By Jeff Deiss, CFP, AEP, Wealth Advisor

Original Content by ACM Wealth

We wrote a piece in 2017 about the importance of maintaining equities in your portfolio and how, academically, equities provide the best investment outcome over long periods of time. In contrast to what we know academically, we also talked about the psychological benefits of maintaining cash and how “cash can buy happiness”.

There is no doubt that our emotions do play a role in investing. It’s unavoidable for even the most sophisticated investors and the volatility of financial markets reflects our fear and greed over time.

Today we’re sharing some thoughts on common situations where our emotions get the better of us and make it more difficult to achieve investment success and reach our financial goals. The hope is that if we can recognize the symptoms, then we may be better prepared to understand them and avoid making mistakes.

Fear of losing money. As I mentioned back in 2017, the pain of loss is said to be three times more impactful as the satisfaction provided by a similar gain. So we go to great lengths to avoid loss and this often creates investment paralysis. Symptoms of investment paralysis include avoiding investing altogether (which makes meeting financial goals difficult or even impossible) or selling winning investments (for fear of losing the gain) while losing investments are left in the portfolio indefinitely.

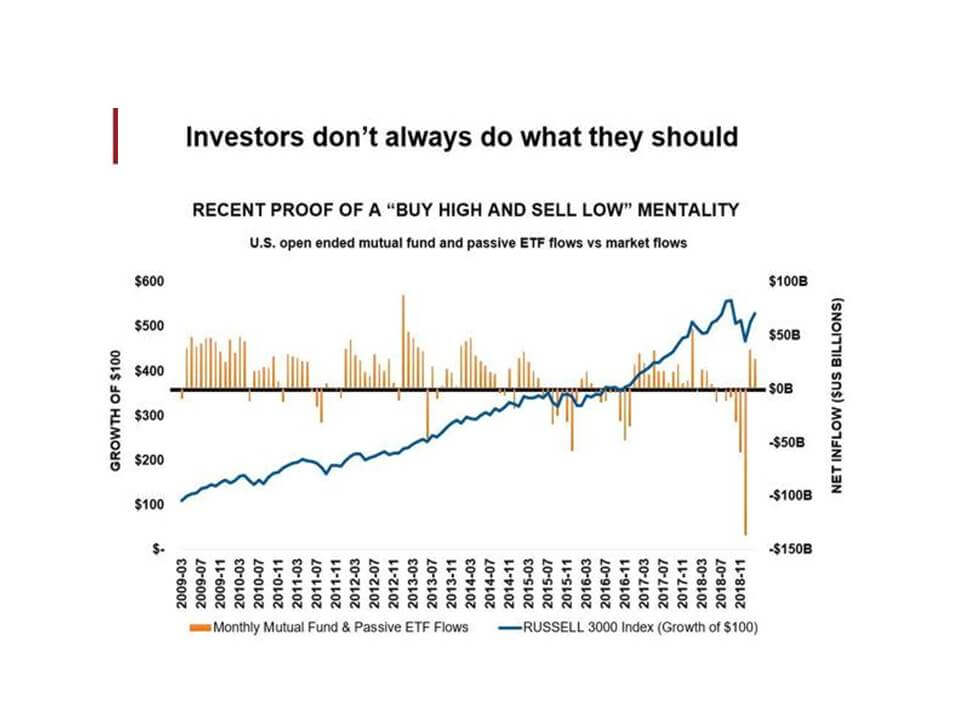

Data shown is historical and not an indicator of future results. Sources: Monthly mutual fund, passive ETF flows, and Russell 3000® Index, Morningstar, Direct. Data as of February 28th, 2019. Index performance is not indicative of the performance of any specific investment. Indexes are not managed and may not be invested in directly.

The following chart illustrates how investor fear corresponds to normal stock market volatility. It tracks market inflows and outflows against the growth of the Russell 3000 Index (a benchmark of the entire U.S. stock market). Since the start of the bull market back in 2009, investors have withdrawn funds from the market (rather than adding funds) seemingly every time there has been a market pullback.

In all of these situations, the best course of action was to do nothing. Those who remained invested did a lot better than those who did not. It sounds simple in theory, but the above indicates that this is difficult to accomplish without some help.

Investments in stock and bonds are gaining and losing value all day, every day. There’s actually a lot more volatility than most of us recognize. But we only lose money if we happen to sell something for less than what we purchased it. Fortunately, our personal investment time horizons are much longer than just a day and with proper planning, we can and should avoid losing money by choosing an investment strategy the fits with our goals and then staying invested. Over the time periods that represent major investment goals, like a normal retirement today, properly managed investment portfolios add value (be it through income and/or appreciation) over time.

Following the herd. The opposite emotion of fear that can overwhelm an investor is greed. Symptoms include owning the hot stock or fund or economic sector and following the crowd (i.e., chasing performance) when it’s likely that these investments have already run up and that real value lies elsewhere.

It’s a challenge to go against the consensus and take our emotions out of investment decisions. It’s easier to follow the money and follow the crowd because most of us would prefer to suffer along with everybody else than to win all alone. The risk here is that the crowd’s goals may be very different than your individual goals. And when the crowd includes influential family members and friends, it can be more difficult to break from the herd and so it’s important to recognize this.

Reacting too Quickly. Just like your investments are changing in value all day every day, there are new events and changes to ongoing concerns that we could react to on a seemingly daily basis. The media has an influence on how we receive and interpret information today, which can affect how we feel (our confidence) and so it’s important to keep this in mind.

Generally speaking, markets overreact to news (whether it be stock specific or something broader) and then eventually revert to some equilibrium after the news is fully digested. Whenever possible, it’s better to let the market react to news than to be part of the reaction.

Over the course of the past two years, we highlighted the fact that day to day events in Washington (or even who is currently President) tend to have little influence on the economy over time, but they are easy to react to. If anything, the headlines (or tweets) are more interesting to talk about, to use as conversation starters or perhaps as an excuse to vent our frustration. Similarly, news of bad performance for an individual company (stock of bond) does not portend bad performance for the overall economy.

Over time, what really matters is the health of the economy, which we talk about regularly in our weekly commentary. By recognizing and distinguishing these influences, it may be easier to sort through the noise, keep the bigger picture and your goals in mind, and not react impulsively.

The stock market goes up over time. It just doesn’t go up in a straight line. And volatility is normal so don’t overreact and let it derail you from your plan.

The Remedy

The best remedy to avoiding impulsive decisions where emotions get the better of us is to have a plan and stick to it (or to work with someone who you trust and can help you create and maintain a plan). Your plan should determine the purpose of why you are investing and the investment strategy you choose should determine how you achieve your plan’s objective. Expected returns need to be reasonable and linked to your time horizon. Longer time horizons, like the length of a typical retirement today, give us more time to recover from bad years and more chances to be in the market for good years.

Academically, a portfolio of 100% stocks over the long term achieves the best investment outcome. Emotionally, very few of us can tolerate the normal volatility that a 100% stock portfolio will experience. The best way to moderate the impact of volatility in difficult markets is to maintain some balance and own some stocks and bonds and perhaps if it makes us happy and doesn’t impair our ability to achieve our goals, keep some cash available too. Assets do not move up/down in lockstep. When stocks rise, bonds may fall. Or at other times, bonds also may rise when stocks do. A Balanced approach helps take some of the emotion out of investing by making the ride smoother and making it easier to remain invested, which is the key to investment success.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth