by Dr. JoAnne Feeney

Portfolio Manager

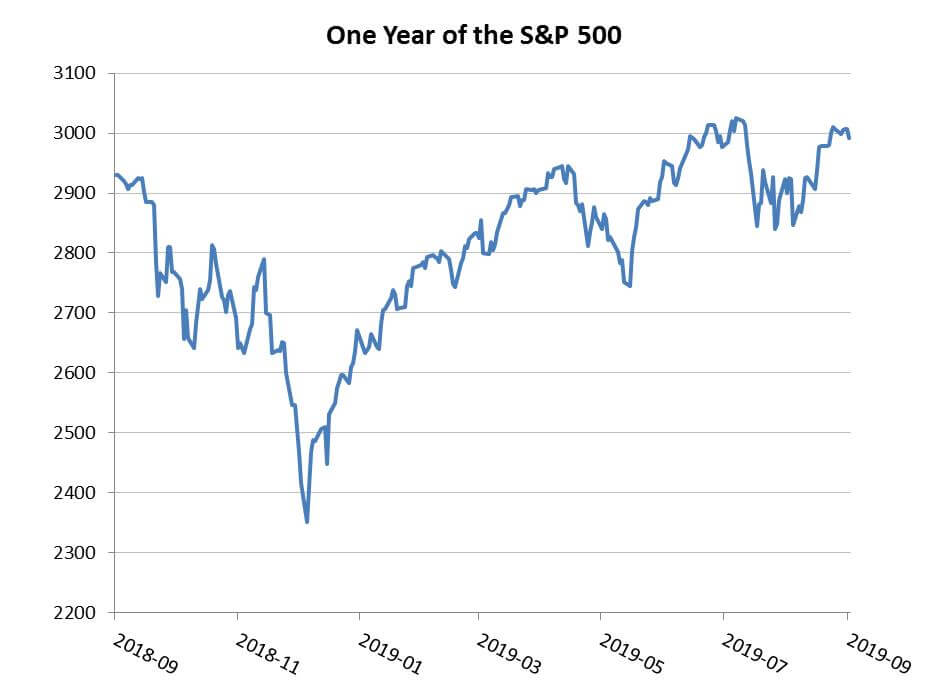

Investors may be pleased to realize that the S&P 500 has risen 19% year to date, even as they lament that the market has slowed down considerably this quarter, having risen just 0.9% thus far. Moreover, the ride has been a bumpy one, as the chart below illustrates, and reflects the many news headlines about the economy, monetary policy, and other disruptions, such as the attack on Saudi oil. We know that long-term investing requires staying well-exposed to the forces driving long-term stock appreciation while finding defensive positions to cushion the downside. It is our view that the underlying fundamentals supporting the market are solid, so the market should continue its irregular ascent, and investors should take advantage of random setbacks to add to positions.

Source: S&P Dow Jones Indices LLC, S&P 500 [SP500], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SP500, September 22, 2019.

Source: S&P Dow Jones Indices LLC, S&P 500 [SP500], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SP500, September 22, 2019.

Some of the news behind the past year’s ride reflected changes in the “real” economy, while other developments concerned monetary policy, and the third source of market moves can best be described as “shocks” to the economy. By separating market drivers into these three buckets we can better discern whether any one piece of information is signaling a shift in long-term prospects for the economy, an industry, or an individual company. And then we can decide how to adjust portfolios.

Think of the first bucket containing information on the “real” economy—GDP growth, industrial production, unemployment, etc. This is the world where stuff gets made and it underlies the profits firms generate, and so, in the long run, determines how valuable companies can become. This bucket also catches the information that can tell us whether we’re likely to be approaching a recession. Last week’s news revealed stronger-than-expected signals regarding the U.S. economy, but the OECD cut its forecast of global growth. The positive U.S. news included lower-than-expected unemployment filings, stronger existing home sales, and better new home starts and indicates solid current economic fundamentals and a positive tilt to cyclical forces. More importantly, long-term prospects for the U.S. economy appear intact. Last week, the Economist’s Technology Quarterly focused on the growing role of computing power in everyday things. The spread of cheap chips is enabling better and cheaper industrial equipment, cars and trucks, smart home systems, medical care, and the list goes on. These developments point to faster economy-wide productivity growth and suggest a sustainable tailwind for valuation expansion for a broad set of companies in multiple sectors. So the real economic data indicates that the disruptions are mostly temporary, while the growth prospects remain solid.

The second bucket—monetary policy—is trickier because investors view the Federal Reserve both as a distinct force, capable of affecting asset values through its policy moves, and as a reflection of the twists and turns in the real economy. Last fall, the Chairman’s offhand comment signaling greater-than-expected rate increases had investors worried that the Fed would inadvertently stymie the expansion. Communication from the Fed since then convinced investors otherwise, and last week’s rate cut helped to cement that view. And by signaling the potential for a less accommodative future, the Fed also managed to reassure investors that its view on the U.S. economy remains relatively positive. So while Fed announcements may continue to impact the market, we see the Fed’s stance supporting further stock appreciation as it pursues a cautiously accommodative policy.

The third bucket includes all the “shocks” capable of driving stock prices. These include mostly temporary disturbances, but it’s important to be on the lookout for temporary shocks that can turn into more persistent ones. Take the ups and downs surrounding the China trade war, for example. When it appears a deal is imminent, the market rallies, but when talks break down—as they appeared to do when the China delegation hot-footed it back home on Friday—the market reacts negatively. For the most part, the trade war creates a largely temporary headwind for companies mired in its midst. Eventually, we will come to agreement and trade volumes will pick up again. But there are prospects for long-lasting damage if it stretches out too long. The attack on Saudi oil facilities is another example of a largely temporary shock. The spike in oil prices proved short-lived once the long-term risk—that of all-out Middle East war—abated. While news of such shocks will continue to rile the equity market, we see the longer-term drivers continuing to support the prospects for expansion.

Another look at the chart above reinforces the importance of staying invested for the long run. A great deal of the volatility over the last year was driven by what proved to be temporary shocks, and that is generally the case. The positive longer-term trends on the growth front and current cyclical dynamics are more than offsetting the short-term negative shocks and appear likely to continue to do so provided the real economy maintains its current track.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth