The Overlooked Social Security Rules

That Can Make or Break Retirement

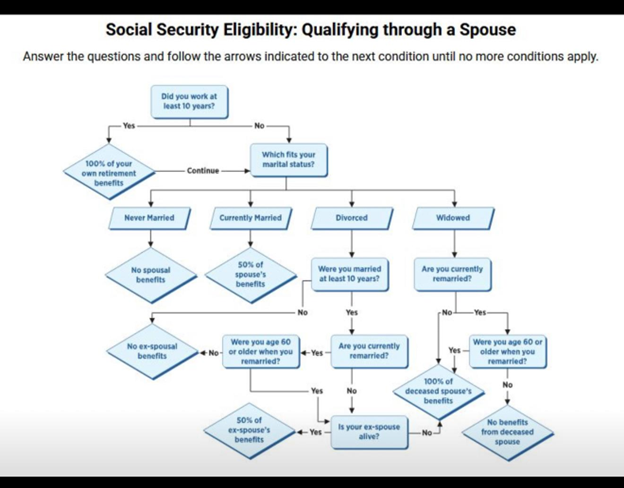

When Linda walked into my office, she was 58, recently divorced, and worried. She had spent years raising kids while her husband, Mark, built his career. Her part-time work over the years never added much to her Social Security credits. She assumed retirement meant living off whatever she’d saved plus a modest monthly check. The truth was better—because she’d been married more than 10 years, she could claim a spousal benefit worth up to 50 percent of Mark’s full retirement benefit once she hit the right age.

That “10 years” rule is a hard line. Nine years and eleven months won’t cut it. But if you clear that mark, you can collect on your ex’s record even if they’ve moved on, remarried, or started a new family. The timing matters. If Linda claimed at 62, her check would be permanently smaller. We built a plan to let her savings carry her until full retirement age, when her spousal benefit would be at its max.

Life moved forward. At 63, Linda remarried. Most people wouldn’t connect a wedding date to a Social Security strategy, but here it mattered. Because she remarried after age 60, she kept her right to claim on Mark’s record. That small detail protected years of potential benefits.

Then the unexpected hit. Her second husband passed away at 67. It was devastating personally, but financially, another rule kicked in. As a widow who remarried after 60, Linda could now claim a survivor benefit worth 100 percent of her late husband’s Social Security. It was far higher than her spousal benefit from Mark. We switched her to the survivor benefit right away, while letting her own retirement benefit grow until age 70 for the biggest possible future payout.

Your Social Security decision isn’t just about when you’re eligible. It affects your taxes, your Medicare premiums, and how long your other savings last. It’s about seeing how each rule interacts with the rest of your life and making moves that keep the most money in your pocket over decades, not just the next year.

Linda’s story is a reminder that this isn’t about squeezing the system; it’s about understanding it. Marriages begin and end. Spouses pass away. The rules stay the same, but the smartest path through them changes as life unfolds. And the people who plan ahead are the ones who get the most out of what they’ve earned.

Sources

-

https://en.wikipedia.org/wiki/Social_Security_%28United_States%29

-

https://www.findlaw.com/family/divorce/divorce-remarriage-and-social-security.html

-

https://blog.ssa.gov/what-you-should-know-about-social-security-if-your-spouse-passes-away

-

https://www.ssa.gov/OP_Home/handbook/handbook.04/handbook-0406.html

-

https://www.finivi.com/divorce-remarriage-social-security-guide-maximizing-benefits

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, AUG. 11 | |

| None scheduled | |

| TUESDAY, AUG. 12 | |

| 6:00 AM | NFIB optimism index |

| 8:30 AM | Consumer price index |

| 8:30 AM | CPI year over year |

| 8:30 AM | Core CPI |

| 8:30 AM | Core CPI year over year |

| 10:00 AM | Richmond Fed President Tom Barkin speaks |

| 10:00 AM | Kansas City Fed President Jeff Schmid speech |

| 2:00 PM | Monthly U.S. federal budget |

| WEDNESDAY, AUG. 13 | |

| 8:00 AM | Richmond Fed President Tom Barkin speaks |

| 2:00 PM | Chicago Fed President Austan Goolsbee speaks |

| 12:30 PM | Atlanta Fed President Raphael Bostic speaks |

| THURSDAY, AUG. 14 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Producer price index |

| 8:30 AM | Core PPI |

| 8:30 AM | PPI year over year |

| 8:30 AM | Core PPI year over year |

| 2:00 PM | Richmond Fed President Tom Barkin speaks |

| FRIDAY, AUG. 15 | |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 8:30 AM | Empire State manufacturing survey |

| 8:30 AM | Import price index |

| 8:30 AM | Import price index minus fuel |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 10:00 AM | Business inventories |

| 10:00 AM | Consumer sentiment (prelim) |

Most anticipated earnings for this week

Did you miss our last blog?

Active vs Passive in 2025: Who’s Winning?

Did you miss our last blog?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.