5 Smart Investing Principles – Estimate Your Time Horizon

There is no shortage of self-help material available for people looking to boost their investing knowledge. Between television programs, magazines, and other information sources, you can read about “The Best” this and “The Most Important” that. It can be easy to get confused, especially when you get conflicting ideas.

Understanding a few key investment principles can be a great place to start. It can give you a better framework to understand the information as you take in the ideas. It can also provide context for evaluating the concepts and strategies suggested.

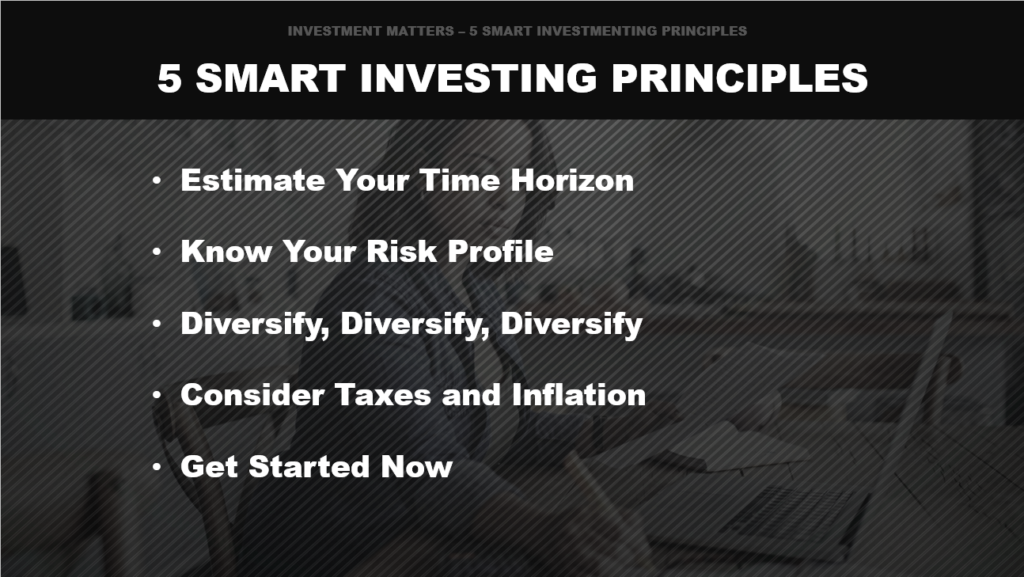

In this series of posts we will go through five smart investing principles. These are key concepts that could help you understand what it takes to create an investment portfolio that’s designed to pursue your investment goals.

There are five smart investing principles that are helpful to understand if you want to potentially break the cycle of buying high and selling low. Are there other investing principles? Absolutely. But for the purposes of our discussion today, we’re going to focus on the five that we believe are critical to understand.

First, estimate your time horizon. Is your investment horizon three years away or 30 years?

Second, know your risk profile. Can you tolerate big swings in the value of your investments, or do you prefer less volatility? Knowing your risk profile is an important step as you consider various types of investments.

Third, diversify, diversify, diversify. This one’s so important we listed it three times.

Fourth, consider the effects of taxes and inflation.

And finally, get started now. Take the initiative and get going. If you learn nothing else today, please understand the importance of getting started now. When it comes to pursuing investment goals, the more time you have the better.

Keep in mind that a diversified portfolio does not assure a profit or protect against loss in a declining market.

Estimating Your Time Horizon

Let’s take a look at our first principle, estimating your time horizon.

Generally, if your time horizon is short, you may be more comfortable with a more conservative investing approach. Certain investments can be volatile and may not be appropriate if you have a short-term horizon.

If your child is headed to college in five years, many people would say you have a mid-term horizon. You may want to be less conservative with your investing approach and have a larger exposure to equity investments.

When you have a long-term horizon, you may consider adopting a more aggressive approach. If you intend to retire in 10–15 years, having a larger exposure to stock investments may make more sense. One way to lower your exposure to stock market risk is by investing for the long term, which gives your money time to recover from periods of market fluctuations and loss. Of course, past performance is no guarantee of future results.

Principle 2: Know Your Risk Profile

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.