Forefront’s Market Notes: February 12th, 2024

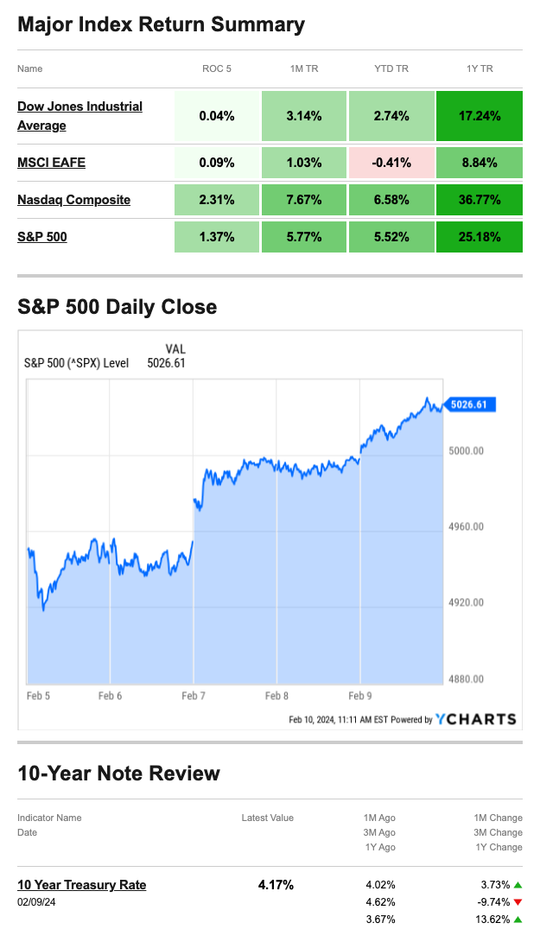

The stock market experienced solid gains last week, concluding the trading week on a positive note, thanks to robust corporate reports and favorable inflation news; this propelled the S&P 500 Index to achieve a new record high at the end of the week.

S&P Tops 5,000

At the start of last week’s trading, stocks faced downward pressure due to comments by Fed Chair Powell over the weekend, signaling that the Federal Reserve had no immediate plans to initiate interest rate cuts. Consequently, the yield on the two-year U.S. Treasury note, highly influenced by monetary policy, increased to its highest level in two months.1

By the end of trading on Monday, stocks had regained a significant portion of their previous losses. Influencing this market rally were positive corporate earnings reports. This trend continued throughout the week, contributing to the overall market momentum. By Friday, 67% of the companies listed in the S&P 500 had released their Q4 results, and an impressive 77% of those companies exceeded earnings expectations.2

Investors expressed enthusiasm on Friday after a report indicating that December’s inflation was lower than initially anticipated. This positive news revitalized buying activity, resulting in the S&P 500 surpassing 5,000 for the first time.3

Source: YCharts.com, February 10, 2024. Weekly performance is measured from Monday, February 5, to Friday, February 9.

ROC 5 = the rate of change in the index for the previous 5 trading days.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Economic Strength

The strength of the U.S. economy has come into the spotlight. An analysis conducted by The Wall Street Journal recently proposed that the economy’s resilience could be attributed, at least in part, to the productivity driven by the technology sector.4

What might rein in that productivity? One possible influence could be the increase in oil prices witnessed last week. Additionally, shipping companies have been imposing surcharges for several months to mitigate recent conflict, and these charges may contribute to global inflation this year, potentially dampening investor enthusiasm.5

Are You Prepared for a Natural Disaster?

Natural disasters, such as hurricanes, earthquakes, or fires, can happen anytime, so preparing before disaster strikes is essential. Here are a few tips to help you prepare in case anything happens:

-

- Update Your Family’s Emergency Plans: Your emergency plans can include knowing where to go, where you keep all necessary documents and possessions, and what you need to be prepared for. Check up on the emergency plans for your home or business frequently because things can change.

- Create Digital Copies Of Important Documents: Most financial organizations, such as banks and insurance companies, provide digital copies of bank statements, tax returns, and insurance policies anyway, and keeping all these digital copies saved and organized is an excellent practice to get into. If you only have paper copies of important documents, scan them and save them securely to access them in an emergency.

- Document Valuables: Documenting valuables makes it easier to claim insurance and tax benefits after a natural disaster. A disaster loss workbook will help you compile a list of belongings and photographs that can make this process even more accessible for both the IRS and your insurance provider.

*This tax tip is for informational purposes only and is not a replacement for real-life advice. Consult your tax, legal, and accounting professionals for more specific information.

Tip adapted from IRS.gov6

Footnotes and Sources

1. The Wall Street Journal,February 4, 2024

2. FactSet.com, February 9, 2024

3. CNBC.com, February 9, 2024

4. WSJ.com, February 8, 2024

5. CNBC, February 9, 2024

6. IRS.gov, March 8, 2023

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, FEB. 12 | |

| 9:20 AM | Fed Gov. Michelle Bowman speaks |

| 12:00 PM | Richmond Fed President Tom Barkin speaks |

| 1:00 PM | Minneapolis Fed President Neel Kashkari speaks |

| 2:00 PM | Monthly U.S. federal budget |

| TUESDAY, FEB. 13 | |

| 8:30 AM | Consumer price index |

| 8:30 AM | Core CPI |

| 8:30 AM | CPI year over year |

| 8:30 AM | Core CPI year over year |

| WEDNESDAY, FEB. 14 | |

| 9:30 AM | Chicago Fed President Austan Goolsbee speaks |

| 4:00 PM | Fed Vice Chair for Supervision Michael Barr speaks |

| THURSDAY, FEB. 15 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Empire State manufacturing survey |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| 8:30 AM | Import price index |

| 8:30 AM | Import price index minus fuel |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 10:00 AM | Home builder confidence index |

| 1:15 PM | Fed Gov. Christopher Waller speaks |

| 7:00 PM | Atlanta Fed President Raphael Bostic speaks |

| FRIDAY, FEB. 16 | |

| 8:30 AM | Housing starts |

| 8:30 AM | Building permits |

| 8:30 AM | Producer price index |

| 8:30 AM | Core PPI |

| 8:30 AM | PPI year over year |

| 8:30 AM | Core PPI year over year |

| 9:10 AM | Fed Vice Chair for Supervision Michael Barr speaks |

| 10:00 AM | Consumer sentiment (prelim) |

| 12:10 PM | San Francisco Fed President Mary Daly speaks |

Most anticipated earnings for this week:

Did you miss our last blog?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.