those emotional responses and structuring your plan around it is paramount to success. Those who try and change who they are, tend to never find success, but those who understand their emotional triggers can develop a plan around that and set themselves up for success.

So What?

So how does this impact all of you?

- Subconscious emotions lead to behavioral mistakes when investing

- Be aware of what triggers an emotional response, build around it

Stock market calendar this week:

Wednesday August 18th:

FOMC Minutes @ 2:00PM

Thursday August 19th:

Initial and continuing Jobless Claims @ 8:30AM

Most anticipated earnings for this week: