Forefront’s Monday Market Update

#1 Rule to Build Wealth

More than half of Warren Buffets fortune came after he qualified for Social Security, in his mid-60s. No one will deny what an incredible investor Warren Buffet is, but during the 2013 Berkshire Hathaway shareholder meeting, Warren, and right-hand man Charlie Munger discussed how they have owned 400 to 500 stocks over the course of their career, and made a majority of their money on just 10 of them. Munger said “If you remove just a few of Berkshire’s top investments, its long-term track record is pretty average.”

Just give it time

My father owned a pharmacy in the Bronx for nearly my entire life. There was a period of time when he moved to a much larger store front in New Rochelle, NY. He quickly went from a 900 sq ft. pharmacy, to a 30K sq ft. space that he needed to fill. I was still a child, so getting to arrange (read: play) in the toy aisle was my favorite weekend activity, and he didn’t miss many weekends bringing me with him to work.

I remember him buying these creepy looking toys with different colored hair, and HUGE eyes. They were Trolls, and a staple of his toy aisle for years. He had the trolls lined up perfectly, one after the other, staring across the aisle at his massive wall of Beanie Babies. Both of these toys sat on those shelves for nearly 18 months, never moving. My mother would tell him to buy different toys, that even his own children didn’t want to play with them. He told her to just give it time, and while we waited all the other toys around them were bought and replaced. Suddenly, Trolls and Beanie Babies were flying off the shelves, and when I asked my father about the total toy sales for the life of his store in New Rochelle, he told me that Trolls and Beanie Babies made up 80% of total sales.

Investing and Time

For all of the people claiming to know, with 100% certainty, that Russia would invade Ukraine, they sure didn’t do much to their portfolios in anticipation. Timing the market is not a skill, it is simply luck.

All of my clients have plans that focus on the time frame for each bucket of dollars instead of the potential returns. When you look at each basket of dollars in terms of time, it helps to restore your emotional balance in the face of extreme fear and panic.

I always laugh at advisors who are telling their clients that the cash you have in the bank is losing you money. These days, with the inflation numbers being so high, I hear almost every single advisor I know giving this same advice to people.

What if that cash lets you stay invested with all of your other money instead of acting emotionally and in a panic? What if that cash lets you not be afraid of your boss, or take a risk on a career move that will make you immensely happier? All Forefront Wealth Planning clients have a cash component, both outside of their portfolios as well as inside of the portfolios. Cash reduces risk, and provides comfort, both of which are invaluable when investing.

Having that cash provides a short-term bucket of assets that helps to protect you in case of short-term emergencies.

Looking at the rest of your dollars in terms of time horizon allows you to adjust your risk tolerance based on the statistical probability of losing money, which is the definition of risk tolerance. Many advisors ask potential clients ridiculous questions like “how would you feel if your portfolio dropped by 20%? How about 50%?”

Scared. The answer is scared.

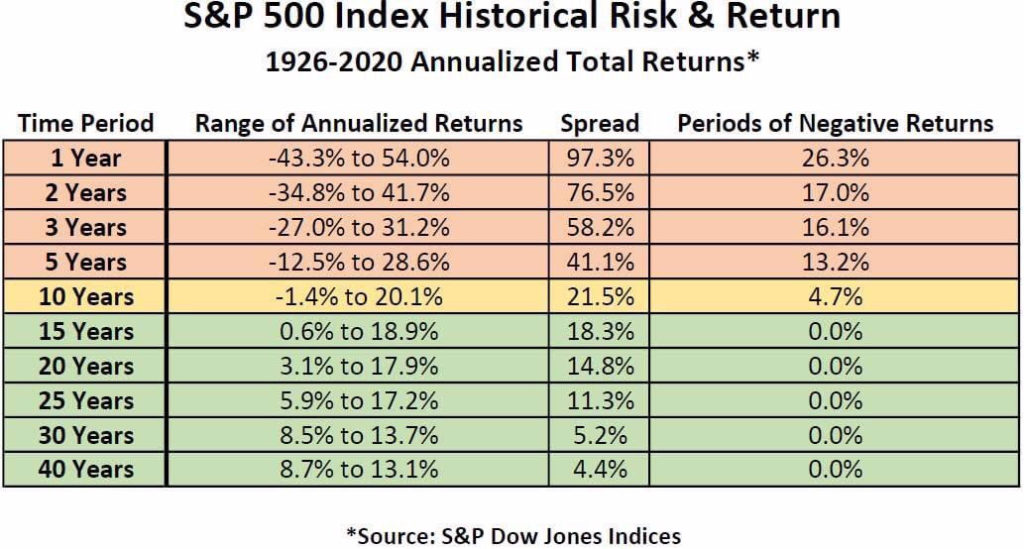

It doesn’t take a rocket scientist to understand that losing money is nerve racking and causes fear. It helps though when you are looking at the time horizon of your money and realize that if the money is intended to be invested for 10+ years, the probability of losing money is virtually 0. In fact, if the time horizon is 15 years or more the probability of losing money based on historical data IS 0!

You have a 46% chance of losing money on any given day in the market. That means 54% of the time you make money, but the longer you hold those investments, the better your chances of making money are. I bring this up, at this moment because it is easy to be scared and to panic. Creating baskets of money, with time horizons attached, that help dictate the overall risk tolerance, is the #1 rule to building wealth.

So What?

So how does this impact all of you?

- Baskets of money, attached to time horizon builds wealth.

- Cash is not losing money in the bank, if it provides you options and freedom.

Stock market calendar this week:

| MONDAY, MARCH 14 | |

| 11:00 AM | 1-year inflation expectations |

| 11:00 AM | 3-year inflation expectations |

| TUESDAY, MARCH 15 | |

| 8:30 AM | Producer price index, final demand |

| 8:30 AM | Empire state manufacturing index |

| WEDNESDAY, MARCH 16 | |

| 8:30 AM | Retail sales |

| 8:30 AM | Retail sales excluding motor vehicles |

| 8:30 AM | Import price index |

| 8:30 AM | Import price index excluding fuels |

| 10:00 AM | NAHB home builders’ index |

| 10:00 AM | Business inventories (revision) |

| 2:00 PM | FOMC announcement on fed funds rate |

| 2:30 PM | Fed Chair Jerome Powell news conference |

| THURSDAY, MARCH 17 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Building permits (SAAR) |

| 8:30 AM | Housing starts (SAAR) |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| FRIDAY, MARCH 18 | |

| 10:00 AM | Existing home sales (SAAR) |

| 10:00 AM | Index of leading economic indicators |

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.