Forefront’s Market Notes:

November 11th, 2024

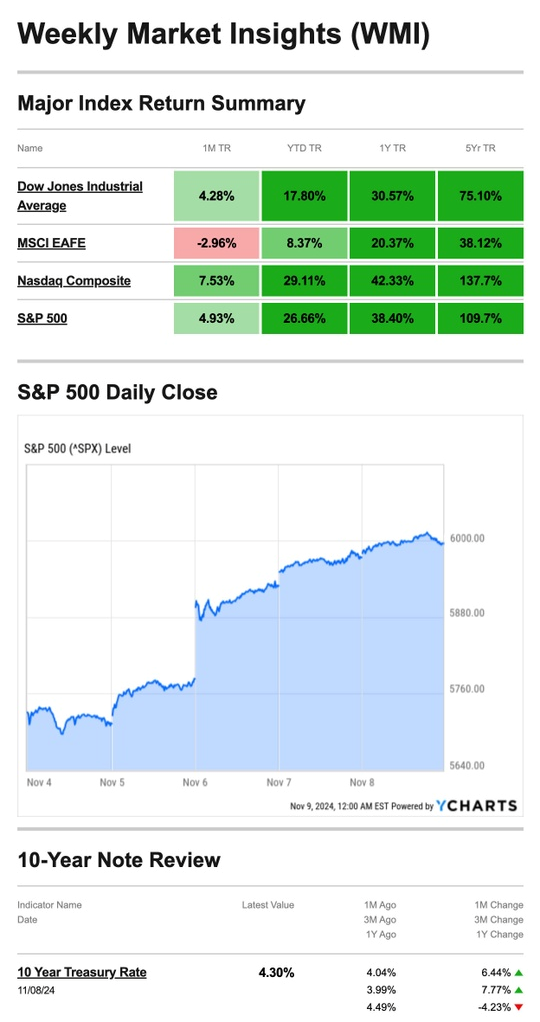

Stocks surged higher last week, fueled by the Fed’s rate cut decision and post-election enthusiasm as investors looked to future policy impacts of a Republican-controlled Senate and executive branch. (The House of Representatives remains undecided.)

The Standard & Poor’s 500 Index spiked 4.65 percent, while the Nasdaq Composite Index gained 5.74 percent. The Dow Jones Industrial Average rose 4.61 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, was flat (-0.02 percent).1,2

Stocks Extend Rally on Election News

It was a shaky start to the week for stocks as investors anxiously awaited election results and the Fed’s interest-rate decision.3

On Election Day, stocks rallied broadly before polling places closed. After the election was called early the next morning, stocks opened higher and climbed throughout the trading session. The yield on the 10-year Treasury fell to 4.307 percent.4,5

Stocks opened higher Thursday, and the rally picked up momentum after the Federal Reserve approved its second consecutive interest rate cut. Economic news that showed a 2.2 percent rise in third-quarter productivity helped support the move.6,7

Stocks finished the week with a number of records: the S&P 500 crossed the 6,000 mark, and the Dow breached 44,000 for the first time on Friday. While the S&P and Dow closed slightly below those record levels, each had their best week in a year.8

Source: YCharts.com, November 9, 2024. Weekly performance is measured from Monday, November 4, to Friday, November 8. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Fed Cuts Rates

As expected, the Federal Reserve cut interest rates by a quarter percentage point at its November meeting.

However, Fed Chair Jerome Powell signaled some uncertainty about the pace of future rate cuts, which slightly unsettled the markets.

Citing a desire to “steer between the risk of moving too quickly and perhaps undermining our progress on inflation, or moving too slowly and allowing the labor market to weaken too much,” Powell said the Fed will continue to monitor the economy’s progress.9

Be On the Lookout for Tax Carryovers

Deductions or credits not used fully one tax year that may be eligible to be carried over into future years include:

- When you have a net operating loss

- When your total expenses for a permitted deduction exceed the amount you’re allowed to deduct in a given year

- When a credit you qualify for exceeds the amount of tax you owe in a year

- Adoption tax credits

- Foreign tax credits

- Credits for energy efficiency

Track these (or have your software do it) so you don’t forget them from one year to the next.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS10

Footnotes and Sources

1. The Wall Street Journal, November 8, 2024

2. Investing.com, November 8, 2024

3. CNBC.com, November 4, 2024

4. CNBC.com, November 5, 2024

5. The Wall Street Journal, November 6, 2024

6. The Wall Street Journal, November 7, 2024

7. MarketWatch.com, November 7, 2024

8. The Wall Street Journal, November 8, 2024

9. The Wall Street Journal, November 7, 2024

10. IRS.gov, January 30, 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, NOV. 11 | |

| Veteran’s Day holiday, bond market closed | |

| TUESDAY, NOV. 12 | |

| 6:00 AM | NFIB optimism index |

| 10:00 AM | Fed Gov. Christopher Waller speaks |

| 10:15 AM | Richmond Fed President Tom Barkin speaks |

| 5:00 PM | Philadelphia President Patrick Harker speaks |

| WEDNESDAY, NOV. 13 | |

| 8:30 AM | Consumer price index |

| 8:30 AM | CPI year over year |

| 8:30 AM | Core CPI |

| 8:30 AM | Core CPI year over year |

| 9:30 AM | New York Fed President John Williams delivers welcoming remarks |

| 9:45 AM | Dallas Fed President Lorie Logan speaks |

| 1:00 PM | St. Louis Fed President Alberto Musalem speaks |

| 1:30 PM | Kansas City President Jeff Schmid speaks |

| 2:00 PM | Monthly U.S. federal budget |

| THURSDAY, NOV. 14 | |

| 7:00 AM | Federal Reserve Gov. Adriana Kugler speaks |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Producer price index |

| 8:30 AM | PPI year over year |

| 8:30 AM | Core PPI |

| 8:30 AM | Core PPI year over year |

| 3:00 PM | Federal Reserve Chair Jerome Powell speaks |

| 4:15 PM | New York Fed President John Williams speaks |

| FRIDAY, NOV. 15 | |

| 8:30 AM | Import price index |

| 8:30 AM | Import price index minus fuel |

| 8:30 AM | Empire State manufacturing survey |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 10:00 AM | Business inventories |

| 1:15 PM | New York Fed President John Williams opening remarks |

Most anticipated earnings for this week:

Did you miss our last blog?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.