Forefront’s Market Notes:

July 29th, 2024

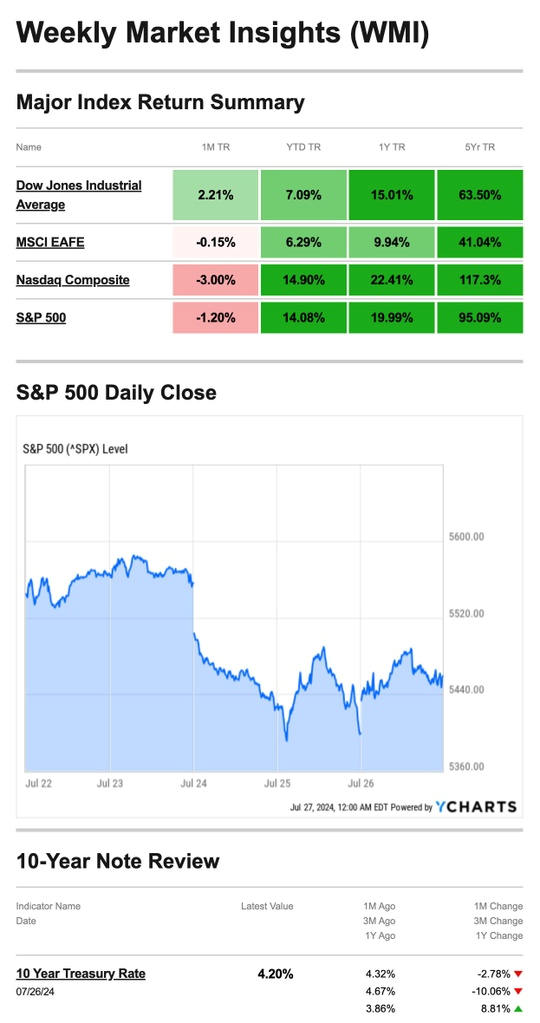

Stocks had a mixed, see-saw week as disappointing corporate reports unsettled investors who appeared to rotate away from some leading groups in favor of other names.

The Dow Jones Industrial Average picked up 0.75 percent. Meanwhile, the Standard & Poor’s 500 Index declined 0.83 percent, and the Nasdaq Composite Index dropped 2.08 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, fell 1.49 percent for the week through Thursday’s close.1

Q2 Corporate Reports Start

Last week began with some positive momentum, but after Tuesday’s close, two influential tech companies reported disappointing Q2 numbers, which soured sentiment. On Wednesday, the S&P dropped 2 percent, and the Nasdaq fell more than 3 percent.

Stocks attempted to rebound on Thursday on news that gross domestic product grew much faster than expected in Q2, but sellers swooped in near the close.3

Stocks rallied broadly on Friday after a positive inflation report. The personal consumption expenditures index, widely considered the Fed’s preferred inflation measure, showed only a slight uptick in June—in line with expectations.4

Source: YCharts.com, July 27, 2024. Weekly performance is measured from Monday, July 22, to Friday, July 26.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Watch the Rotation

July 26 saw the end of the third consecutive week in which the Dow led the other two averages and its fourth straight week of gains.

At the same time, the S&P and Nasdaq have been under pressure, with both posting losses for the second consecutive week.

So far in July, the Dow is up nearly 4 percent, the S&P is down slightly, and the Nasdaq is off by over 2 percent. That’s a marked change from earlier in the year when the Nasdaq led.5

Start a New Business Off on the Right Foot

Starting a new business? There are some tax tips to know to get yourself moving in a positive direction something like that the Internal Revenue Service (IRS) shares for new business owners:

Choose the proper business structure: The form of business determines which income tax return a business taxpayer needs to file. The most common business structures are a sole proprietorship, a partnership, a corporation, an S corporation, and an LLC.

Apply for an Employer Identification Number (EIN): An EIN is used to identify a business.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov6

Footnotes and Sources

1. The Wall Street Journal, July 26, 2024

2. The Wall Street Journal, July 26, 2024

3. The Wall Street Journal, July 25, 2024

4. CNBC.com, July 26, 2024

5. The Wall Street Journal, July 26, 2024

6. IRS.gov, May 8, 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, JULY 29 | |

| None scheduled | |

| TUESDAY, JULY 30 | |

| 9:00 AM | S&P Case-Shiller home price index (20 cities) |

| 10:00 AM | Consumer confidence |

| 10:00 AM | Job openings |

| WEDNESDAY, JULY 31 | |

| 8:15 AM | ADP employment |

| 8:30 AM | Employment cost index |

| 9:45 AM | Chicago Business Barometer (PMI) |

| 10:00 AM | Pending home sales |

| 2:00 PM | FOMC interest-rate decision |

| 2:30 PM | Fed Chair Powell press conference |

| THURSDAY, AUG 1 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | U.S. productivity |

| 9:45 AM | S&P U.S. manufacturing PMI |

| 10:00 AM | ISM manufacturing |

| 10:00 AM | Construction spending |

| FRIDAY, AUG. 2 | |

| 8:30 AM | U.S. employment report |

| 8:30 AM | U.S. unemployment rate |

| 8:30 AM | U.S. hourly wages |

| 8:30 AM | Hourly wages year over year |

| 10:00 AM | Factory orders |

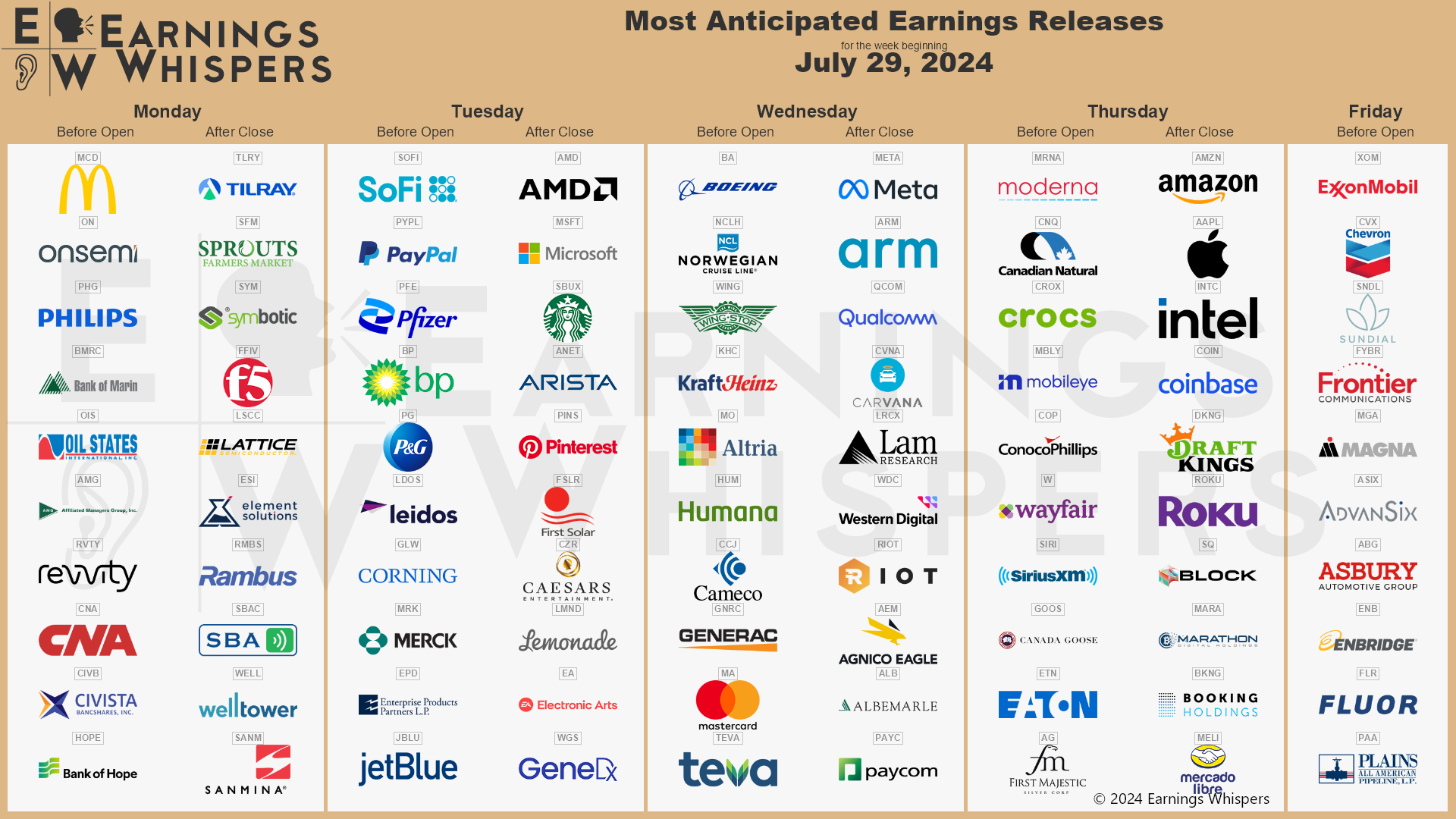

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: July 22nd

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.