by Dr. JoAnne Feeney

Portfolio Manager

Earnings season got off to a rocky start, but that was to be expected. Comments from management teams regarding the future were laced with cautious sentiment. Even though most investors understand that companies will struggle to estimate this year’s sales and earnings, they are still hoping that companies have some visibility to the end of this crisis. It’s premature for firms to have that kind of clarity, yet the S&P 500 still managed to climb nearly 4% last week, capping a third week of recovery. Since March 23rd, the S&P has appreciated 28%, after having fallen 30% from the beginning of the year. This leaves the S&P down roughly 12% year to date, but with highly divergent sector performance. Investors remain concerned—and for good reason.

Most critically, the outlook remains highly uncertain. Unusually, it is the near-term that is highly uncertain, while the long-term is relatively predictable. But with COVID, the near term is plagued by ongoing shutdowns in economic activity. We don’t know the timetable or how the reopening will occur. But eventually we know the economy will be fully operational – no restrictions on activities. Restaurants will reopen, pro sports will return, movie theaters will once again offer the big screen to all. The key word is eventually. Will such a state of normalcy await a vaccine? Or will an effective treatment emerge and be sufficient to allow us to return to normal life? Or perhaps testing will clearly demark the safe? Or will herd immunity develop relatively quickly (since asymptomatic cases appear far more prevalent than previously thought)? Regardless of the path—and barring a viciously mutating virus (of which there is as yet no evidence)—the longer term brings us back to normalcy. That means the more distant future is less uncertain than the next several months. Yet the market is still heavily discounting many companies with strong secular drivers in the “normal” world, because they are temporarily sidelined in the “virus” world. For the investor with a sufficiently long view, this creates opportunity.

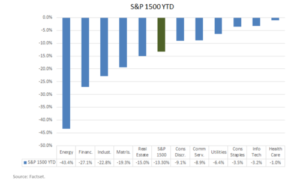

A cursory look at the behavior of the S&P 500 over the last few weeks suggests that investors are jumping to that more normal, long-term view. After all, the market is only down 12% year to date, even as the economy remains shuttered. But this cursory view is illusory. A closer look reveals that most of the gains are being drive by a handful of stocks. Indeed, over the last several years, the S&P 500 has been increasingly dominated by its largest five companies—that share has climbed from roughly 12% in 2015 to over 20% this year. Whether we look at the FANG stocks (Facebook, Amazon, Netflix, and Alphabet) or the larger MFAANG (add in Apple and Microsoft), we see a stark divergence between these and the broader market. The weighted average for MFAANG is up 4.3% year to date, while the remaining 494 companies’ stocks are down roughly 15% on average. The disparity in performance can also be seen across sectors in the broader S&P 1500 Composite:

The recovery, thus far, has been highly concentrated, and this reveals that investors are still taking a very cautious view toward the economic outlook. While preliminary discussions of reopening dominate the news, investors remain focused either on relatively safe investments (staples and utilities) or companies whose businesses are part of the solution to the crisis (health care, info tech). At the company level, those providing home entertainment, work-at-home tech, and shopping services are seeing strong demand as are those in the middle of solving the COVID crisis itself. This is a very narrow list, as the disparity in sector performance shows. Many companies are trading with little weight given to the eventual return to normal, and that leaves investors with ample territory for bargain hunting—and a longer way to go to full recovery.

The recovery, thus far, has been highly concentrated, and this reveals that investors are still taking a very cautious view toward the economic outlook. While preliminary discussions of reopening dominate the news, investors remain focused either on relatively safe investments (staples and utilities) or companies whose businesses are part of the solution to the crisis (health care, info tech). At the company level, those providing home entertainment, work-at-home tech, and shopping services are seeing strong demand as are those in the middle of solving the COVID crisis itself. This is a very narrow list, as the disparity in sector performance shows. Many companies are trading with little weight given to the eventual return to normal, and that leaves investors with ample territory for bargain hunting—and a longer way to go to full recovery.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth