Intelligence, Luck, or Discipline

Investing isn’t a hard science, it’s a soft skill. The outcome is much more driven from how you behave, rather than how smart you are.

Below is a transcript of a conversation I had this weekend with one of my best friends.

Friend: I am up 16% this year, isn’t that good

Me: Are you any closer to your goals?

Friend: What goals?

It seems counterintuitive, but the most successful investors follow a disciplined approach that is working towards a clear goal, not some arbitrary performance metric.

Intelligence or Luck?

No matter how smart you are, teaching behavior is very difficult. A genius who can’t control their emotions will fail with their finances. The opposite holds true as well, regular folks who have the correct behavioral skills will be wildly successful.

Here, let me prove it.

Ronald Reed

In 2014 a janitor at a J.C. Penny store in Vermont named Ronald Reed passed away, leaving a fortune of $8M+ dollars behind. When he passed he was making $12.00 an hour. So how did he do it?

Ronald Reed accumulated wealth the good old fashion way, through discipline. He saved, invested, and kept his emotions in check.

- The trades go back to the early 1950’s.

- On multiple occasions Mr. Reed would have seen his portfolio value cut by more than 50%.

- This never stopped his disciplined approach.

- His top holdings upon his passing were:

- Wells Fargo & Company

- Procter & Gamble

- Colgate-Palmolive

- American Express

- J.M. Smucker

- Johnson & Johnson

- VF Corp.

- McCormick

- Raytheon

- United Technologies

So, what’s the goal then?

The goal is not to pass away with the highest net worth possible, rather, it is to maximize the power of your money to give you the life you want to live.

Money is a tool, nothing more or less and has to be considered along with an abundance of other things that matter to you personally when making decisions.

We all like seeing our account balances grow, and our net worth climb higher, but is the goal really to be Scrooge Mcduck?

Discipline, Discipline, Discipline

I don’t want you to think I don’t practice what I preach, both with my clients and in my own life. I get nervous also, but every time I think I should make a change in my portfolio, because my children are getting older, I need to do repairs to my home, or simply because I am scared of the uncertainty the future holds, I take a step back and go through my plan.

I have cash saved up for short term emergencies, just like we build for all of you. We have multiple streams of income we can tap depending on taxes and where you are in your life.

Finally, I remind myself that discipline is what leads to success. Making changes because of my emotions is leaving my success up to luck.

So What?

So how does this impact all of you?

- Be prepared for volatility leading up to the election, but don’t let it swing your emotions.

- Markets are irrational in the short term, and can whipsaw, but success in investing is based on how you act and react rather than your intelligence.

- Investing isn’t a hard science, it’s a soft behavioral skill.

- Be like Ronald Reed. Be happy in life, be disciplined, and don’t be emotional with your investments.

- Your psychology of money has more to do with your plans success than anything else.

What to look forward to this week

Wednesday Sept 16th, 2020

Retail Sales for August @ 8:30AM

Fed Chairman Jerome Powell Press Conference @ 2:30PM

Thursday Sept 17th, 2020

Initial and Continuing Jobless Claims @ 8:30AM

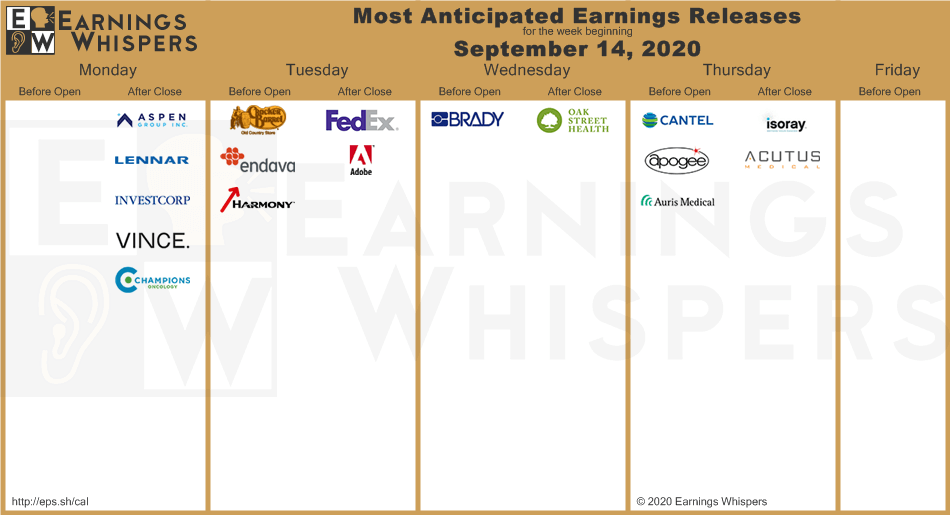

Most anticipated earnings for this week

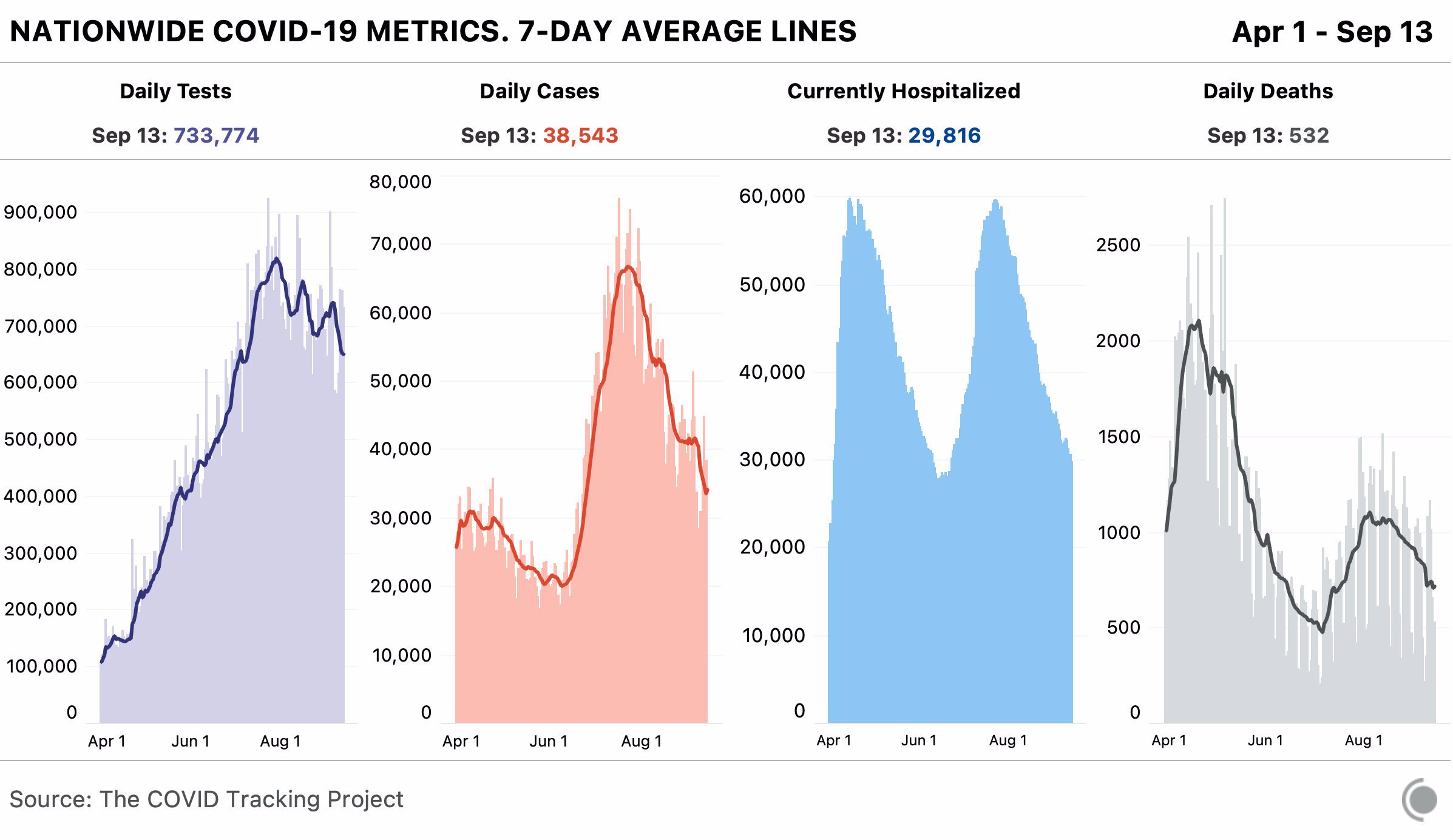

Latest Covid-19 Data

Don’t forget to check out last weeks episode of Forefront’s Friday Fun, and remember “its personal, not just business.”