by Randall Coleman, CFA

When I wrote this weekly commentary in July, Elon Musk had just overtaken Warren Buffet on the Bloomberg Billionaires Index. Well, what a difference six weeks can make. As of August 31, Elon had rocketed ahead of Warren, adding another $33 Billion to his nest egg. In that commentary, I posed a simple question: how long can it go on? Well, what a difference two days can make.

There was definitely a hiccup in the market on Thursday last week. After closing Wednesday at an all-time high, the S&P 500 Index shed -3.51% on Thursday, followed by another -0.81% on Friday. The technology-heavy NASDAQ Index fared worse, falling -4.96% on Thursday and -1.27% on Friday. In sober terms, the S&P 500 is back where it was on August 24, nine days ago, and the NASDAQ is back where it was on August 21, ten days ago. Roughly two weeks of high-pressure air has been let out of the tires. Nothing happens in a straight line. Poor Elon’s stake in his company dropped from a high of $85 Billion on Monday to $71 Billon on Friday: a $14 Billion hit in four days. A billion here, a billion there, pretty soon it adds up to real money. Right?

While Mr. Musk is still firmly ahead of Mr. Buffet in the League of Rich, it’s important to note the paths that companies take to get to where they are. Many of ACM’s commentaries have talked about the incredible divergence in stock performance this year. What we have seen in the past few days is a very healthy rotation in leadership in the market.

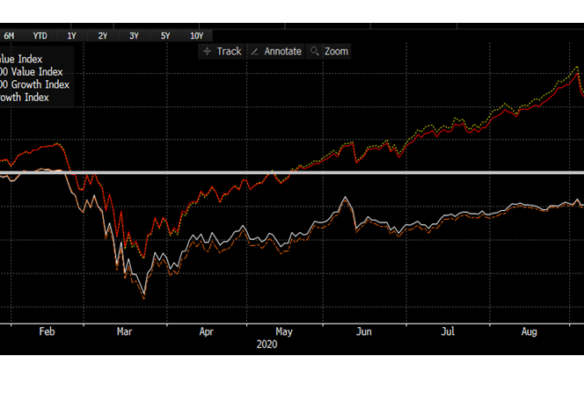

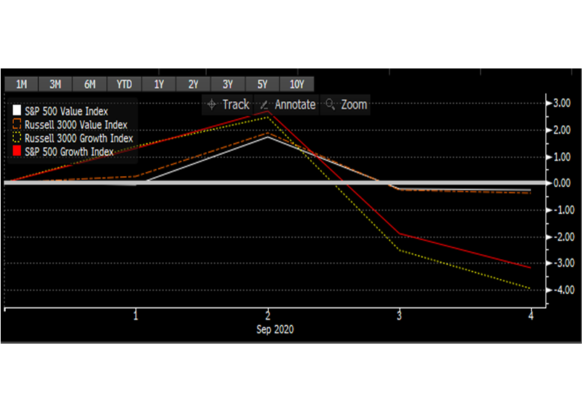

As we’ve talked about before, a narrow handful of mega-cap stocks has been the primary driver for market performance, leading to a huge discrepancy in year-to-date performance between the haves and the have-nots. This disparity has further manifested itself in style favoritism. Growth stocks (loosely characterized by faster sales growth, lower dividend payments, higher price-to-earnings multiples) have significantly outperformed compared to value stocks (loosely the opposite of growth, with lower sales growth, higher dividend payments, lower price-to-earnings multiples) through the end of August. This situation has reversed for the month to date, with value stocks nearly flat versus a nearly -4.00% decline in growth stocks.

Should this rotation prove long lasting, we would welcome it as a very healthy development. The extreme gap between the many stocks that have underperformed and the very few stocks (see: The New Nifty Five) that have propelled the market needs to narrow. At the same time, underperforming mid-cap and small-cap stocks should begin to close the gap. While the S&P 500 is firmly in positive territory, the Russell Midcap Index is down -1.82% year to date and the small cap Russell 2000 Index is down -7.13% for the same time period. With positive signs in the employment market—August payrolls rose 1.4 million, the unemployment rate dropped to 8.4%, average hourly earnings rose 0.4%—we expect a broadening in economic activity, which should disproportionately benefit smaller companies as they are the largest employers in the U.S., with more than 52% of all jobs in the country created by firms with fewer than 500 employees.

The beginnings of a trend in sector leadership may also be underway. Information Technology and Consumer Discretionary have greatly outpaced the remaining ten sectors year to date. The big hiccup we experienced last week took the leaders into last place for the month to date.

Source: Bloomberg

Again, this sector rotation is a healthy development. As economic activity picks up and spreads out, underperforming sectors should perk up. Leadership in the market often persists for longer than expected and when it shifts, it can take investors by surprise. We’ll never get tired of saying it, but this is when a diversified portfolio is critical. Finally, as I mentioned earlier, nothing happens in a straight line. Rotations occur and we’re there for them.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACMWealth