Forefront’s Market Notes

A powerful Friday rally left stocks higher last week, extending the market’s early November gains.

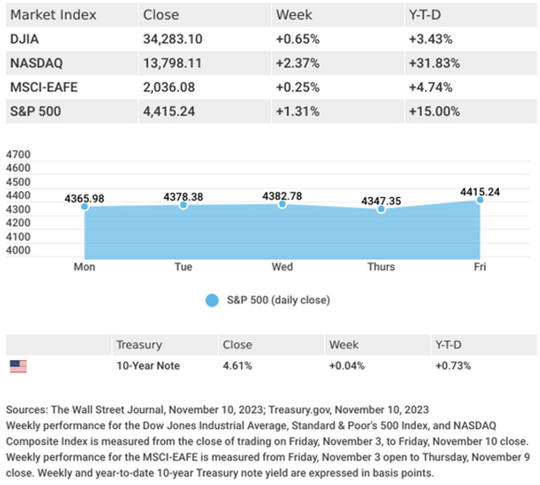

The Dow Jones Industrial Average rose 0.65%, while the Standard & Poor’s 500 advanced 1.31%. The Nasdaq Composite index jumped 2.37% higher for the week. The MSCI EAFE index, which tracks developed overseas stock markets, edged 0.25% higher.1,2,3

Stocks Extend Gains

In a news-light week, stocks added to the gains of the previous week’s rally, helped by stable bond yields. Last week’s advance did not go smoothly, however, as the week’s accumulated gains were erased on Thursday by the combination of a 30-year Treasury bond auction that saw lower-than-expected investor demand, which sent bond yields sharply higher, and disconcerting remarks by Powell that disappointed investors harboring hopes for the conclusion of the Fed’s rate-hike cycle.

Stocks rebounded strongly on Friday as investors reconsidered Powell’s comments, and bond yields retreated, leaving the rally from October lows intact.

Powell Speaks

In last week’s presentation to a gathering sponsored by the International Monetary Fund, Fed Chair Powell said that while he and other Fed officials were encouraged by the progress in bringing down inflation, he was “not confident” that the Fed’s current restrictive monetary policy stance was sufficient to achieve the Fed’s target inflation rate of two percent.4

His comments, which followed the Fed’s two successive decisions to pause on fresh interest rate increases, emphasized that there remained a long way to go to achieve their goal, and the Fed is committed to doing what’s necessary to reach that target, whether that’s through additional rate hikes or by keeping rates high for longer.

Here Are Some Things You Might Consider Before Saying Goodbye to 2023

What has changed for you in 2023? For some, this year has been as complicated as learning a new dance. Did you start a new job or leave a job behind? That’s one step. Some bigger changes, especially those in the family, are practically a pirouette.

If notable changes occurred in your personal or professional life, you may want to review your finances before this year ends and 2024 begins. Proving that you have all the right moves in 2023 might put you in a better position to tango with 2024.

Even if your 2023 has been relatively uneventful, the end of the year is still a good time to get cracking and see what changes may need to be made.

Do you engage in tax-loss harvesting? That’s the practice of taking capital losses (selling securities worth less than what you first paid for them) to manage capital gains. If you are thinking about this move, consider seeking some guidance from a professional who can provide insights.4

In fact, you could even take it a step further. Consider that up to $3,000 of capital losses in excess of capital gains can be deducted from ordinary income, and any remaining capital losses above that amount can be carried forward to offset capital gains in upcoming years.4

Keep in mind this article is for informational purposes only and is not a replacement for real-life advice. Please consult your tax professional before modifying your tax strategy.

Do you want to itemize deductions? You may just want to take the standard deduction for the 2023 tax year, which has risen to $13,850 for single filers and $27,700 for joint. If you think it might be better to itemize, now would be a good time to get the receipts and assorted paperwork together.5

Are you thinking of gifting? How about donating to a qualified charity or non-profit organization before 2023 ends? Your gift may qualify as a tax deduction. For some gifts, you may be required to itemize deductions.6

While we’re on the topic of year-end moves, why not take a moment to review a portion of your estate strategy? Specifically, take a look at your beneficiary designations. If you haven’t reviewed them for some time, double-check that these assets are structured to go where you want them to, should you pass away. Lastly, look at your will to see that it remains valid and up-to-date.

Check on the amount you have withheld. If you discover that you have withheld too little on your W-4 form so far, you may need to adjust your withholding before the year ends.

What can you do before ringing in the New Year? New Year’s Eve may put you in a dancing mood, eager to say goodbye to the old year and welcome 2024. Please do it now rather than in February or March. Little year-end moves might help you improve your short-term and long-term financial situation.

Footnotes and Sources

1. The Wall Street Journal, November 10, 2023.

2. The Wall Street Journal, November 10, 2023.

3. The Wall Street Journal, November 10, 2023.

4. CNBC, November 9, 2023.

5. Investopedia.com, May 2, 2023

6. IRS.gov, October 18, 2022

7. IRS.gov, August 9, 2023

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, NOV. 13 | |

| 8:50 AM | Fed Governor Lisa Cook speaks |

| 2:00 PM | Monthly U.S. federal budget |

| TUESDAY, NOV. 14 | |

| 3:00 AM | New York Fed President John Williams speaks |

| 5:30 AM | Fed Vice Chair Philip Jefferson speaks |

| 6:00 AM | NFIB optimism index |

| 8:30 AM | Consumer price index |

| 8:30 AM | Core CPI |

| 8:30 AM | CPI year over year |

| 8:30 AM | Core CPI year over year |

| 10:00 AM | Fed Vice Chair for Supervision Michael Barr testifies to Senate panel |

| 12:45 PM | Chicago Fed President Austan Goolsbee speaks |

| WEDNESDAY, NOV. 15 | |

| 8:30 AM | Producer price index |

| 8″30 am | Core PPI |

| 8:30 AM | PPI year over year |

| 8:30 AM | Core PPI year over year |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 8:30 AM | Empire State manufacturing survey |

| 9:25 AM | New York Fed President John Williams speaks |

| 10:00 AM | Business inventories |

| 10:00 AM | Fed Vice Chair for Supervision Michael Barr testifies to House panel |

| 3:30 PM | Richmond Fed President Tom Barkin speaks |

| THURSDAY, NOV. 16 | |

| 7:10 AM | Fed Vice Chair for Supervision Michael Barr speaks |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Import price index |

| 8:30 AM | Import price index minus fuel |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| 8:30 AM | Cleveland Fed President Loretta Mester speaks |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 9:25 AM | New York Fed President John Williams speaks |

| 10:00 AM | Home builder confidence index |

| 10:30 AM | Fed Governor Christopher Waller speaks |

| 10:35 AM | Fed Vice Chair for Supervision Michael Barr speaks |

| 12:00 PM | Fed Governor Lisa Cook speaks |

| FRIDAY, NOV. 17 | |

| 8:30 AM | Housing starts |

| 8:30 AM | Building permits |

| 8:45 AM | Boston Fed President Susan Collins speaks |

| 9:45 AM | Fed Vice Chair for Supervision Michael Barr speaks |

| 9:45 AM | Chicago Fed President Goolsbee speaks |

| 10:00 AM | San Francisco Fed President Daly speaks |

| 10:15 AM | Boston Fed President Susan Collins TV appearance |

Most anticipated earnings for this week:

Did you miss our blog last week?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.