Forefront’s Market Notes

January 13th, 2025

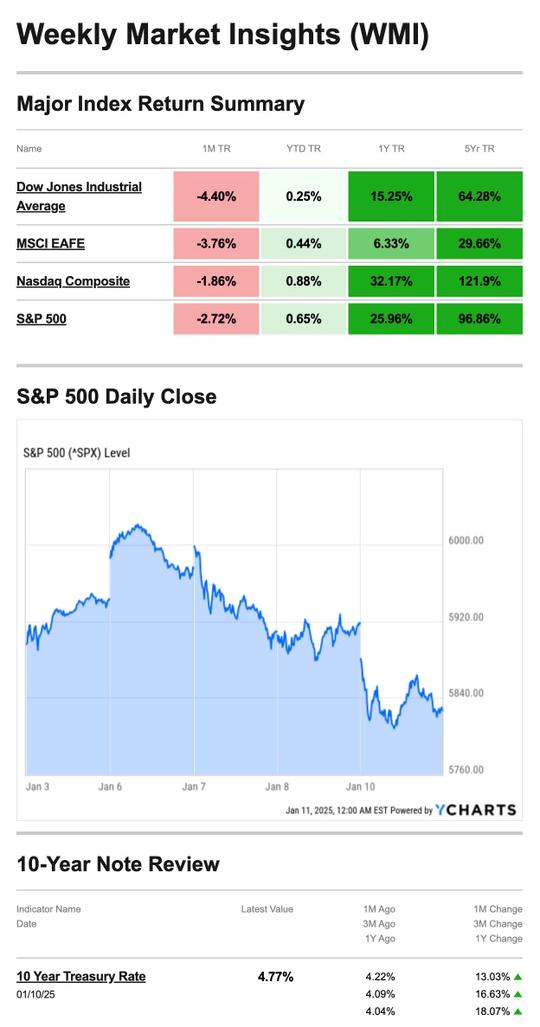

Stocks fell for the second consecutive week as a round of fresh economic data stoked inflationary fears among investors.

The Standard & Poor’s 500 Index declined 1.94 percent, while the Nasdaq Composite Index dropped 2.34 percent. The Dow Jones Industrial Average lost 1.86 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, slipped 0.49 percent.1,2

Inflation Stymies Markets

Stocks rallied broadly to start the week, but two economic reports on Tuesday—job openings and the prices-paid index among service companies—raised fresh inflation concerns. Higher Treasury yields also put pressure on stocks.3,4

Stocks flattened out on Wednesday. Investors reacted to news that most Federal Open Market Committee members agreed inflation risks had increased, per minutes from the Fed’s December meeting.5,6

U.S. stock markets were closed Thursday in observance of President Jimmy Carter’s funeral.

On Friday, a warmer-than-expected December jobs report caused investors to question whether the Fed will adjust rates in 2025. News that consumer sentiment ticked down also pushed stocks lower.7

Source: YCharts.com, January 11, 2025. Weekly performance is measured from Friday, January 3, to Friday, January 10. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

When Good Becomes Bad News

The economy added 256,000 jobs in December—100,000 more than economists expected. That’s the second-highest monthly job gain for 2024. Unemployment ticked down to 4.1 percent, which was also better than anticipated.

Job growth and lower unemployment signals good news for the economy but bad news for the markets. A stronger jobs market puts less pressure on the Fed to adjust rates, especially with inflation top-of-mind among investors.8,9

Self-Employed Tax Obligations

There are a few tax considerations to consider when you work for yourself. Generally, you’re required to file and pay estimated taxes during the year.

- Make quarterly payments if you’ve determined you need to use Form 11040-ES.

- Filing annually: If you’re filing annually, you must use Schedule C to report income or loss. To file your Social Security and Medicare taxes, you should file Schedule SE Form 1040.

- Deductions: If you’re using part of your home for business, you may be able to make certain deductions, such as for your office or a portion of your home’s square footage used for business purposes.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS10

Footnotes and Sources

1. The Wall Street Journal, January 10, 2025

2. Investing.com, January 10, 2025

3. CNBC.com, January 6, 2025

4. The Wall Street Journal, January 7, 2025

5. CNBC.com, January 8, 2025

6. MarketWatch.com, January 8, 2025

7. CNBC.com, January 10, 2025

8. The Wall Street Journal, January 10, 2025

9. TradingEconomics.com, January 10, 2025

10. IRS.gov, September 30, 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, JAN. 13 | |

| 2:00 PM | Monthly U.S. federal budget |

| TUESDAY, JAN. 14 | |

| 6:00 AM | NFIB optimism index |

| 8:30 AM | Producer price index |

| 8:30 AM | Core PPI |

| 8:30 AM | PPI year over year |

| 8:30 AM | Core PPI year over year |

| 10:00 AM | Kansas City Fed President Jeffrey Schmid speaks |

| 2:00 PM | Fed Beige Book |

| 3:05 PM | New York Fed President Williams delivers opening remarks |

| WEDNESDAY, JAN. 15 | |

| 8:30 AM | Consumer price index |

| 8:30 AM | CPI year over year |

| 8:30 AM | Core CPI |

| 8:30 AM | Core CPI year over year |

| 8:30 AM | Empire State manufacturing survey |

| 9:00 AM | Richmond Fed President Barkin speaks |

| 11:00 AM | New York Fed President Williams speaks |

| 12:00 PM | Chicago Fed President Goolsbee speaks |

| THURSDAY, JAN. 16 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 8:30 AM | Import price index |

| 8:30 AM | Import price index minus fuel |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| 10:00 AM | Business inventories |

| 10:00 AM | Home builder confidence index |

| FRIDAY, JAN. 17 | |

| 8:30 AM | Housing starts |

| 8:30 AM | Building permits |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

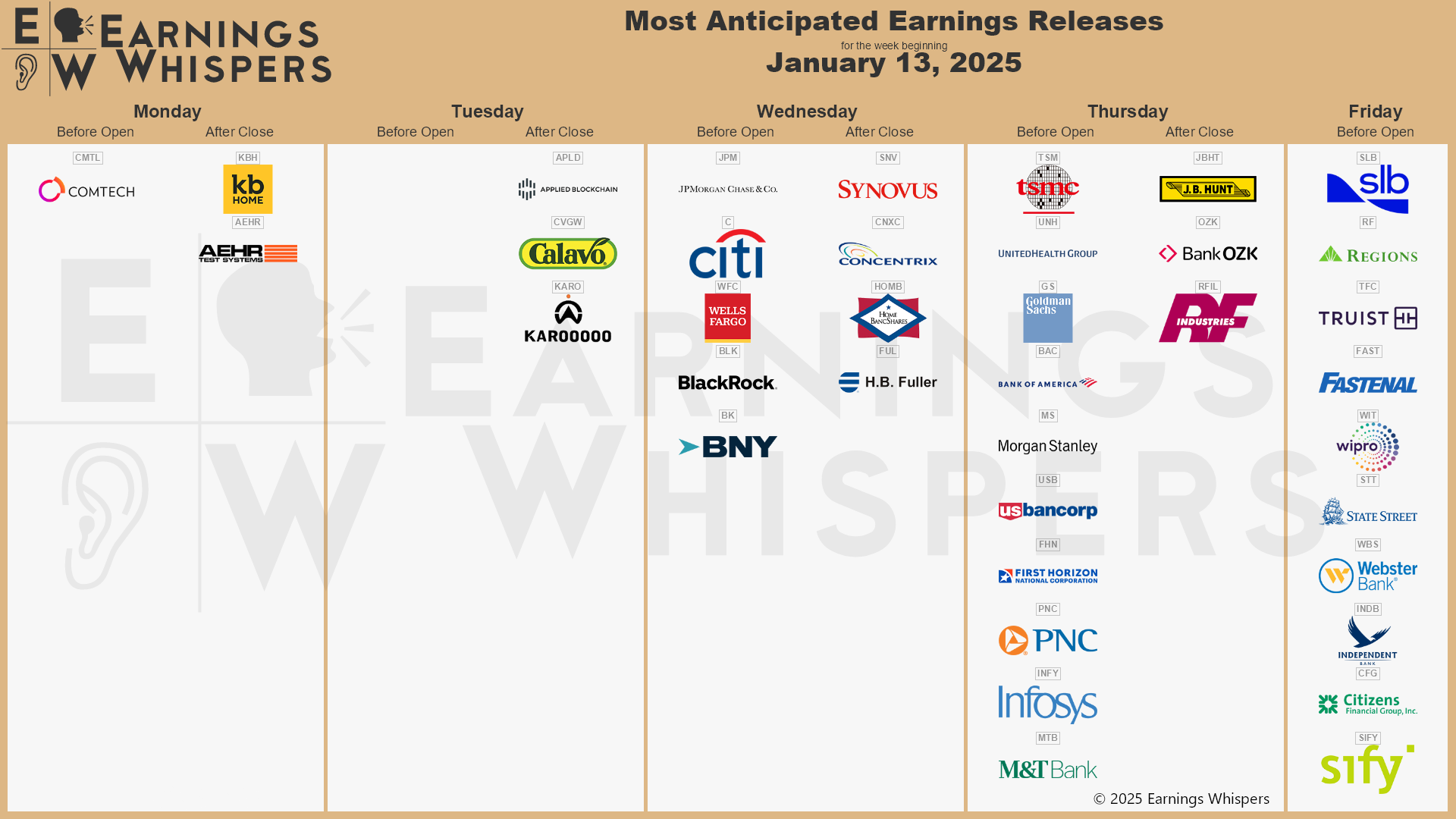

Most anticipated earnings for this week

Did you miss our last blog?

Forefront Market Notes: January 6th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.