August 15, 2022

Forefront’s Monday Market Update

The Fed, Inflation, and Soft Landings

Writing this blog post gets complicated at times, as I try and provide a mix of information and education while trying not to bore all of you. As I struggled throughout the week to think of a good topic, I realized the subjects were being handed to me through the common questions I was being asked by clients, friends, and family. The man at the sporting goods store even asked me about inflation while I picked up my son’s restrung lacrosse stick.

What do I think about the latest CPI Report?

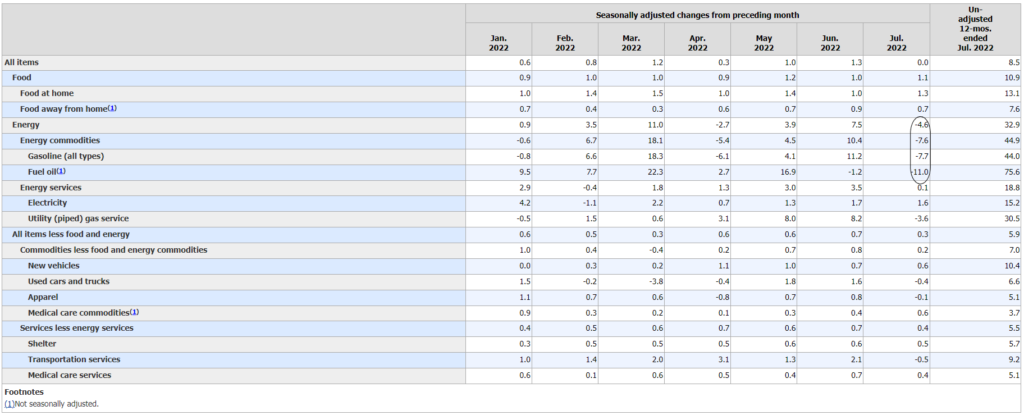

From June to July, inflation was effectively flat, which is the first good news we have gotten in 2022 when it comes to inflation. As you can see in the data that I circled on the chart, the energy component of the CPI number has softened considerably.

Month over month, inflation is flat, but from July 2021 to July 2022, inflation is still up an uncomfortable 8.5%. It will take time before we begin to see more normal inflation readings without the number being so high, but those things don’t happen overnight. Each month, hopefully, we will see a steady decline in the overall inflation rate. However, one piece of data is not enough to declare something a trend, so what happens to prices over the coming months will matter a lot.

What will the Fed do next?

This is one of those questions that, if I knew the answer definitively, we would all be a lot wealthier. As mentioned earlier, the inflation data we get moving forward will play a significant role in what the Federal Reserve does next.

The indication given by Fed officials has been that further rate hikes are still warranted, and they are considerably more concerned about inflation than the job market at the moment. With that in mind, it is safe to say we will continue to see rate hikes moving forward, but how aggressive will those rate hikes be? Will we see another seventy-five basis point (.75%) move?

Neel Kashkari, the Minneapolis Fed Bank President, said at the Aspen Ideas Conference that he sees the Fed Funds rate to be near 3.9% this year and 4.4% by the end of 2023. Some of this is just lip service to investors to show how serious the Fed is about bringing inflation down, but even mentioning hard numbers brings some truth to his statements.

A Soft Landing

Until the media started using this term, most of us thought this was aviation jargon that pilots used. Alas, the question of “will we have a soft landing?” continues to be something I am asked every week.

Much like the question of what the Fed will do, my answer is general speculation. I try to use as much data to formulate an answer, but sometimes logic and reasoning don’t jive with the markets. Something that most pros will never tell you about investing, but I shout from the rooftops: You don’t need to predict the future to be a successful investor!

The labor market data shows signs of strength, and it is tough to have a recession without job losses. That said, we could go into a recession while the stock market rips higher to all-time highs. We might also see the market plummet even as the economy strengthens. Sometimes logic and reasoning don’t jive with the market on a day-to-day basis, which is why predicting anything is never a good idea. Planning for the worst-case scenario and being pleasantly surprised is the only way to make predictions in our portfolio.

So What?

So how does this impact all of you?

- Planning for the worst-case scenario and being pleasantly surprised is the only way to make predictions in our portfolio.

- You don’t need to predict the future to be a successful investor.

Stock market calendar this week:

| MONDAY, AUG. 15 | |

| 8:30 AM | Empire State manufacturing index |

| 10:00 AM | NAHB home builders’ index |

| TUESDAY, AUG. 16 | |

| 8:30 AM | Building permits (SAAR) |

| 8:30 AM | Housing starts (SAAR) |

| 9:15 AM | Industrial production index |

| 9:15 AM | Capacity utilization rate |

| WEDNESDAY, AUG. 17 | |

| 8:30 AM | Retail sales |

| 8:30 AM | Retail sales ex-motor vehicles |

| 8:30 AM | Real retail sales |

| 9:30 AM | Fed Gov. Michelle Bowman speaks |

| 10:00 AM | Business inventories |

| 2:00 PM | Federal Open Market Committee minutes |

| 2:30 PM | Fed Gov. Michelle Bowman speaks |

| THURSDAY, AUG. 18 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Philadelphia Fed manufacturing index |

| 10:00 AM | Existing home sales (SAAR) |

| 10:00 AM | Leading economic indicators |

| 1:20 PM | Kansas City Fed President Esther George speaks |

| 1:45 PM | Minneapolis Fed President Neel Kashkari speaks |

| FRIDAY, AUG. 19 | |

| 9:00 AM | Richmond Fed President Tom Barkin speaks |

| 10:00 AM | Advance report on selected services |

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.