December 12, 2022

Forefront‘s Monday Market Update

The Line Between Genius and Idiot

Sorry about the hiatus, everyone; Forefront Wealth Planning is making some big moves as a firm, which has taken a little longer to adjust to than I thought. We are back, though, and today I am writing about something that has been on my mind for all of 2022.

During bull markets, the TV and media didn’t miss any opportunity to tell all of us about how intelligent certain investors were because of their incredible performance.

Often, bull markets crown geniuses, while idiots are revealed during bear markets. Many times, it happens to the same person.

Something we all need to remember, performance in a bull market does not make you more intelligent, just like bear market performance doesn’t make you an idiot. Both tend to make you feel a certain way, and the truth generally lies in the middle.

Confidence =/= Credibility

As investors, we are all paying too much attention to the loudest and most confident voices in the room rather than the most thoughtful ones. Certainty is not a sign of credibility, and speaking assertively is not a substitute for thinking critically. It is better to learn from complex thinkers than from smooth talkers.

Intelligent Investor or Investor Intelligence

Early in my career, I poured myself into textbook financial intelligence. I could/can build some of the most amazing discounted cash flow models, and I thought the technical knowledge I was acquiring was all I needed to be a successful investor and advisor for my clients.

Being the smartest and most technical person in the room doesn’t matter if you lack the emotional intelligence to stick with your strategy, even in the most challenging times. The outcome of your financial success is influenced to a much greater degree by your temperament and behavior than it is by your IQ and intelligence.

Intuition

I love my clients. That comes across in my writing, but I love every single one. Not just for the confidence and faith, they have put in me but because our relationship is building simultaneously on this journey of saving and building wealth. That doesn’t mean I don’t have some clients that make me want to pull my hair out.

I had a conversation last week with a client who wanted to zig and zag to try and increase performance. He told me his intuition was telling him something big would happen.

Intuition, when it comes to investing, is a game of chance. Perhaps some hedge fund manager in the world picks investments based on his gut or the direction his dog is facing when they wake up; who knows? What the rest of us regular investors should do is automate our savings and investment strategies and remove gut instinct from the equation.

Bear Markets

There is always a first for everything, but every bear market in the history of the U.S. stock market has reversed course, and the markets have hit new all-time highs at some point. Sometimes it takes days, weeks, months, or even years, and to speculate on the time frame would be nothing more than a guess on my part. I am not in the guessing business.

Patience has always been rewarded for investors who learn to be uncomfortable with uncertainty. Nothing is guaranteed, and I guess the entire world could collapse, bringing the stock market down with it, but if that happens, will your investments even matter at that point?

Investing during down markets is a bet on humanity figuring it out. There are no guarantees with anything, but that is a bet that I will make ten times out of ten.

So What?

So how does this impact all of you?

-

The stock market is UP 194% (11.5 %/yr) over the last 10 years!You wouldn’t earn the 11.4%/yr without enduring the -23% drops.

-

No bear market is the same; trying to plan to get in and out is impossible.

Stock market calendar this week:

| MONDAY, DEC. 12 | |

| 11:00 AM | NY Fed 1-year inflation expectations |

| 11:00 AM | NY Fed 5-year inflation expectations |

| 2:00 PM | Federal budget (compared with Nov. 2021) |

| TUESDAY, DEC. 13 | |

| 6:00 AM | NFIB small-business index |

| 8:30 AM | Consumer price index |

| 8:30 AM | Core CPI |

| 8:30 AM | CPI (year-on-year) |

| 8:30 AM | Core CPI (year-on-year) |

| 8:30 AM | CPI excluding shelter (3-month rolling annualized rate) |

| WEDNESDAY, DEC. 14 | |

| 8:30 AM | Import price index |

| 2:00 PM | Federal funds rate announcement |

| 2:00 PM | SEP median federal funds rate for end of 2023 |

| 2:30 PM | Fed Chair Jerome Powell news conference |

| THURSDAY, DEC. 15 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Retail sales |

| 8:30 AM | Retail sales excluding motor vehicles |

| 8:30 AM | Empire state manufacturing index |

| 8:30 AM | Philadelphia Fed manufacturing index |

| 9:15 AM | Industrial production index |

| 9:15 AM | Capacity utilization rate |

| 10:00 AM | Business inventories |

| FRIDAY, DEC. 16 | |

| 9:45 AM | S&P U.S. manufacturing PMI (flash) |

| 9:45 AM | S&P U.S. services PMI (flash) |

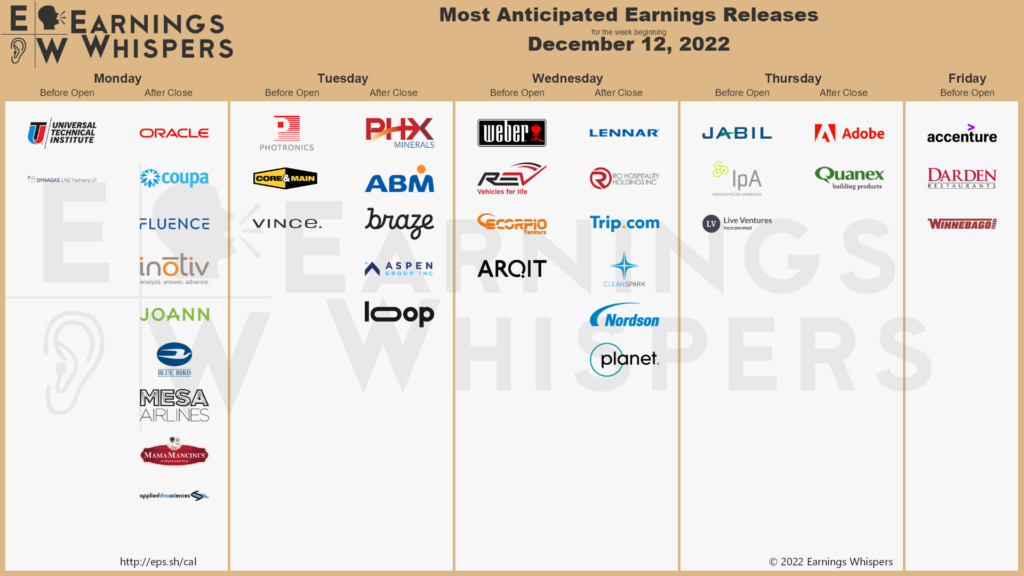

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.