by ACM Wealth

ACM Wealth Administrator

What a difference a month makes. Not only has the S&P 500 recouped much of its losses since late March, but the economic data is starting to turn positive. The pandemic is still with us, but we are learning how to live with it. A vaccine may yet be many months away, but mask-wearing and social distancing are allowing some business activities to resume. And regardless of the fact that new cases in the U.S. have remained stubbornly flat at around 20,000 per day, perhaps partly due to increased testing, there is hope that we can reopen and simultaneously prevent a resurgence of infections. At least, that’s what the market’s move is telling us. But is it onwards and upwards from here?

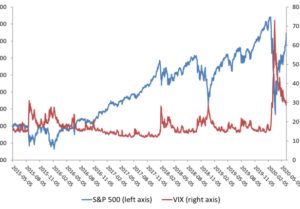

Sources: Chicago Board of Options Exchange; S&P Dow Jones Indices LLC, S&P 500© [SP500], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SP500, June 6, 2020.

Volatility remains elevated, as the VIX shows above, even as the S&P 500 has returned to mid-December levels. Nevertheless, investors are clearly enthusiastic as businesses begin to reopen and employment losses begin to reverse. Good news on the economic front has helped the rally along, even as protests, ongoing COVID concerns, and U.S.-China tensions create an unsettled background. For more on those, please see ACM’s Global Portfolio Manager David Ruff’s recent Commentary.

Not only did the unemployment rate take an unexpected turn lower, but non-farm payrolls increased by 2.5 million in May. A decline of 7.5 million had been expected. Although the true unemployment rate is likely 3 points higher because of the failure to classify some workers “absent from work for other reasons” as unemployed, the month-over-month improvement was roughly the same. Half of the improvement in the higher payroll count came from the restaurant sector and another portion came from construction. These were among the areas hardest hit from the shutdown, so it shouldn’t be surprising that they needed to rehire as the economy reopens. Since the surveys were taken during the week of May 12, and little had reopened by then, it’s likely that the rehiring was prompted by the receipt of PPP funds, which required employee retention.

As reopening continues, we should see more people return to work, although bringing 21 million people back into employment should be expected to take some time. Rehiring will also take time as consumer and firm behavior adapts to the ongoing presence of the virus and the lessons learned by many firms about the viability of remote work. The pandemic has accelerated a number of trends in shopping, working, and living. That means that the post-pandemic economy will have different job opportunities. The workers that are dislocated will have to find those new jobs. Workers may also need more time to acquire the needed skills. The path to recovery may be a bumpy one, but investors are already basing valuations on sales and profits in 2021 and 2022.

The Congressional Budget Office expects GDP to recover after a lengthy period of adjustment. Its most recent update puts GDP on a path to return to its 2019 level by late 2022:

Source: Bureau of Labor Statistics.

Investors recognize that it is the future potential of companies that matters, not the past, and provided nothing disturbs those optimistic expectations, the rally in stock prices would be expected to be sustained. What could go wrong? While personal income climbed in May, as support checks and higher unemployment insurance arrived, those are slated to expire at the end of July. As income checks from the government end, they must be replaced by payroll checks from work. In addition, the economy will be operating with ongoing mitigation efforts to prevent resurgence of COVID infections. Businesses will be required to operate with limits on capacity. Individuals are likely to continue social distancing practices, keeping demand lower than pre-COVID levels for dining out, movie going, travel (air, hotels), and events. If firms are unable to reopen fully, they may also be unable to rehire all their employees or even survive.

Since the pace of reopening may be uneven, we should expect sales and profit outlooks to be revised as workers find their way to new job opportunities. So while it is encouraging that investors are looking forward, many factors remain highly uncertain, as ACM’s Global Portfolio Manager Paul Broughton’s June 1, 2020 commentary discusses, so we should expect frequent updates to market expectations, and with those, fluctuations in stock valuations. It may be a bumpy ride, but investors need only to look back to previous recessionary periods to know that a diversified portfolio ultimately benefits from rising production and profits over the long term.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth