Forefront’s Market Notes:

July 15th, 2024

Stocks advanced last week as market leadership shifted amid fresh inflation data and quarterly corporate reports starting to roll in.

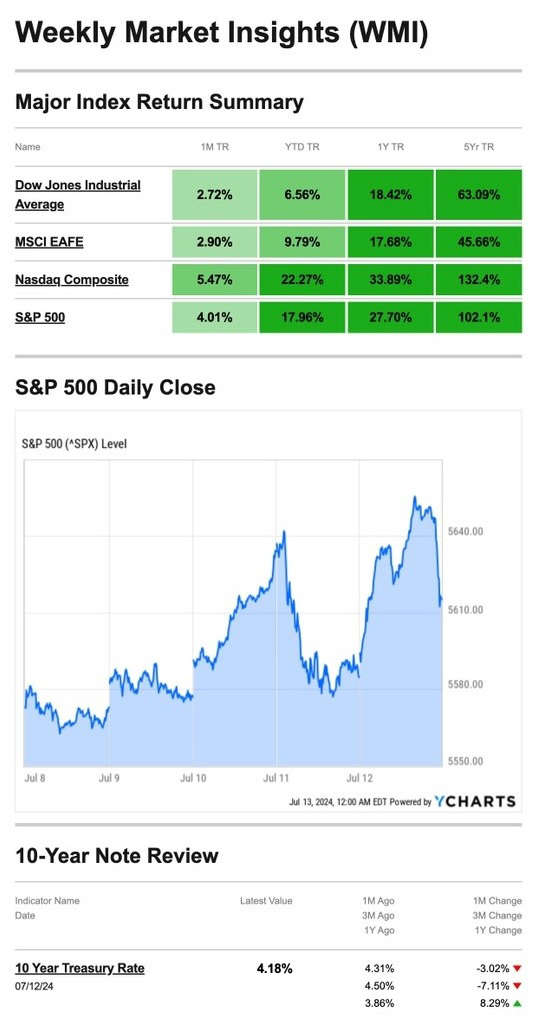

The Standard & Poor’s 500 Index advanced 0.87 percent, while the Dow Jones Industrial Average picked up 1.59 percent. The tech-heavy Nasdaq Composite Index, which has led all year, rose 0.25 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, rallied 1.62 percent for the week through Thursday’s close.1

Dow Breaks 40,000 (Again)

Mega-cap tech led modest gains for the S&P 500 and Nasdaq in the first two days of the week, with the Dow posting modest losses both days.

But that narrow trading range didn’t last long as market leadership shifted midweek. Upbeat corporate earnings reports and milder-than-expected consumer inflation in June drove momentum in a handful of larger industrial and consumer stocks.2,3

Q2 earnings season got into full swing later in the week, dominated mostly by financial and consumer-oriented companies. Markets seemed initially unfazed by better-than-expected reports from some money center banks. Some observers suggested higher interest rates may be one of the reasons for the market’s lukewarm response.4

The Dow ended the week with a solid gain after three consecutive weeks of trailing the S&P 500 and Nasdaq. The Dow also closed above 40,000, the first time it had done so since May, and hit a 52-week intraday high on Friday.

Source: YCharts.com, July 13, 2024. Weekly performance is measured from Monday, July 8, to Friday, July 12.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Mixed Inflation News

Two inflation reports came out last week: PPI and CPI.

The Producer Price Index, which measures the change in wholesale prices, rose 2.6 percent in June year over year—its largest increase in 16 months. By contrast, the Consumer Price Index, which tracks consumer prices, showed that the pace of inflation slowed in June.

Markets shrugged off the conflicting data, instead embracing the cooler CPI data. The Fed is likely taking notes for its next Fed meeting, scheduled for July 30-31.5

Give Back to Your Community By Working as a Tax Volunteer

If you’re looking for a way to give back to your community and help people with low-to-moderate incomes, consider applying to volunteer with the Volunteer Income Tax Assistance or Tax Counseling for the Elderly programs. These programs offer free tax help to senior citizens, persons with disabilities, and those who speak limited English to understand their tax situations.

Here are some of the perks of being a VITA or TCE volunteer:

- Flexible hours: Generally, volunteers contribute 3-5 hours per week. Some sites are open all year, but most programs are open from January to April.

- Convenience: Thousands of VITA and TCE sites are set up in neighborhoods across the country, so it’s convenient to volunteer at a location close to home. These locations are usually community centers, libraries, schools, and malls.

- No experience needed: You don’t have to be a tax pro to volunteer because all volunteers receive special training and can serve in various roles.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov6

Footnotes and Sources

1. The Wall Street Journal, July 12, 2024

2. The Wall Street Journal, July 12, 2024

3. The Wall Street Journal, July 11, 2024

4. The Wall Street Journal, July 12, 2024

5. The Wall Street Journal, July 12, 2024

6. IRS.gov, May 8. 2024

7. heart.org, May 8, 2024

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, JULY 15 | |

| 8:30 AM | Empire State manufacturing survey |

| 12:00 PM | Fed Chairman Powell speaks |

| TUESDAY, JULY 16 | |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 8:30 AM | Import price index |

| 8:30 AM | Import price index minus fuel |

| 10:00 AM | Business inventories |

| 10:00 AM | Home builder confidence index |

| 2:45 PM | Fed Gov. Adriana Kugler speaks |

| WEDNESDAY, JULY 17 | |

| 8:30 AM | Housing starts |

| 8:30 AM | Building permits |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 2:00 PM | Fed Beige Book |

| THURSDAY, JULY 18 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| 10:00 AM | U.S. leading economic indicators |

| FRIDAY, JULY 19 | |

| 10:40 AM | New York Fed President Williams speaks |

| 1:00 PM | Atlanta Fed President Raphael Bostic speaks |

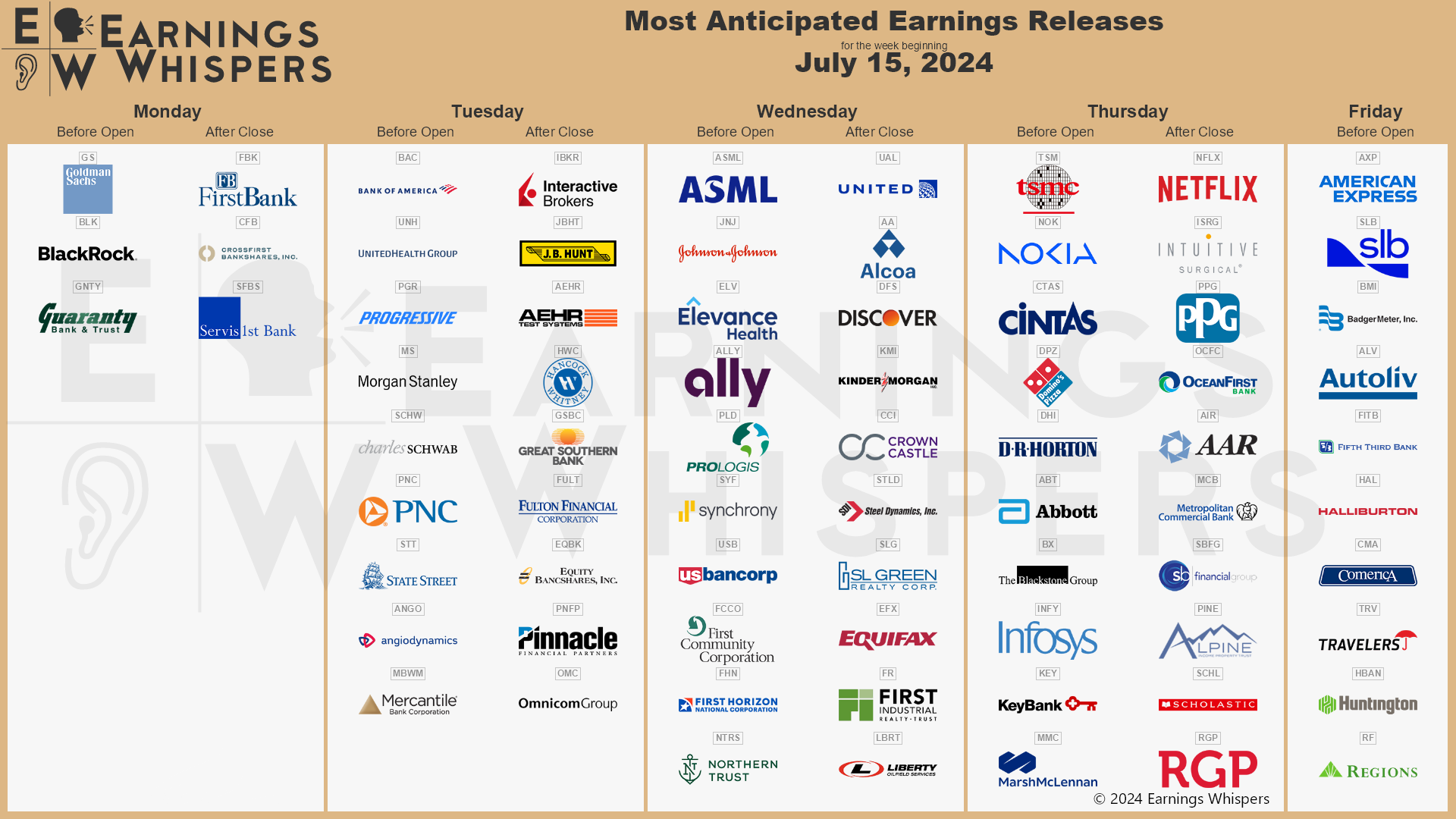

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: July 8th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.