Kamala Harris is the VP pick, is the market going to crash now?

I have spoken to many of you over the past few weeks about your fear of a market correction based on the outcome of the presidential election. When I am looking at my own accounts and portfolio, I think about the same thing because fear is a natural human emotion when facing the unknown.

Who is going to win in November is a very big unknown……except, maybe the stock market knows what is going to happen?

Stock market, or fortune-teller?

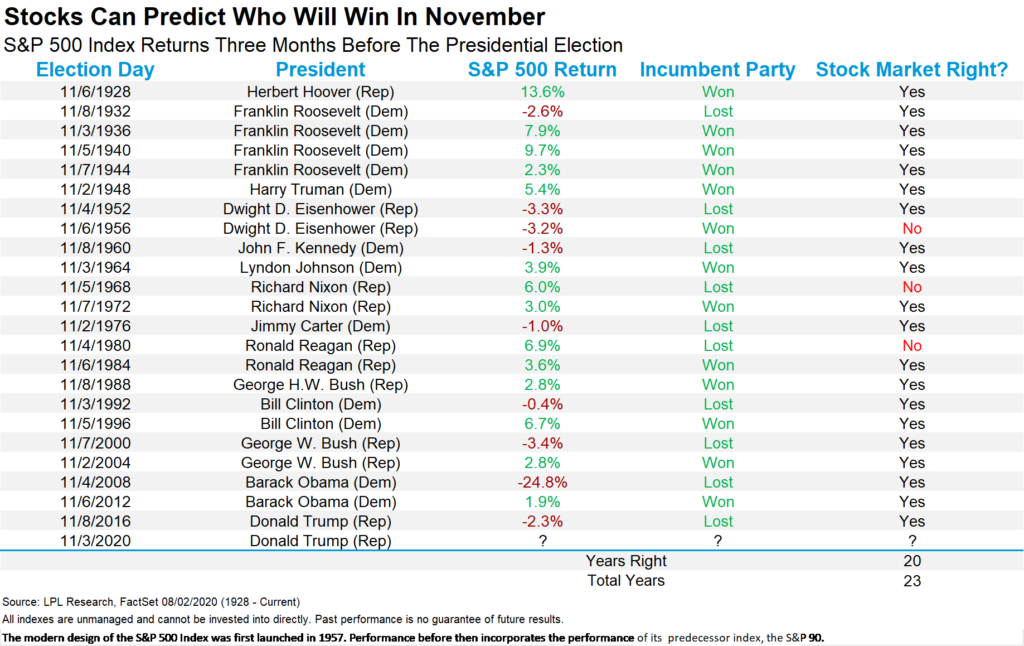

Since 1984 the stock market has had a 100% success rate in predicting who the new president is going to be. We can go back to 1928 and the markets have an 87% success rate of predicting the winner of an upcoming presidential election.

But how?

It all comes down to price movement and returns over the 3 months leading up to the election.

When the markets are up in August, September and October leading up to the election the incumbent candidate (or the incumbent party) usually win, but if stocks are lower, the incumbent/party normally lost.

Prove it!

A little hard to wrap your mind around but it’s true. Let’s look at 2016 as an example, when almost nobody thought Donald Trump could possibly beat Hillary Clinton, except the stock market.

Market had a 9-day losing streak leading up to the election.

Copper was up 14 days in a row (an infrastructure play, clearly directed towards a Trump win)

Does it matter who wins?

On the night of Donald Trump’s presidential win, stock futures dropped 1,000 points overnight. Sometimes markets aren’t rational in the short term, and this irrationality is the largest driver of market volatility.

So, what happens if Joe Biden and Kamala Harris win?

Frankly, not a whole lot except for some short-term irrationality. As the Biden/Harris team begin to release more concrete policy initiatives we will get a clearer picture but some things have already come out.

- Corporate taxes will likely rise, but not back to the 35% level.

- We have heard the number 28% thrown out by Joe Biden, but will likely fall in around 25%.

- This isn’t a materially bad thing for the markets, and at a time of an increasing national debt, might be necessary regardless of who is in office.

- Democrats will be generous with Unemployment and Stimulus to the American people.

- This will drive economic growth, just like the initial $1200 dollar checks did.

Your personal feelings won’t drive the markets

Elections tend to bring with it anxiety and fear, and this election more than ever. We all might have differing views or thoughts on Democrats or Republicans, but what those views won’t do is drive growth in your portfolio.

As your advisor and friend, I leave my political views and ego at the door because neither of those will lead to good investment decisions.

So What?

So how does this impact all of you?

- Don’t let fear drive the bus

- The markets can provide some insight into eventual election results

- Regardless of who wins, it will be okay.

What to look forward to this week

Housing starts for July on Tuesday August 18th, 2020 @ 8:30AM

FOMC Minutes from the July 28th-29th meeting on Wednesday August 19th, 2020 @ 2PM

Initial and Continuing Jobless Claims on Thursday August 20th, 2020 @ 8:30AM

Existing Home Sales on Friday August 21st, 2020 @ 10AM

Most anticipated earnings for this week

Most anticipated earnings for this week

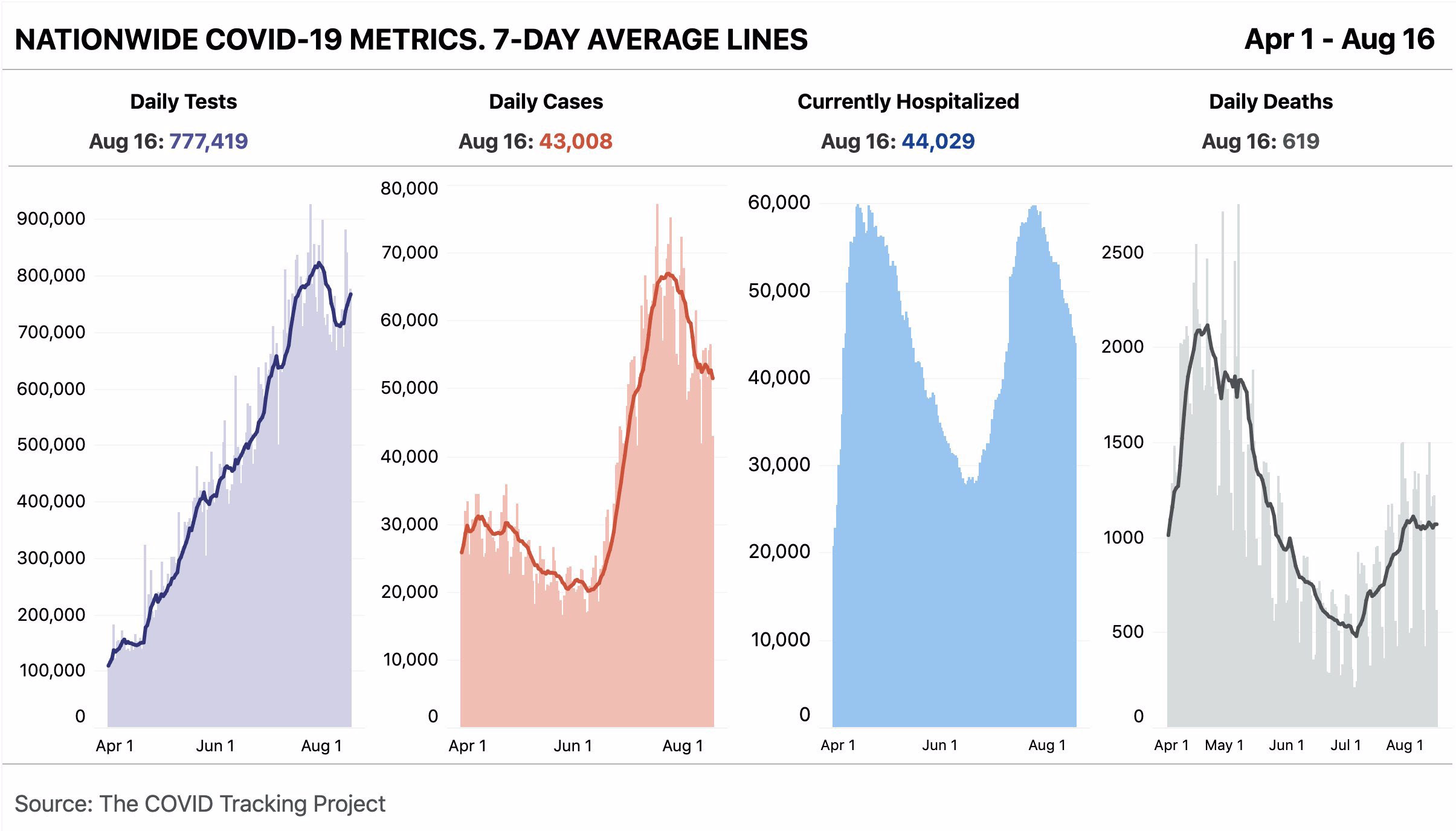

Latest Covid-19 Data

Don’t forget to check out last week’s episode of Forefront’s Friday Fun, and remember “its personal, not just business.”