Mastering the Mind:

The Empty Boat and the

Biases That Steer Your Finances

Money is supposed to be rational. Numbers are objective. Yet when we deal with money, our emotions and instincts have a way of slipping into the driver’s seat. The real challenge in financial planning is not always the market or the economy. It is how we respond when life bumps into us.

I often think about an old Taoist parable called the Empty Boat. A monk is meditating in his boat on a calm lake. Another boat drifts into him, jolting him from his peace. Frustration rises. He is ready to lash out at the careless intruder. But when he looks up, he sees the boat is empty, carried only by the wind. In an instant, his anger disappears. After all, how can you stay mad at an empty boat?

This story is a perfect reminder that many of life’s collisions are not personal. Markets fall, jobs get lost, roofs leak, and bills arrive at the worst time. None of it is aimed at us. But our reactions can turn these bumps into real damage. That is why understanding our own mental shortcuts, or biases, is just as important in financial planning as understanding investments or tax law.

Confirmation Bias

Confirmation bias is the tendency to seek out information that confirms your existing beliefs and disregard any information that contradicts them. If you are convinced a stock is a winner, you will find every article that praises it and tune out any warnings. In practice, I have seen clients buy into a trendy stock or cryptocurrency, then scour the Internet for positive news to validate their choice. Even as red flags pile up, they cling to stories that make them feel good about holding on. This bias leads to portfolios that are heavily tilted toward one idea, rather than being balanced across many. The danger is that one bad bet can undo years of progress.

Overconfidence

Overconfidence convinces us that we know more than we do. It is what pushes people to chase hot tips or try to out-trade Wall Street. The truth is, even professionals with endless resources struggle to beat the market consistently.

I once met with a business owner who believed he could pick stocks better than any advisor. He was convinced his instincts and business background gave him an edge. He bought and sold constantly; sure he was beating the system. When we reviewed his performance over five years, he had earned less than if he had simply stayed in a diversified portfolio. The worst part was that he had also taken on far more stress and risk than necessary.

Loss Aversion

Job cuts are another sign of stress. John Deere confirmed new layoffs at multiple plants as orders slowed. Management tied the pullback to weaker demand from farmers and lower order volumes. Psychologists have shown that losing money feels about twice as painful as gaining the same amount feels good. That is why investors panic when the market drops. It is also why people cling to failing investments. I had a couple who called me during the 2020 market crash. They were terrified, ready to sell everything to stop the pain of seeing their balances drop. If they had followed through, they would have locked in losses and missed the recovery that came months later. Instead, we reviewed their goals, reminded them that retirement was decades away, and stayed the course. By 2021, their portfolio had fully recovered and grown even more. Loss aversion nearly cost them thousands.

Hindsight Bias

After the fact, we like to tell ourselves we saw it coming. That is hindsight bias. Think of the 2008 housing collapse. Today, many people say it was obvious, but very few acted on it beforehand. I have heard clients say things like, “I knew the market was going to crash last year” or “I should have bought Apple back in the 90s.” These stories give us a false sense of control, but they are not true. No one knows the future. The danger is that hindsight makes us overconfident about predicting what is next. It tempts us to gamble instead of planning. Keeping a decision journal, or reviewing choices with an advisor, helps you see clearly what you knew at the time, not what you think you knew later.

The Empty Boat in Real Life

All of these biases fuel the same trap. They make us believe that life’s financial collisions are personal. The market crashed to spite us. That medical bill arrived to punish us. A partner overspent to sabotage the plan. None of this is true. These are empty boats. But the anger, panic, or regret we attach to them creates real harm. I have seen clients ready to sell their portfolios at the bottom of the market, convinced they were doomed. By stepping back and remembering that the market is an empty boat, they avoided a mistake that would have cost them years of growth. I have seen couples argue over spending until they remembered that most financial friction is just a bump, not a betrayal. Calm communication solved what blame never could.

Strategies to Keep Biases in Check

You cannot erase bias completely. No one can. But you can build guardrails to limit its impact. Slow down decisions. Rash choices invite bias. Take time to reflect before acting. Automate good behavior. Contributions, rebalancing, and savings work better when they run on autopilot. Diversify. A broad portfolio cushions against overconfidence and loss aversion. Stress test your plan. Think through worst-case scenarios in advance so you are prepared. Use a second set of eyes. An advisor brings objectivity and keeps you accountable.

Why Professional Guidance Matters

The hardest part of financial planning is not the math. It is mastering your own behavior. Biases work quietly, convincing you to act on instinct instead of reason. That is where an advisor adds the most value. I have had clients call, ready to sell everything in a panic. A single conversation reminding them why we built their plan kept them steady. Those moments often matter more than any investment selection. They protect wealth, reduce stress, and help families move toward long-term goals.

Final Thoughts

The Empty Boat teaches us that most collisions are not personal. Our biases convince us otherwise. Confirmation, overconfidence, loss aversion, anchoring, and hindsight bias are always lurking, ready to twist our view. Recognizing them, building systems to manage them, and leaning on professional guidance turns financial planning into a calmer and more successful journey. In the end, the strongest tool you have is not a stock pick or a tax trick. It is a steady mind. Master that, and the rest of your financial life falls into place.

Sources

- Bloom, Sahil. “The Empty Boat Mindset.” X (formerly Twitter).

- Kahneman, Daniel. Thinking, Fast and Slow. Farrar, Straus and Giroux, 2011.

- Tversky, Amos, and Daniel Kahneman. “Judgment under Uncertainty: Heuristics and Biases.” Science, vol. 185, no. 4157, 1974, pp. 1124–1131.

- Barber, Brad M., and Terrance Odean. “Trading Is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors.” The Journal of Finance, vol. 55, no. 2, 2000, pp. 773–806.

- Odean, Terrance. “Are Investors Reluctant to Realize Their Losses.” The Journal of Finance, vol. 53, no. 5, 1998, pp. 1775–1798.

- Thaler, Richard H. Misbehaving: The Making of Behavioral Economics. W.W. Norton & Company, 2015.

- Statman, Meir. “Behavioral Finance: Past Battles and Future Engagements.” Financial Analysts Journal, vol. 55, no. 6, 1999, pp. 18–27.

Stock market calendar this week:

| MONDAY, SEPT. 1 | |

| Labor Day holiday | |

| TUESDAY, SEPT. 2 | |

| 9:45 AM | S&P final U.S. manufacturing PMI |

| 10:00 AM | ISM manufacturing |

| 10:00 AM | Construction spending |

| WEDNESDAY, SEPT. 3 | |

| 8:30 AM | Fed governor Christopher Waller TV appearance |

| 9:00 AM | St. Louis Fed President Alberto Musalem speaks |

| 10:00 AM | Job openings |

| 10:00 AM | Factory orders |

| 1:30 PM | Minneapolis Fed President Neel Kashkari speaks |

| 2:00 PM | Fed Beige Book |

| TBA | Auto sales |

| THURSDAY, SEPT. 4 | |

| 8:15 AM | ADP employment |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | U.S. productivity (revision) |

| 8:30 AM | U.S. trade deficit |

| 9:45 AM | S&P final U.S. services PMI |

| 10:00 AM | ISM services |

| 10:00 AM | Senate Banking nomination hearing for Stephen Miran to be Fed governor |

| 12:05 PM | New York Fed President John Williams speaks |

| 7:00 PM | Chicago Fed President Austan Goolsbee speaks |

| FRIDAY, SEPT. 5 | |

| 8:30 AM | U.S. employment report |

| 8:30 AM | U.S. unemployment rate |

| 8:30 AM | U.S. hourly wages |

| 8:30 AM | Hourly wages year over year |

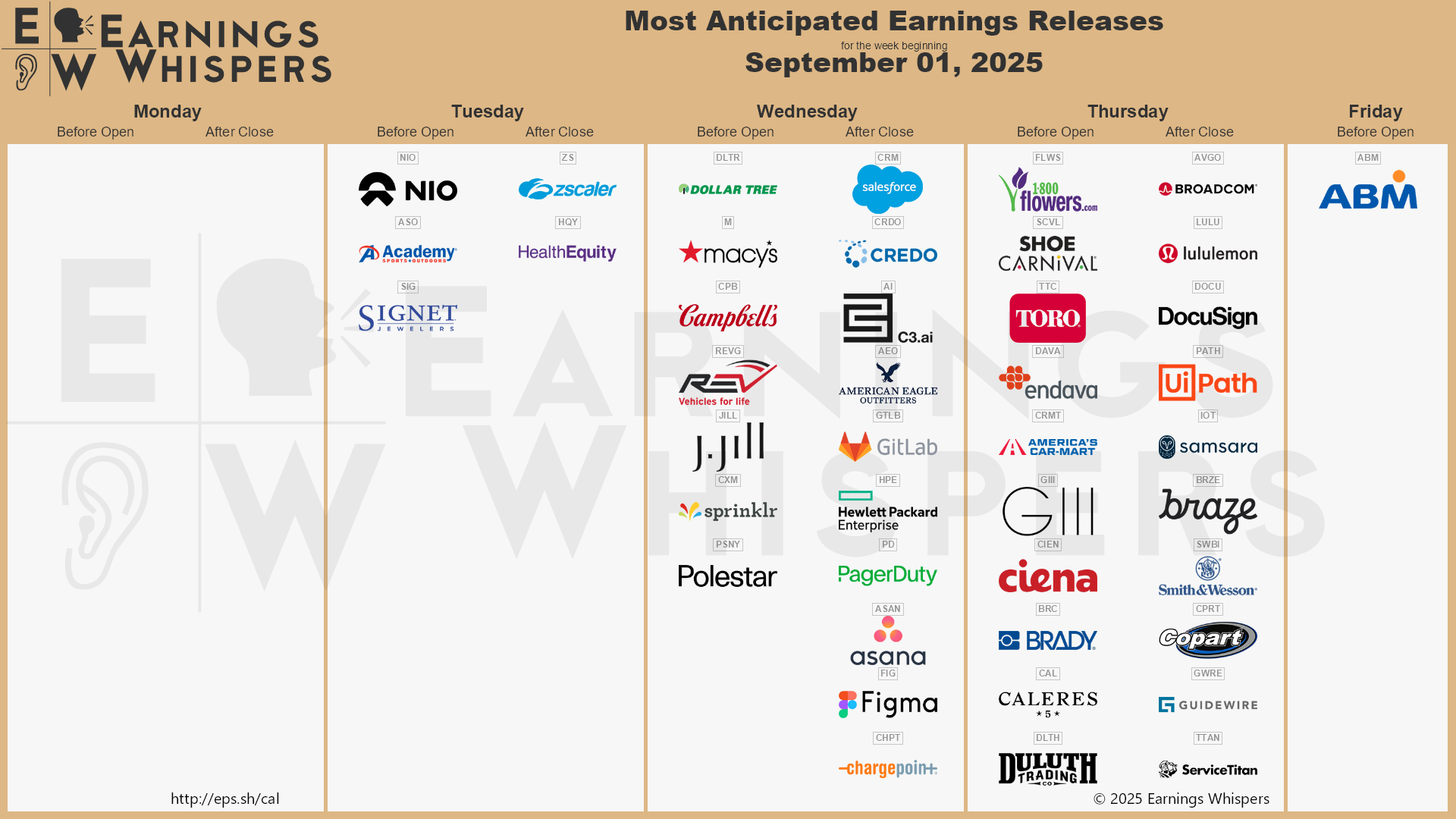

Most anticipated earnings for this week

Did you miss our last blog?

Tariffs Are A Hidden Tax We All Pay

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.