The Market Just Dropped – Now What?

If you’ve been investing for more than five minutes, you’ve probably felt the urge to panic at some point. The market drops, the financial media screams “crash,” and suddenly, your well-diversified portfolio feels like a ticking time bomb.

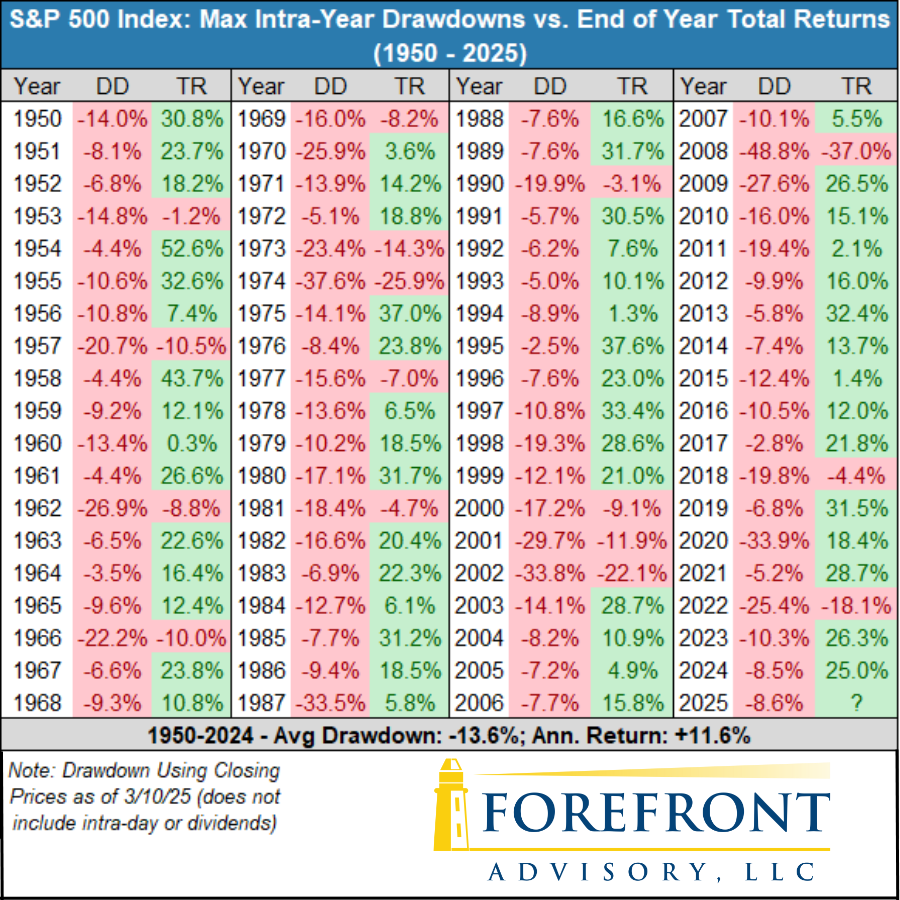

But take a deep breath. Now look at the chart above.

This dataset covers 75 years of S&P 500 drawdowns—every time the market took a hit within the year—versus how it actually finished by year-end. The takeaway? Every single year had a drawdown. Yet most years still ended positive.

In fact, from 1950 to 2024, the average intra-year decline was -13.6%, but the average annual return was +11.6%.

If that doesn’t put market dips into perspective, nothing will.

The Inescapable Reality of Market Cycles

Let’s make this simple: drawdowns are not anomalies—they are the cost of compounding wealth.

- In 1987, markets crashed -33.5% (Black Monday). By year-end? +5.8%.

- In 2009, during the Great Financial Crisis, the market tanked -28.3%. Finished the year +26.5%.

- In 2020, COVID panic sent markets tumbling -33.9%. Ended up +18.4%.

The short-term pain feels real when you’re in it, but reacting emotionally often turns a paper loss into a permanent one.

Why Smart Investors Don’t Flinch

- Market Drops Are Normal. Really Normal.

People act like every downturn is “unprecedented.” But the truth? The market drops double digits almost every year.

Yet, despite all that volatility, a $10,000 investment in the S&P 500 in 1950 is worth over $19 million today. That’s if you didn’t sell when things got scary.

- The High Cost of Market Timing

Many investors think they’ll outsmart the market by dodging downturns and jumping back in when things “look better.” But here’s the brutal truth: the best market days often happen right after the worst ones.

- From January 1, 1980, to December 31, 2023, 10 of the 20 best trading days happened in years with negative total returns, while 11 of the 20 worst days occurred in years with positive returns (Vanguard).

- From 1995 to 2024, missing the market’s 10 best days would have cut an investor’s returns in half (Hartford Funds).

This isn’t some academic theory—it’s a fact backed by market history.

The biggest upswings tend to happen when fear is at its peak:

- In 2020, the second-best day of the year happened right after the second-worst day (Visual Capitalist).

- In March 2020, during the COVID crash, three of the 30 best days and five of the 30 worst days occurred within just eight trading days (Wells Fargo Advisors).

If you panic and sell after a bad day, odds are you’ll miss the recovery—and that could cost you years of compound growth.

- Economic Fundamentals Matter More Than Headlines

Let’s zoom out. Despite recessions, wars, inflation spikes, and financial crises, the U.S. economy has one powerful force behind it: productivity growth.

Yes, there will be business cycles. Yes, valuations will get stretched at times. But corporate earnings, innovation, and long-term labor force growth keep pushing markets higher over time.

Betting against the U.S. economy has been a losing trade for over a century.

What Should You Do When the Market Drops?

- Turn Off the Financial News – It’s designed to keep you anxious, not informed.

- Revisit Your Plan – If your goals haven’t changed, your portfolio shouldn’t either.

- Stay the Course – This isn’t speculation; it’s investing. And investing rewards patience.

Final Thought: The Pig vs. The Chicken

A chicken lays an egg for breakfast, but the pig? The pig is all in for the bacon.

Successful investing isn’t about being involved like the chicken. It’s about being committed like the pig. And commitment means riding out the inevitable drawdowns instead of running from them.

So the next time the market drops and you feel like panicking, just remember: the data doesn’t lie, but your emotions do. Stay invested, stay rational, and let time work its magic.

Did you miss our last blog?

Navigating Market Volatility: Why Smart Investors Stay the Course

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.