The Money Talk That Isn’t Really About Money

There’s something quietly powerful about Sunday afternoons.

They’re not the weekend anymore, but not quite the workweek either. It’s this strange little window where the world slows down just enough for something real to sneak in. No soccer practice, no Costco haul, no late emails from someone who “just wanted to get this to you before Monday.”

It’s where the best conversations happen.

Not the ones you schedule. The ones that just sort of arrive. The kind that starts casual, maybe even a little clumsy, but somehow ends up going deeper than you expected.

And some of the most important ones? They don’t even sound like they’re about money.

They start with questions like:

“Hey… is there a financial decision you made this year that you’re actually proud of?”

Or, “Do we ever feel a little off when it comes to money stuff?”

Sometimes it’s as simple as, “Does this life we’re building still feel like it fits us?”

Those questions aren’t about budgets or spreadsheets. They’re about something more foundational: trust, alignment, safety. And if you’re building a life with someone, especially in the chaos of careers, kids, and keeping it all together, these moments matter more than any financial plan on paper.

What the Gottmans Know(That Most of Us Learn the Hard Way)

Drs. John and Julie Gottman have spent decades studying what makes couples stay together and what slowly pulls them apart. And while most people guess the top marriage killers are things like infidelity or family drama, the research shows otherwise.

Money is the second leading cause of divorce.

But it’s not just money problems. It’s the way money issues often go unspoken. The way we avoid hard conversations. The way resentment builds, silently and slowly, when one person takes on all the financial responsibility or makes decisions solo, even with good intentions.

What the Gottmans found is that healthy couples aren’t the ones who never disagree about money. They’re the ones who can talk about it without fear. They fight fair. They listen. They approach finances as a team, not as opposing sides of a ledger.

The truth is that the way we talk about money reveals a great deal about how we handle vulnerability, power, and trust.

Real Life Isn’t Just About “Making It”

I worked with a couple a few years ago, we’ll call them Eric and Vanessa, who were doing just fine on paper. Dual incomes. Smart investors. Maxed-out retirement accounts. They had the kind of financial life most people spend years trying to create.

But one day, in the middle of a routine planning session, Vanessa paused and said, “I feel like we’re building a life I didn’t agree to.”

She wasn’t upset about the numbers. She was overwhelmed by how little ownership she felt in the direction they were headed. Eric wasn’t excluding her out of malice; he just naturally took the reins, thinking he was being helpful. But in doing so, he’d unintentionally cut her out of some of the most meaningful decisions.

They didn’t need a better portfolio.

They needed better communication.

So, they carved out space. Just 30 minutes on Sunday afternoons. No kids. No distractions. Just coffee, some eye contact, and a few grounding questions:

What’s been on your mind this week?

Is there anything that feels off financially, or is there something we should celebrate?

Are we spending in a way that reflects what matters most to us?

Little by little, things started to shift. They stopped treating money like a task to be managed and started treating it like a story they were writing together. Not every conversation was comfortable. But that’s kind of the point.

You Can’t Budget Your Way Into Connection

We love the idea that if we just organize the finances, the peace will follow. That if the spreadsheet balances, so will the relationship.

But that’s not how any of this works.

You can’t build intimacy on a budget template. You can’t automate trust. You have to talk. Not in the middle of a fight. Not during dishes. Not at midnight after a 14-hour day. You need space. Space to be curious, not combative. To ask questions without needing immediate answers.

That’s where the real “money talks” happen. And funny enough, they don’t sound like financial meetings. They sound like:

“I want to understand how you’re feeling about all this.”

“I know we see things differently, and that’s okay—help me get where you’re coming from.”

They sound like love.

Where Real Wealth Lives

You don’t need a detailed agenda to have a meaningful conversation. You don’t even need to solve anything in one sitting. You just need to show up. You need to want to understand each other. Because when you build that kind of safety, you don’t just solve money problems, you prevent them.

So maybe this Sunday, you sit down with your person. No pressure. No big decisions. Just one simple question:

“How do you feel about the life we’re building?”

Because financial security isn’t just about having enough, it’s about knowing that no matter what comes next, you’re building it together.

And if that conversation feels too big or too loaded to have on your own, that’s okay, too. That’s where someone like me comes in. A financial planner who also runs a tax practice can offer more than just investment advice or tax strategies. We help create the space, ask the hard questions, and take the pressure off so couples can focus on building a life, not just managing a balance sheet.

Think of it less like hiring a professional and more like bringing in a guide. Someone who’s not just here for the numbers, but for what the numbers mean to you.

And if that sounds like something your relationship could use, let’s talk, maybe on a Sunday.

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, JUNE 23 | |

| 9:45 AM | S&P flash U.S. services PMI |

| 9:45 AM | S&P flash U.S. manufacturing PMI |

| 10:00 AM | Existing home sales |

| TUESDAY, JUNE 24 | |

| 9:00 AM | S&P Case-Shiller home price index (20 cities) |

| 9:15 AM | Cleveland Fed President Beth Hammack speaks |

| 10:00 AM | Consumer confidence |

| 10:00 AM | Fed Chair Powell testifies to House Financial Service Committee |

| WEDNESDAY, JUNE 25 | |

| 10:00 AM | New home sales |

| THURSDAY, JUNE 26 | |

| 8:30 AM | Advanced U.S. trade balance in goods |

| 8:30 AM | Advanced retail inventories |

| 8:30 AM | Advanced wholesale inventories |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Durable-goods orders |

| 8:30 AM | Core durable-goods orders |

| 8:30 AM | GDP (second revision) |

| 9:00 AM | Cleveland Fed President Beth Hammack speaks |

| 10:00 AM | Pending home sales |

| FRIDAY, JUNE 27 | |

| 10:00 AM | Consumer sentiment (final) |

| 8:30 AM | Personal income |

| 8:30 AM | Personal spending |

| 8:30 AM | PCE index |

| 8:30 AM | PCE (year-over-year) |

| 8:30 AM | Core PCE index |

| 8:30 AM | Core PCE (year-over-year) |

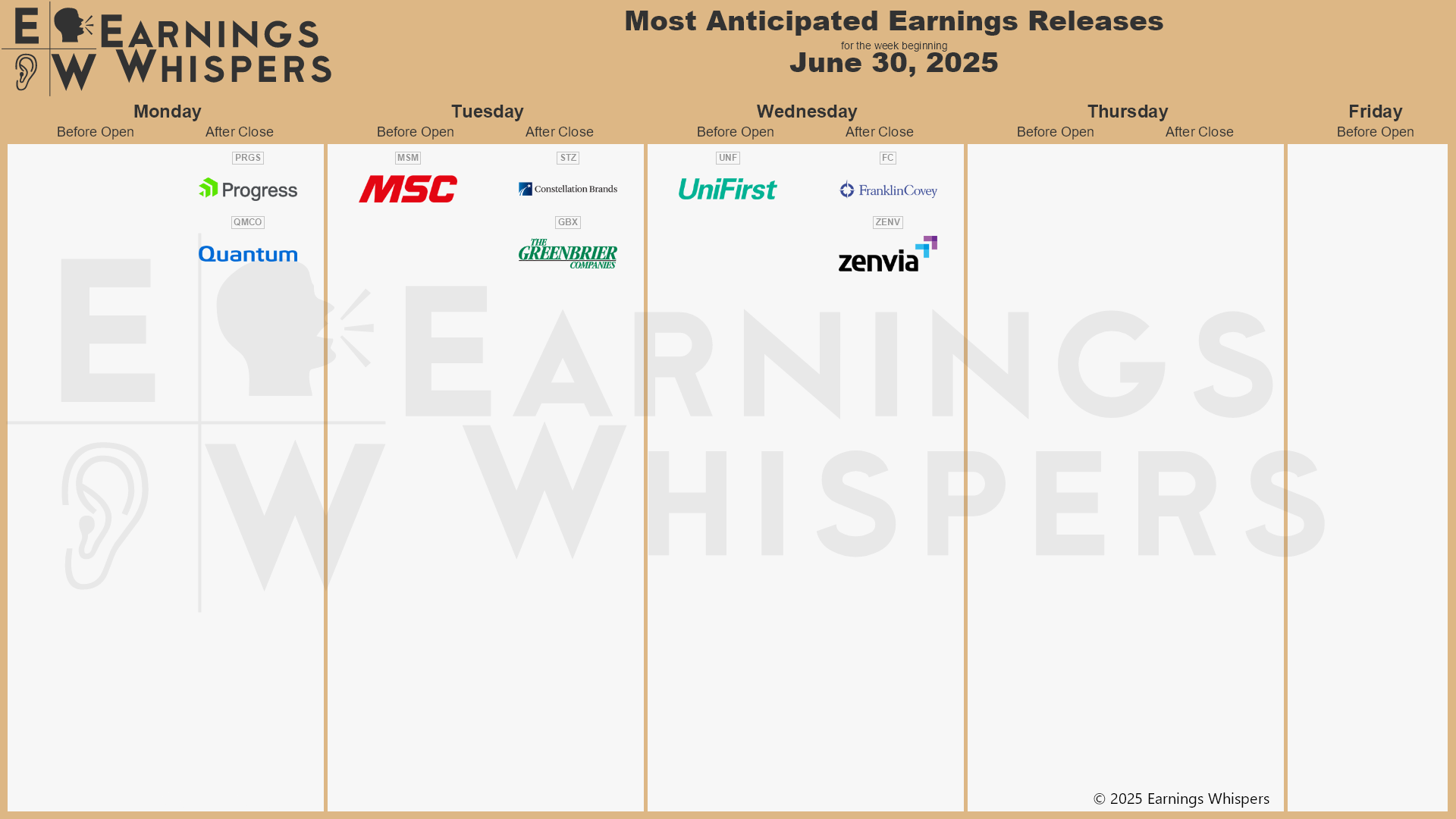

Most anticipated earnings for this week

Did you miss our last blog?

Headlines, Bombs, and Balance Sheets: What Military Strikes Really Mean for Your Portfolio

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.