By JoAnne Feeney

Portfolio Manager

Many investors benefitted last year from the sharp appreciation in stocks of popular work-from-home companies represented by the FANG stocks (FB, AMZN, NFLX, GOOG), while those looking for income were left behind. This year is off to a very different start as last week’s gyrations made clear, and rightly so. FANG+ stocks (ETF: FNGU[1]) fell over 20% from their peak on February 16th, while the average high-dividend stock in the S&P 500 rose roughly 1.5%. We have been expecting this year’s returns to break with the patterns of 2020 and we are seeing that in the disparities in returns across sectors and among growth, value, and high-dividend stocks since November and continuing into 2021. A look at these emerging patterns should serve as a warning—and a guidepost—for investors whose portfolios have become concentrated in FANG and related stocks and for those looking to be well positioned for 2021 and beyond. These patterns also indicate that rising interest rates—which roiled markets last week—may not be the boogeyman most investors fear.

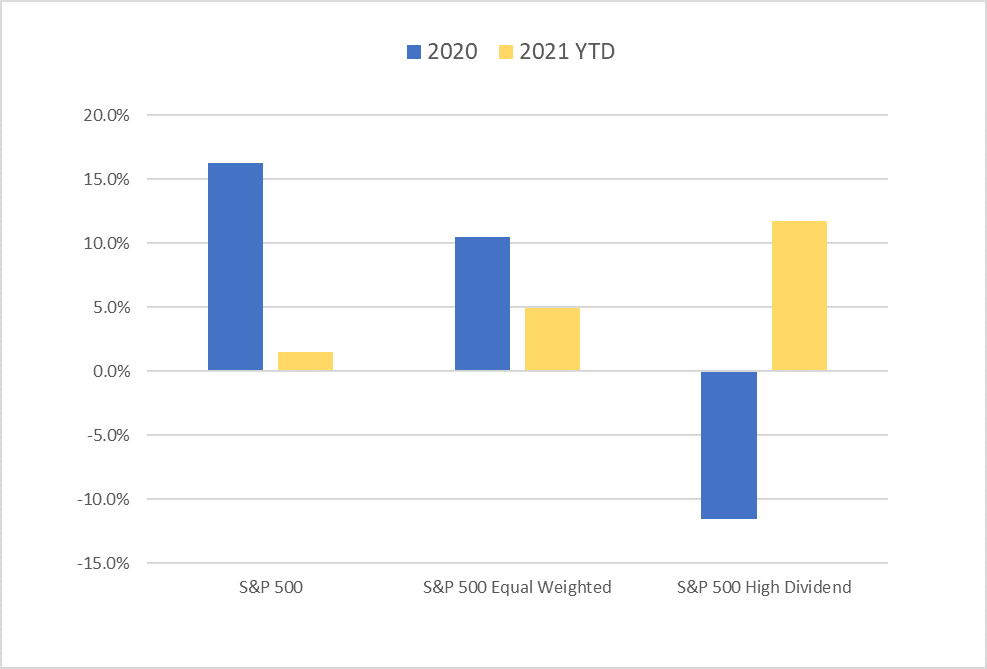

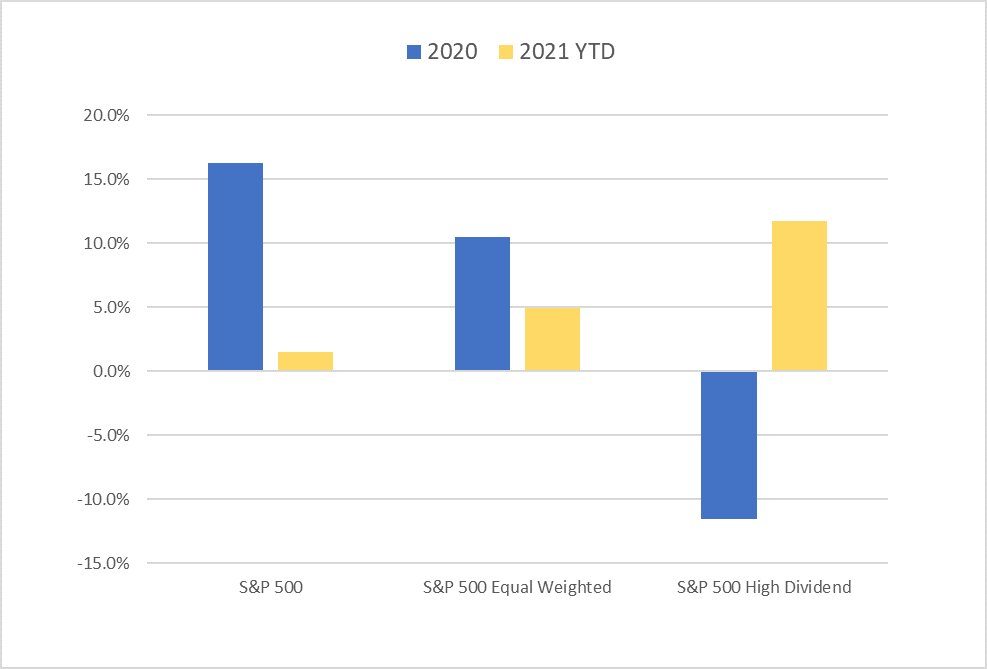

The S&P 500’s increase of 16% last year was driven largely by the popular MFAANG stocks (MSFT, FB, AMZN, AAPL, NFLX, and GOOG), which together comprise 22% of the Index. By contrast, the average stock in the S&P was up just 10%, and the average of the top-80 dividend yielding stocks was down 17%. The returns thus far this year are markedly different:

Source: Bloomberg LLC and Advisors Capital Management Research.

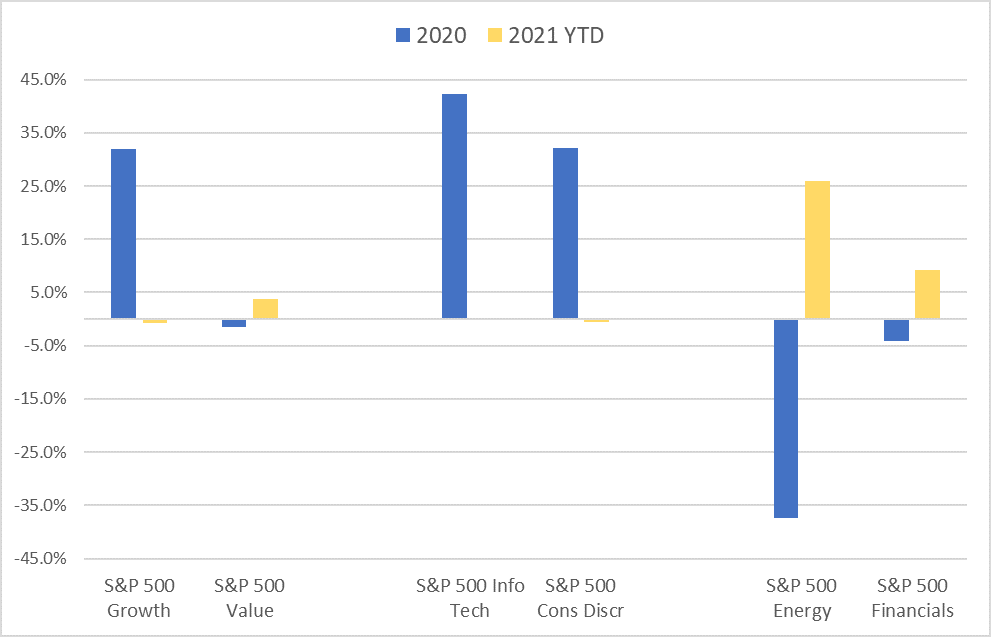

We are poised at the beginning of economic recovery, not just in the U.S., but globally, and longer-term interest rates are rising. Rising rates have, at many times in the past, been associated with lower equity returns, but we shouldn’t hastily conclude that will be the case uniformly this time around. Stocks that underperformed badly last year are now benefitting from the expectation of a broad economic recovery—a recovery that will improve sales and earnings for a wider variety of companies as compared to those that saw business pick up from the stay-at-home shift last year. These stocks are rising despite higher interest rates. While growth stocks are underperforming so far this year, the S&P 500 Value Index is up by more than twice the S&P 500. More tellingly, the sectors where MFAANG mostly reside (Info Tech and Consumer Discretionary) are providing little help to portfolios, while Energy and Financials are rebounding sharply off 2020 declines.

Source: Bloomberg, LLC and Advisors Capital Management Research. Note: Info Tech’s YTD change is not visible, but is up 0.1%.

Value stocks are rising, and if we look more closely, we discover that many of those value stocks are Energy and Financial companies. It’s clear why Value, Energy, and Financials are all rising: many of those companies have earnings and balance sheets which are positively leveraged to strong economic growth or rising rates. But the gains are broader than that: the average S&P 500 company’s shares are up 5.2% thus far, with help from Industrials, Real Estate, and Communications, in addition to Energy and Financials. We expect the return of stronger economic activity to continue to drive returns in many stocks that fell out of favor last year.

The weakness in growth stocks reveals that the increase in interest rates cannot be ignored—as investors discovered last week. The yield curve is steepening (rates on long-term assets rising more than those on shorter-term securities) because investors anticipate both stronger economic growth (which raises the real interest rate) and higher inflation. But how can growth be dead if U.S. economic growth is about to take off? And should growth stocks now be avoided? Even if broader economic growth accelerates, rising rates can hurt growth companies because they impose a higher discount on future earnings, and growth company’s valuation rest far more on future earnings. The greatest risk lies in companies with high price-to-earnings ratios because if earnings fail to outpace expectations and do not sufficiently offset the rise from a higher discount factor, those P/E multiples will contract, and with them, share prices. And because so much additional future growth from the stay-at-home shift was pulled into earnings expectations for MFAANG stocks last year, it would not be surprising for those stocks to continue to underperform this year. Last week’s rising rates made that dynamic clear.

So, the question for growth stocks becomes: which is the greater force, faster growth or rising rates? We see several secular growth drivers in place for the next several years and we see compelling reasons to maintain some exposure there. Companies with enough exposure and deep moats can deliver sufficiently large increases in earnings year after year to offset the impact of a higher discount to those future earnings, provided the current price of shares isn’t too high. The answer for including some growth in a portfolio is to be selective and be sure only to buy growth at a reasonable price.

[1] FNGU tracks the NYSE FANG+ Index which includes: FB, AAPL, AMZN, NFLX, GOOGL, BABA, BIDU, NVDA, TSLA, and TWTR.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth