Forefront‘s Monday Market Update

Advice of a grand father

When my son, AJ, was born in 2013, one of the major goals of mine was to bring him to see my grandfather in Australia who was 98 years old at the time. AJ was born in August, and in November we boarded a plane, heading to Australia.

Belief

My grand father always had my back growing up, working his magic to get me out of trouble with my mother and father. Bringing AJ to see him made my soul smile, and as he aged, I hoped it made his smile as well. We spent 2 weeks with him, and although most of the time was spent sitting quietly, as he held AJ, he gave me some advice on parenting. Advice that I apply to all parts of my life, and help to shape the values of the firm I founded and run.

Zoom out

This is not new advice, and we have all heard this in some variation before, but I can’t think of a time that it has been more relevant. I think I say the words “zoom out” to myself 20 times a day, normally when trying to convince my children to wear a jacket in below freezing temperatures, or trying to get them to remember their times tables and doubles facts. It has helped me immensely in my life to keep that “zoom out” perspective, but I haven’t really needed to use it for investing over the past……decade!

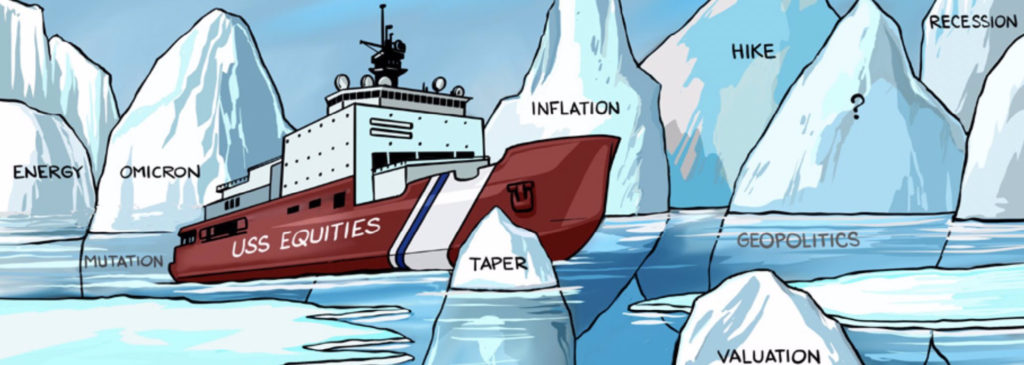

Over the past decade we have seen some short term pull backs in the market, and they have been scary at times, but there has not been a build up of obstacles like we all see facing markets and the global economy. Will Russia invade Ukraine? When will oil prices stop rising? Will the fed raise rates too aggressively? Not aggressively enough? Oh yea, the global pandemic, could that change things?

Zoom out and recognize the gains we have seen in all of our portfolios over the past decade, heck even the past year. The S&P is down just north of 7% this year so far, but up north of 12% over the past 12 months. Keeping perspective of the overall stock market is the only way to weather the ups and downs of normal volatility. On a day to day, short term basis, market moves are irrational and nearly impossible to predict or time. Taking a step back though and understanding that markets will show an overall trend in a longer period of time will help keep your emotions going from concerned to full blown panic.

So What?

So how does this impact all of you?

- Keeping perspective is the only way to deal with ups and downs of normal volatility

Stock market calendar this week:

| MONDAY, FEB. 14 | |

| 8:30 AM | St. Louis Fed President James Bullard interviewed |

| TUESDAY, FEB. 15 | |

| 8:30 AM | Producer price index |

| 8:30 AM | Empire state manufacturing index |

| WEDNESDAY, FEB. 16 | |

| 8:30 AM | Retail sales |

| 8:30 AM | Retail sales excluding autos |

| 8:30 AM | Import price index |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 10:00 AM | Business inventories |

| 10:00 AM | NAHB home builders’ index |

| 2:30 PM | FOMC minutes |

| THURSDAY, FEB. 17 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Building permits (SAAR) |

| 8:30 AM | Housing starts (SAAR) |

| 8:30 AM | Philadelphia Fed manufacturing index |

| 11:00 AM | St. Louis Fed President James Bullard speaks |

| 5:00 PM | Cleveland Fed President Loretta Mester speaks |

| FRIDAY, FEB. 18 | |

| All day | Chicago Booth School-New York Fed meetings |

| 10:00 AM | Existing home sales (SAAR) |

| 10:00 AM | Leading economic indicators |

| 10:15 AM | Fed Gov. Christopher Waller speaks |

Most anticipated earnings for this week: