Tuesday, November 3rd is coming fast. That this particular Tuesday is a presidential election day comes as no surprise. Since 1845, the first Tuesday after the first Monday in November has been election day, and in years divisible by four, that Tuesday is a presidential election day. Markets don’t like surprises and it’s hard to argue that either candidate’s election will amount to a surprise. After all, in the absence of polling data, it’s a coin-toss, a fifty-fifty chance either way. Come what may, the outcome won’t be a surprise. So why is the market so jittery and what’s in store? It’s all about surprises.

I point directly to three areas of surprise that are causing market conniptions: political, economic, and medical.

Political Surprises

Election upsets happen. Election upsets can move the market. Dewey did not defeat Truman, as the photo in the Chicago Tribune indicates. Polls had widely expected Truman to lose the election, so the Tribune jumped the gun with relatively few votes counted. The S&P 500 fell -4.61% on Wednesday, November 3, 1948, the day after the surprise election result.

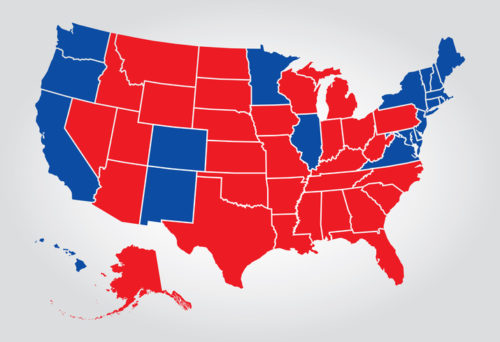

The lesson is that pollsters are not infallible. They can get it wrong. The 2016 election is a more recent example of the phenomenon.

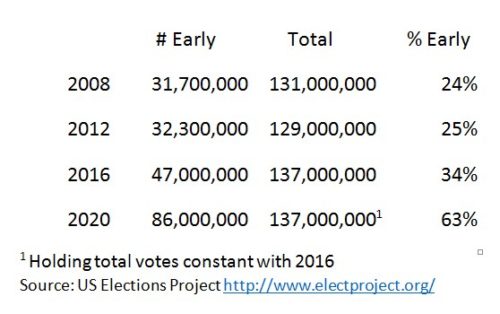

Early voting has taken a huge step up. But is it a surprise? In magnitude, yes, but the trend has clearly been rising for the past 12 years. If total votes cast this year holds constant with total votes in 2016, early voting would account for almost double the percentage cast as in 2016. By October 25, already 80% more early votes had been cast in 2020 than had been cast in

Why do we care about early voting? We care because it can potentially lead to surprises. Previous elections have relied heavily on voting day exit polls to call the results. With such a huge percentage of votes already cast, the reliability of exit polls is severely undermined. Another surprise factor will be the counting and reporting of the early votes. This factor will vary a great deal between the states and will complicate outcome predictions even on election night.

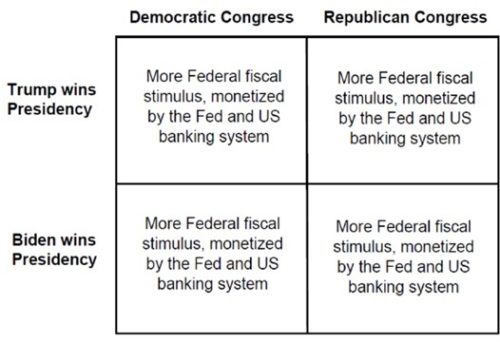

Why do we care about the outcome? A rather tongue-in-cheek contribution to Twitter shows the possible outcomes of the election, both for congress and the presidency. In blunt fashion, it says that there will be no difference in response regardless of the combination of outcomes. There will be stimulus coming.

The surprise factor comes down to timing and magnitude. A potential negative surprise could arise from a lame duck presidency where no movement on stimulus comes for longer than anticipated or hoped for. This is a definite short-term risk to the market. Eventually, however, the government roadblocks will clear and government sponsored help will arrive.

Earnings Surprises

Over the long term, earnings drive stock prices, generally following the rule that, as earnings go up, stock prices go up. If earnings go down, stock prices go down. While earnings announcements have generally been running ahead of expectations (positive surprises), this week saw a reversal. Disappointing news from previously high-flying technology stocks accelerated the recent market downtrend and saw the S&P 500 shed -5.64% for the week. Downside surprises are taking steam out of the market.

Medical Surprises

The icing on our three-tiered surprise cake is Covid-19, throwing in an extra dose of havoc. Local and state officials have been tasked with containing the virus’s spread. This has led to impending further regional or localized shutdowns in the economy. I categorize this as a not-surprise surprise. It’s not a surprise because the lack of coordinated effort and “Covid fatigue” have people clamoring to get out of self-imposed isolation, get their kids back to school, and get back to living life as they used to. It is a surprise because of the rapidity and vengeance of Covid’s return. Timing couldn’t be worse for our date with destiny on Tuesday.

In a world free of surprises, companies would earn exactly what they said they would earn, elections would go to whomever the pollsters said they would go to, pandemics wouldn’t occur, and birthdays would be incredibly boring. Aren’t we fortunate to live in the world we do?