Major Biden, Dog Training, and Financial Planning

If you know me, you know I love dogs. My wife and I have been together 15 years this year, and we have always had a dog, and actually other than for maybe a year total we have always had 2 dogs. Currently we have 2 black labs, Murphy, and The Moose! Moose is our puppy at 10 months old and Murphy is our elder statesman at 5 yrs. old.

Have you ever turned-on ESPN on a random Sunday afternoon and watched dogs jump as far as they can into a pool to grab a toy in the air? We are training Moose to do that, while Murphy wants to swim, jumping off a dock to get a toy is….. not his style. Drastically different personalities, even though they are both Black Labs.

Major Biden is a rescue German Shepherd who has now bit two people. Yes, nipping someone is still a bite. He is a dog who was thrust into a difficult situation because his personality, just like that of his breed, doesn’t fit a house that has more strangers passing through than Grand Central Station. Learning to understand my pups actually helped shape my career, and I take lessons I’ve learned and use them to help my clients.

Fitting into a box

Most of the time when you seek out financial guidance the first question you’re asked is how much money do you have to invest? Somehow the dollar amount is the most important factor, not who you are or your goals.

Inevitably after answering, the conversation turns to performance where most advisors pat themselves on the back and use that as the reason to hire them. What has happened during this 30-minute conversation is you’ve been put into a box that they think you fit in and offered up a plan that fits the people in that box. Nothing like some good old fashion blanket advice.

Just like Major Biden, or Murphy and Moose, humans are no different. We are all similar, but we are all very unique, especially when it comes to our emotions, idiosyncrasies, and personalities pertaining to money. Blanket advice doesn’t work.

Think outside of the box

2020 was the 11th consecutive year a majority of actively managed fund managers underperformed their broader benchmark indexes. The only reason this isn’t the 25th consecutive year is that during the financial crisis actively managed funds pulled off a miracle and outperformed.

For some, this is a clear indication that index funds are the way to go, but for me it shows me that fund managers are human also. They get emotional and scared just like the rest of us, and sometimes they zig when they should zag.

Rate of return should be the thing you worry about least when creating your plan and hiring an advisor. Building a box that fits your exact lifestyle, situation, personality, and future goals matters more. Savings rate is the “rate” that you should be most concerned about. The chart below proves my point better than I ever could. You can double up your rate of return and still have less money than the person who simply saved more.

Why?

Each week I want to educate and inform all of you, and I try and tie it back to what’s going on in the news and markets, but frankly we are all inundated with a 24-hour news cycle.

I have found myself writing more about behavioral finance and the psychology that goes into finances and money. Let’s start using this time to ask ourselves, do we need help, where can I find that help, and how do I decide who is the best person to help me? Someone taking the time to get to know you and your personality, and building the plan that suits who you are is a good start.

So What?

So how does this impact all of you?

- Who you are, should dictate your plan.

- Getting to know someone is how you can help them plan for the future.

- We might have similarilites, but we are all unique, and need to be treated as such when it comes to money

Stock market calendar this week:

Wednesday April 7th:

FOMC Minutes @ 2:00PM

Thursday April 1st:

Initial and continuing Jobless Claims @ 8:30AM

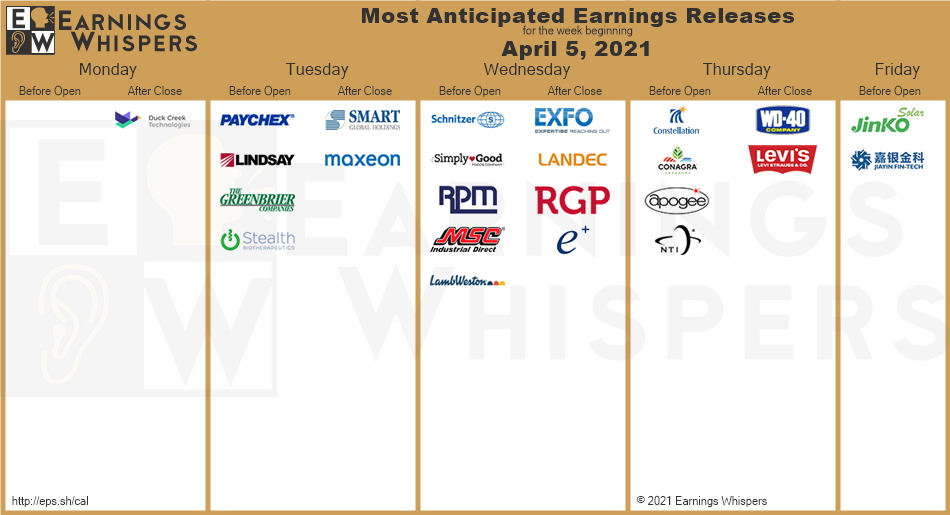

Most anticipated earnings for this week